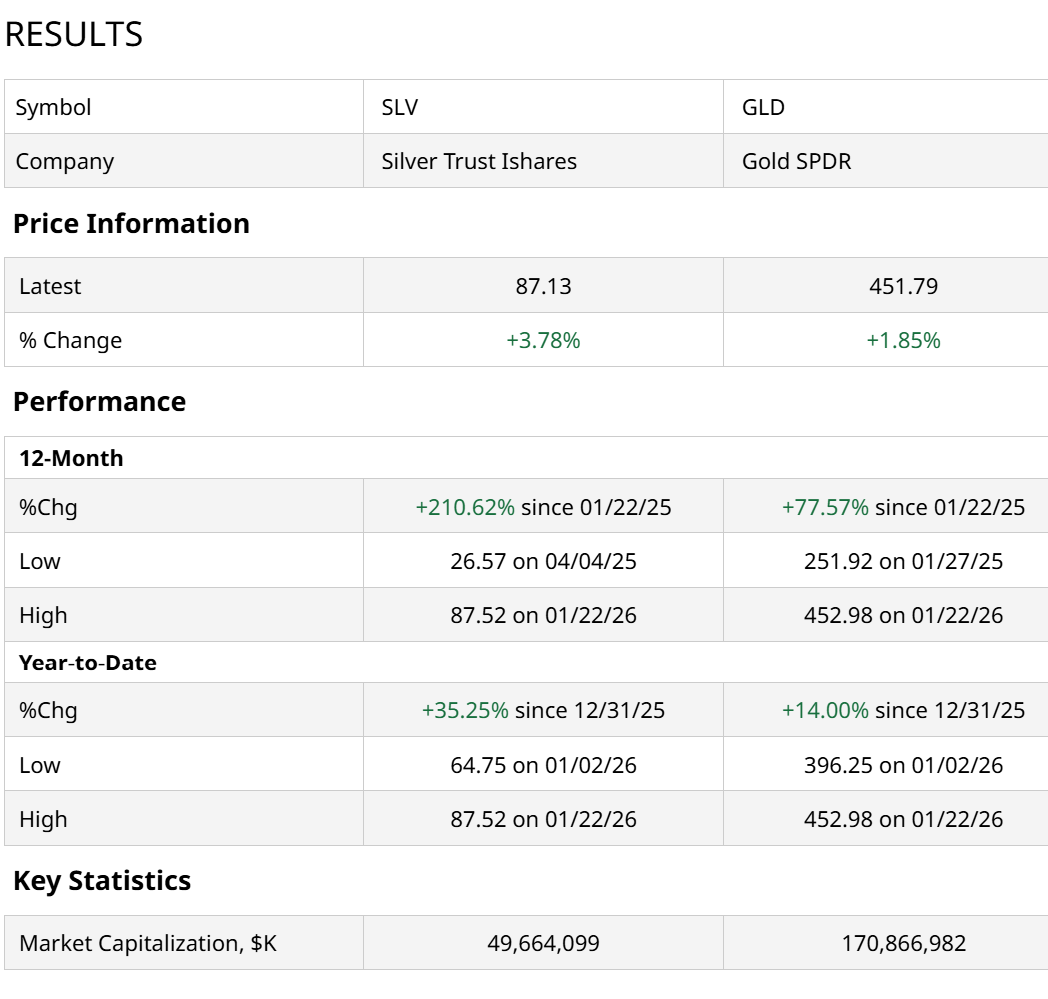

It is a strange time in the world of precious metals. While gold (GLD) is on the move higher again after digesting its massive 2025 gains via a modest pullback, silver (SLV) has entered the conversation after tripling in value over the last year.

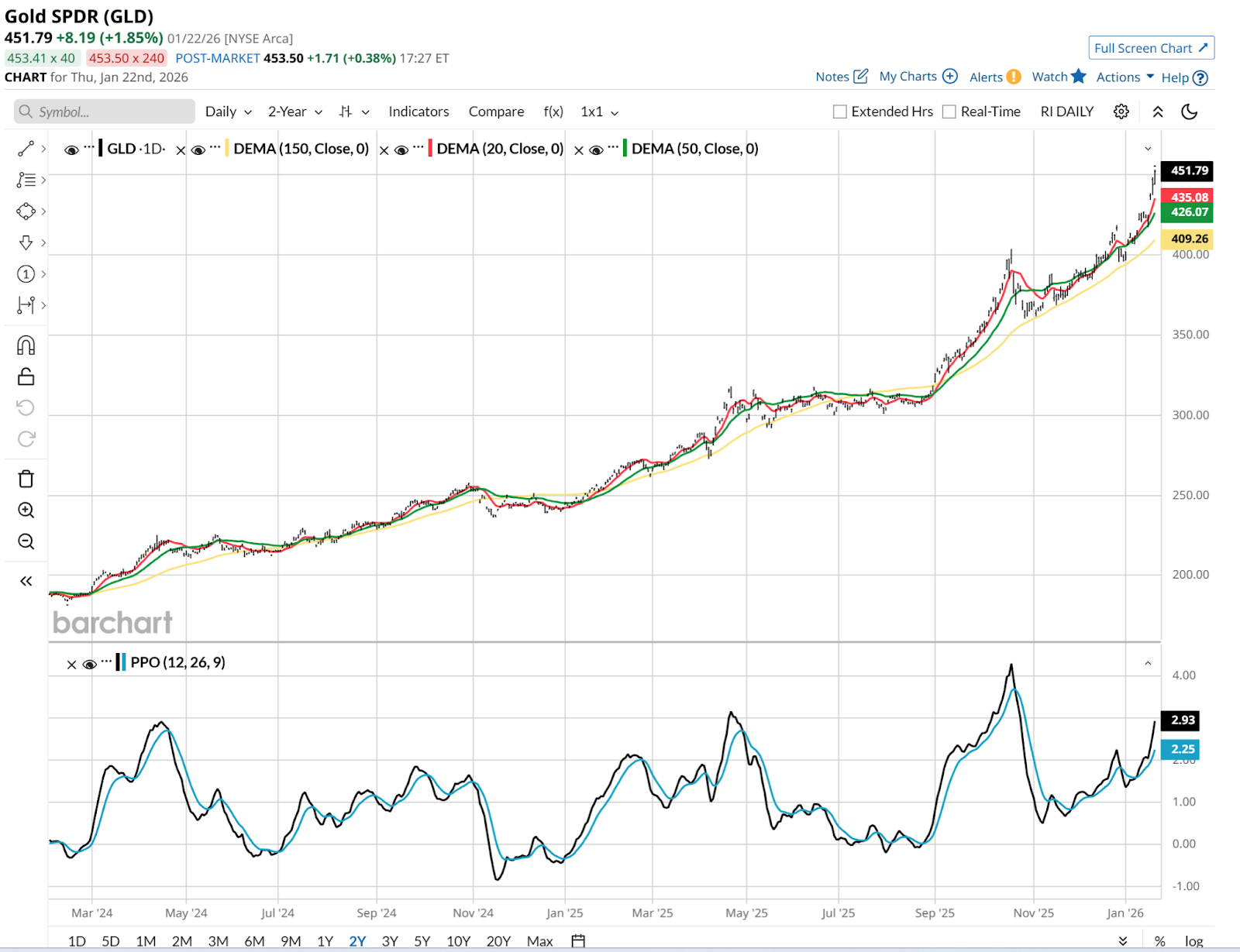

The daily chart of GLD looks very strong. I’m not usually investing in something that moves like this, at least not in large quantities. However, that PPO indicator is encouraging — high, but likely not yet done doing its business. That hints at this being a flow-driven move, perhaps even part of a “sell U.S. assets” trade.

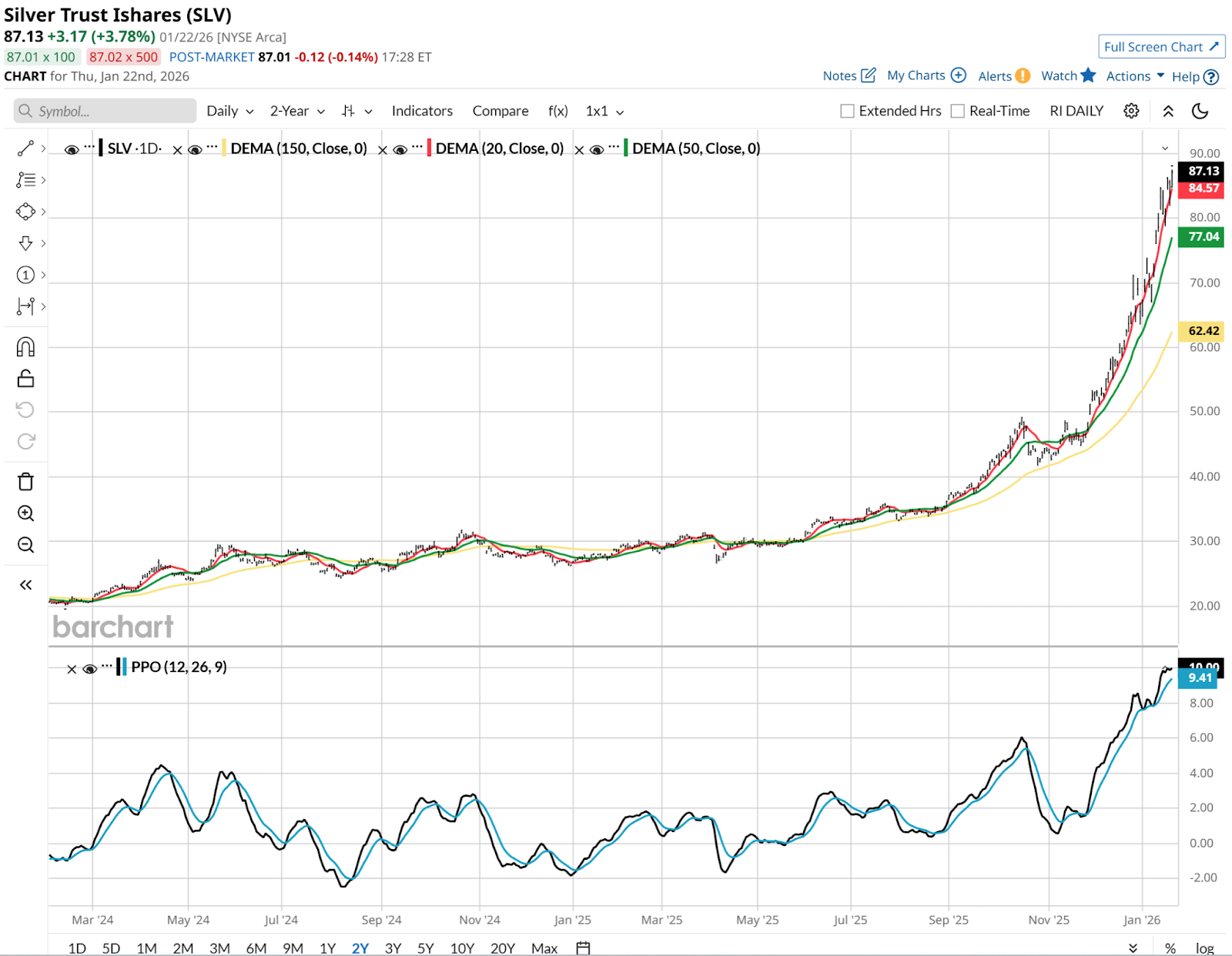

Not to be outdone, SLV’s move looks even stronger. That said, SLV looks like it must be tired. Not a technical term per se, but it describes the urgency with which this commodity has risen since November. Yes, only since November!

Here’s the tale between these two market heavyweights. Astonishing, except when you consider they both had long dry spells prior to these manic moves.

What Is the Gold-Silver Ratio Saying?

The gold-silver ratio involves simply dividing the price of gold per ounce by that of the price of silver per ounce. It peaked at 125:1 during 2020, and has historically been in the range of 50:1 to 80:1. Gold futures closed Thursday at $4,950, and silver at just over $96, so that’s a ratio of just above 50:1, down from over 100:1 in early 2025. Translation: Silver is not cheap, and gold is the favorite to outperform going forward.

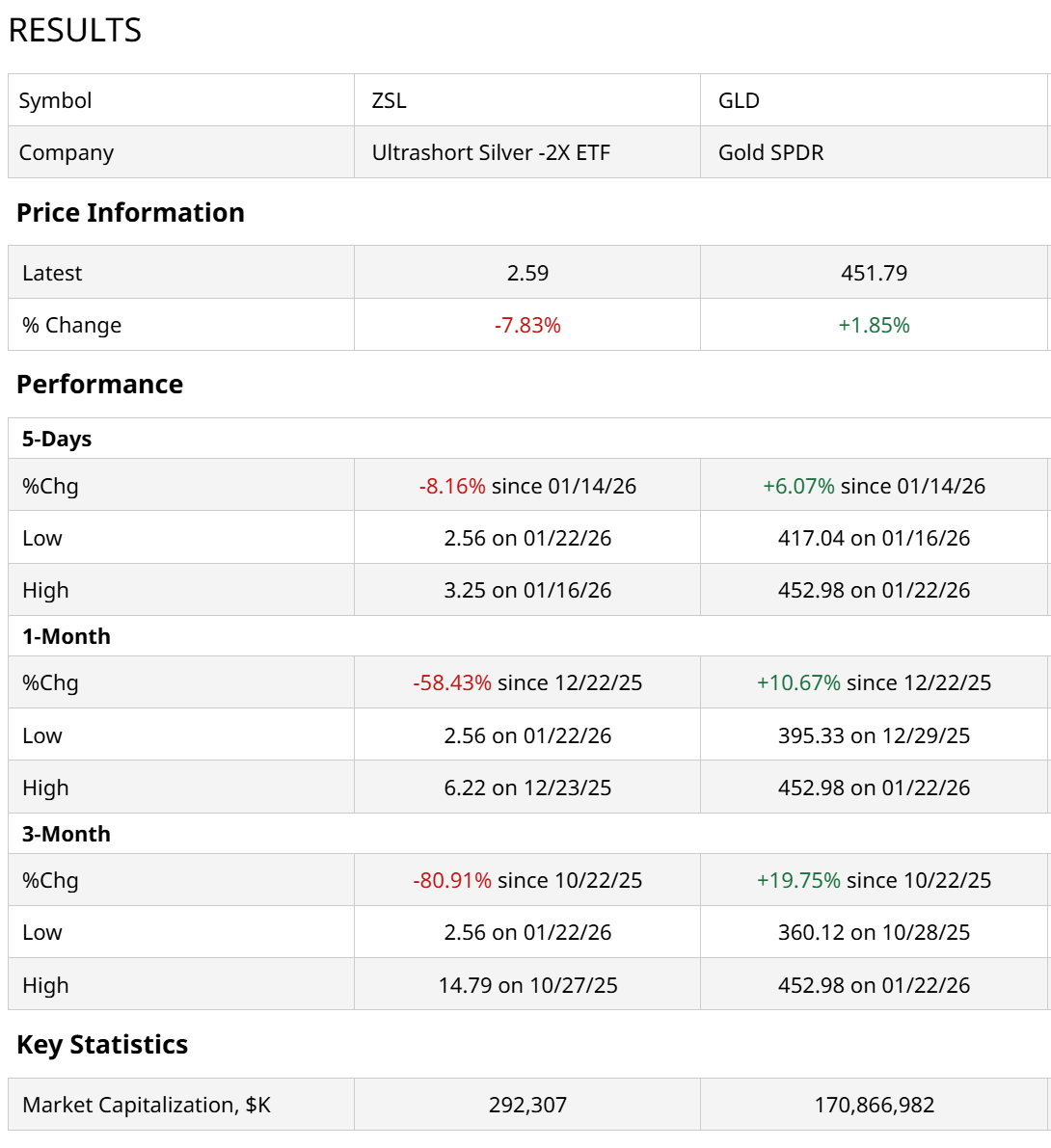

There are many ways to use exchange-traded funds (ETFs) to capture moves up or down in silver and gold. Options and futures are another viable way to go. There is actually not a 1x inverse silver ETF, but there is one that is 2x short silver. That’s Ultrashort Silver -2x ETF (ZSL), and so it behooves anyone considering it to study up vigorously on the math involved. Inverse and leveraged ETFs can be great tools. But like driving a car, you don’t just step in behind the wheel and drive them. This is for trading, not investing.

Buying GLD and ZSL in a 2:1 ratio would approximate a trade setup that is “market-neutral” between gold and silver, at least on a day-to-day basis.

I ran this through a series of short-term performance periods above. This shows that this would have been an awful pairing over the past three months.

And that’s exactly the point. Pairs trading with ETFs is not the kind of analysis where we look at past performance as we might an equity ETF. Instead, we take note of how when a pair of assets (gold and silver) often trend together. When one pulls ahead for a while, reversion to the mean is worth a look.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart