I asked how low world sugar futures prices could fall in a November 11, 2025, Barchart article. I concluded with the following:

I believe that sugar is approaching a price where commodity cyclicality will create a bottom, leading to a price recovery. However, picking a bottom is virtually impossible when a market is making lower highs and lower lows. Therefore, I favor a scale-down approach to sugar, leaving plenty of room to add on further declines.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Nearby March ICE sugar futures were trading at 14.20 cents per pound on November 10, 2025. In my January 9, 2026, Barchart quarterly report on soft commodities, I wrote:

Time will tell if cotton and sugar prices can recover in 2026, but cyclicality favors the upside.

March sugar futures closed 2025 at 15.01 cents per pound. At just below the 15-cent level in late January, world sugar futures are consolidating near their recent lows.

A bearish trend since November 2023

Sugar prices have been trending lower since late 2023, but have held above 14 cents per pound.

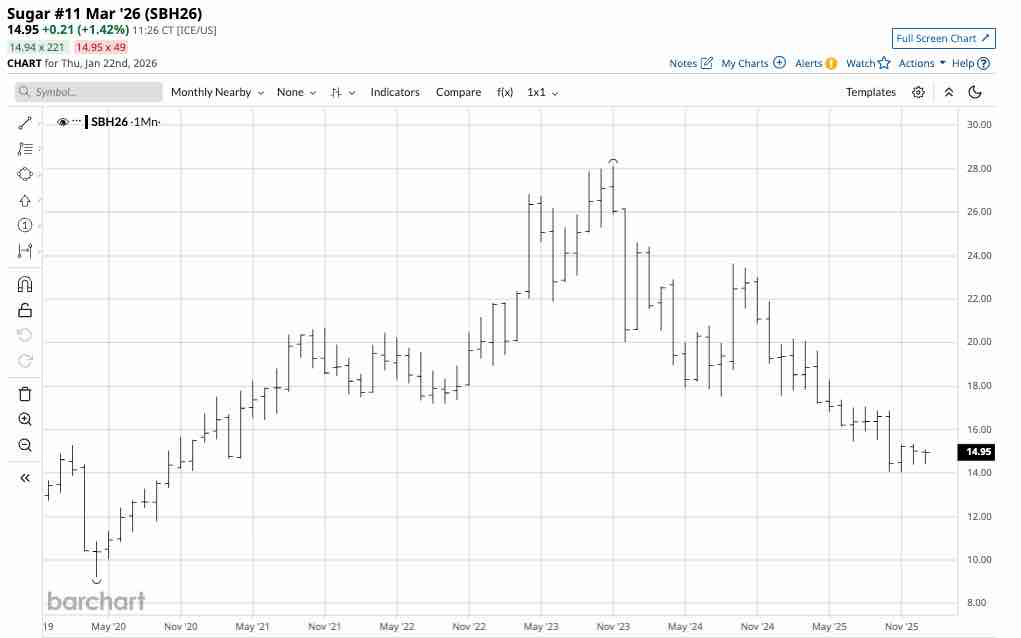

The monthly continuous ICE world sugar futures contract chart shows that the sweet commodity moved 50.11% lower from the November 2023 high of 28.14 cents to the November 2025 low of 14.04 cents per pound. While sugar futures have remained above 14 cents per pound, the price was just below 15 cents per pound in late January 2026.

Sugar is the most liquid soft commodity

The soft commodities sector of the commodities asset class includes world sugar, Arabica coffee, cocoa, cotton, and frozen concentrated orange juice. World sugar is the most liquid soft commodity with the highest daily volume and open interest, the total number of open long and short positions.

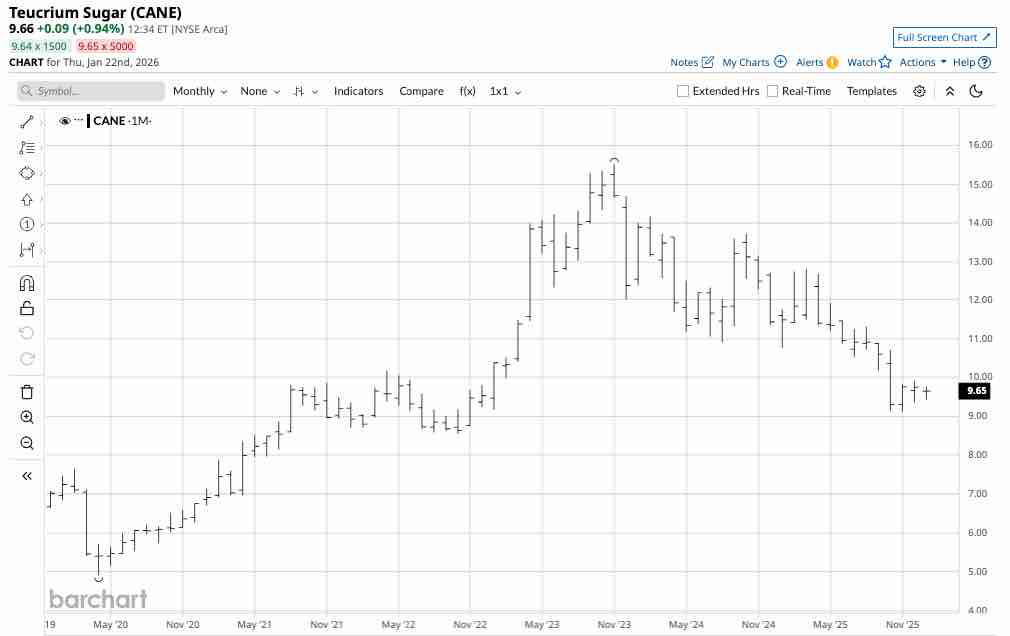

Since world sugar has the highest liquidity, it is the only soft commodity with an ETF that tracks its price action. The Teucrium Sugar ETF (CANE) stands alone as the only soft commodity ETF. Another product, the Invesco DB Agriculture Fund (DBA), provides exposure to most of the soft commodities, but CANE is the only dedicated sugar ETF product.

Sugar- A critical ingredient for food and energy

Sugar is a critical agricultural product, with many producing countries subsidizing their domestic sugar production. In the U.S., sugar #16 is the subsidized sugar futures contract that trades at a significant premium to world sugar #11 futures due to the U.S. government subsidies.

Sugar is not only a food ingredient, but it is also an agricultural ingredient in ethanol production in Brazil, the world’s leading sugarcane-producing country. While corn is the ingredient in U.S. ethanol production, Brazil uses its sugar output to produce biofuel.

Levels to watch and the reasons for a long position

After over two years of a bearish trend, ICE world sugar futures #11 have moved into a narrow trading range.

The chart shows that the daily continuous sugar #11 futures contract has traded between 14.35 and 15.34 cents per pound since November 14, 2025. At 14.96 cents on January 21, the sugar futures were in the middle of the narrow trading range.

From a longer-term perspective, technical support is at the October 2025 low of 14.04 cents per pound, with technical resistance at the August 2024 low of 17.52 cents per pound. A move below 14 cents or above 17.52 cents per pound could create a technical break that may lead to follow-through selling or buying.

The current price consolidation could signal a bottom, as commodity cyclicality below 15 cents could prompt producers to scale back output, leading to declining inventories and increased consumption. In commodities, the cure for low prices is typically those low prices.

CANE is the ETF that tracks a portfolio of ICE world sugar futures

At $9.65 per share, the Teucrium Sugar ETF (CANE) had nearly $13.6 million in assets under management. CANE trades an average of 44,436 shares per day and charges a 0.93% management fee. To mitigate roll risk when one ICE world sugar number 11 rolls from one active month to the next, CANE owns three ICE sugar futures contracts, excluding the nearby contract. CANE tends to underperform sugar futures on the upside and outperform the nearby contract on the downside, as most speculative activity occurs in the nearby active month contract.

The continuous sugar futures contract fell just over 50% from the high in November 2023 to the low in November 2025.

The monthly chart shows that the CANE ETF declined 41.2% over the same period, from $15.51 to $9.12 per share, outperforming the priced action in the continuous ICE sugar futures contract.

Commodity cyclicality suggests that sugar prices could be closer to a potential low than a high in 2026, making the risk-reward on a long position attractive.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart