Seagate Technology (STX) is set to report its upcoming earnings on Jan. 27. That's a date I'm keeping on the calendar, and I suggest other investors in the market do the same.

This upcoming earnings report could reveal plenty about how Seagate has progressed in its bid to tackle what has continued to be extremely robust demand for hardware directly tied to the artificial intelligence (AI) revolution. As a key provider of memory for high-performance computing tasks, Seagate is one of the more overlooked players in the AI boom, in my view.

And despite very robust performance in recent years, there are some indications that this recent rally we've seen in Seagate and other NAND and DRAM supplies could continue. Indeed, DRAM is where it's at in terms of the AI revolution (with NAND being typically used for slower or longer-duration tasks). Accordingly, as one of the largest suppliers of DRAM in the market, Seagate is one stock that could continue to outperform.

I know Seagate as one of the top provider software hard-disk drives, and I have one to back up all my files personally. However, the commercial market is much more important for the company, and this is an area of its business that has surged of late.

Let's dive into what specific analysts are saying about Seagate, and why this stock could be poised for a continuation of its parabolic move thus far in late-2026 and early 2025.

What's the Rub?

Seagate is among the key "vendors likely benefit from a step function in PX when they transition to the next set of [long-term agreements] (likely C2H'26 into CY'27), a shift that isn't yet contemplated by Street models.” That's according to Wall Street analyst Matt Bryson, who covers Seagate stock. His view is that we could be due for a boom in both NAND and DRAM, with Seagate's exposure to both sub-segments of the memory market key to this stock's impressive surge thus far this year.

With Bryson and others upgrading Seagate on the back of its future potential revenue and earnings growth accelerating higher, this is a stock I think is compelling.

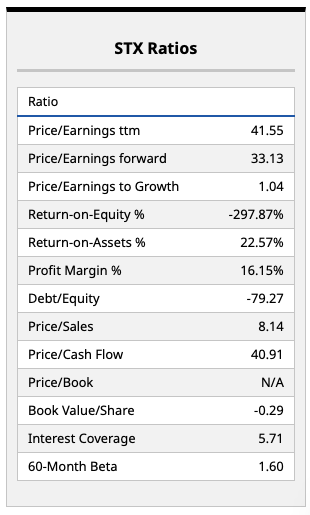

Indeed, the company's current fundamentals do align well with this story above. With a forward price-to-earnings (P/E) multiple of 33x (impressive, considering the roughly four-fold increase in the company's shares since Q2 of last year), this is a stock many growth investors continue to feel is undervalued. So long as Seagate can maintain its profit margin above 15% and deliver the kind of solid revenue growth we've seen in past quarters, I think this is the right take. With a solid balance sheet (look at that debt-to-equity ratio above) and a solid position as a leader in providing much-needed memory to leading AI and data center providers, this is a company that could be very much overlooked in this current environment.

To be frank, I'm one such investor who hasn't paid enough attention to Seagate, and I'd imagine there are plenty of investors out there like me.

What Do Other Analysts Think?

The current consensus price target on STX stock sits well below the company's current share price. I'd argue that the key driving factor behind this is the reality that Seagate has a stock chart like few in the market right now.

When a company like Seagate finally sees acceptance from a broad swath of analysts as one that can deliver continuous and sustained revenue and earnings growth, the market can update their models faster than many analysts can revise their price targets. And while Bryson and others have done just that, this is such a fast-moving sector that I'd expect the Street to lag the market for some time.

Until we see some sort of indication that the supply-and-demand dislocation in the world of memory has abated, this is a stock I think can outperform for quite some time. In my view, STX has one of the best charts in the market and would be one of my top ideas for a short-term momentum trade right now, even ahead of earnings.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.