California-based NVIDIA Corporation (NVDA) is a global leader in accelerated computing and artificial intelligence. Best known for its industry-defining graphics processing units (GPUs), the company powers high-performance computing, data centers, autonomous vehicles, and cutting-edge AI applications. Its market cap currently stands at a market cap of $4.6 trillion.

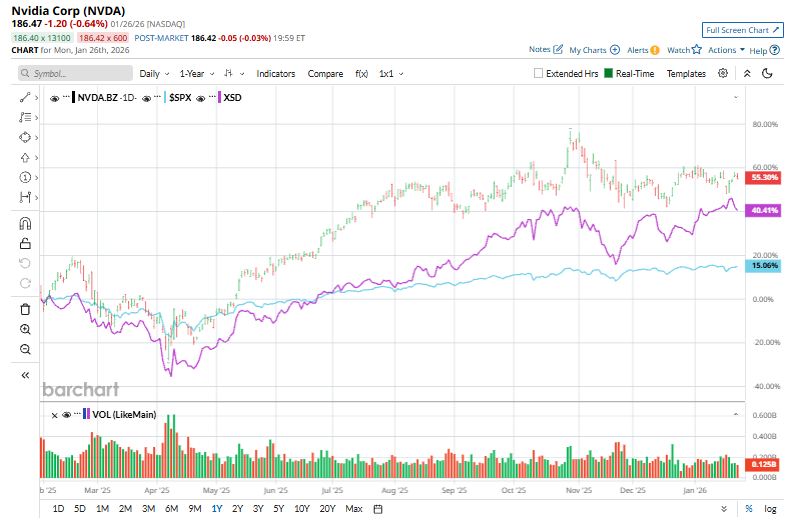

Over the past year, the chip powerhouse has surged 30.8%, while the broader S&P 500 Index ($SPX) has rallied nearly 13.9%. However, NVDA’s performance over the past six months has not been impressive, rising 7.5%, lagging the SPX’s 8.8% rise.

Additionally, the stock has slightly trailed the industry-focused SPDR S&P Semiconductor ETF (XSD), which has gained about 32.5% over the past year and 31.6% over the past six months.

On Jan. 20, shares of NVIDIA fell 3.8% in afternoon trading as rising geopolitical tensions between the U.S. and Europe over Greenland triggered a broader risk-off sentiment in global markets. The decline was driven by renewed concerns after President Trump pushed for U.S. control of Greenland, reviving fears of trade disputes and potential tariffs on European allies.

For the current fiscal year, ending in January 2026, analysts expect NVDA’s EPS to grow 51.2% to $4.43 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

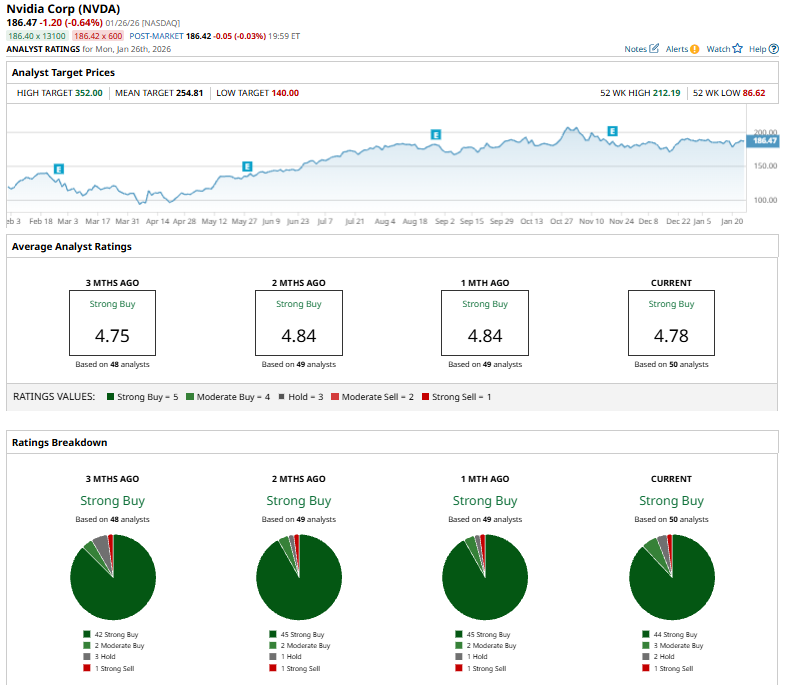

Among the 50 analysts covering NVDA stock, the consensus is a “Strong Buy.” That’s based on 44 “Strong Buy” ratings, three “Moderate Buys,” two “Holds,” and one “Strong Sell.”

This configuration is bearish than a month ago, with 45 analysts suggesting a “Strong Buy.”

On Jan. 16, Jefferies analyst Blayne Curtis reaffirmed a “Buy” rating on NVIDIA and raised the price target from $250 to $275, reflecting a 10% increase and signaling strong confidence in the company’s future performance.

The mean price target of $254.81 represents a 36.6% premium to NVDA’s current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Options Flow Alert: Institutional Money Loading Up on Google Stock

- Stock Index Futures Gain on Tech Boost, FOMC Meeting and Earnings in Focus

- Microsoft Reports Q2 Earnings Jan. 28. Is MSFT Stock a Buy Before Then?

- As IonQ Snaps Up SkyWater Technology for $1.8B, Should You Buy the Quantum Computing Stock Here?