The Coca-Cola Company (KO) is one of the world’s most iconic and recognizable brands, with a legacy that spans more than a century. Founded in 1886 and headquartered in Atlanta, Georgia, the company has grown into a global beverage powerhouse, operating in over 200 countries and offering a vast portfolio that includes Coca-Cola, Diet Coke, Sprite, Fanta, Minute Maid, Simply, and Powerade. Its market cap currently stands at $312.1 billion.

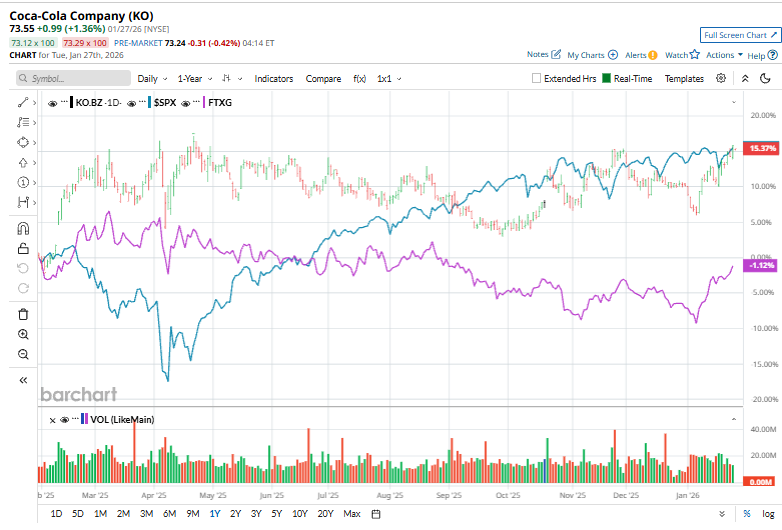

Shares of this beverage giant have slightly underperformed the broader market over the past year. KO has gained 15.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.1%. Over the past six months, KO stock has returned 6.3%, compared to the SPX’s 9.2% gains.

Narrowing the focus, KO has surpassed the First Trust Nasdaq Food & Beverage ETF (FTXG), which has declined 2.7% over the past year and 2.3% over the past six months.

Coca-Cola continues to draw strength from steady demand for its everyday beverages, a vast and diversified global footprint, and formidable pricing power that helps safeguard margins during periods of cost pressure. This defensive appeal was on display on Jan. 20, when the stock advanced more than 1% even as the broader market retreated, underscoring its status as a safe haven amid mounting macroeconomic headwinds. With rising interest rates, slowing global growth, and persistent inflation dampening risk appetite, investors have increasingly rotated away from cyclical names and toward resilient consumer staples such as Coca-Cola.

For FY2025 that ended in December, analysts expect KO’s EPS to grow 3.8% to $2.99 on a diluted basis. The company’s earnings surprise history is solid. It beat the consensus estimate in each of the last four quarters.

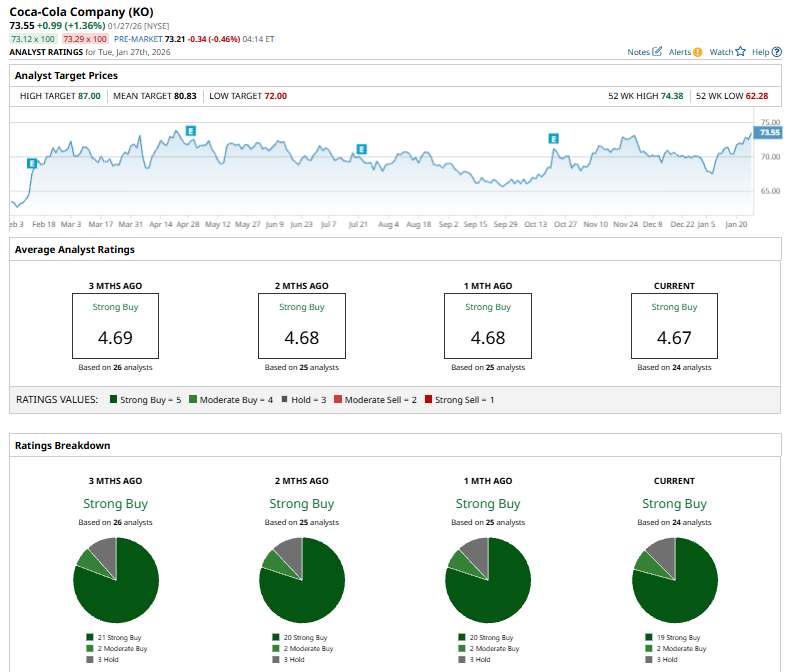

Among the 24 analysts covering KO stock, the consensus is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” and three “Holds.”

The configuration is bearish than a month ago, when 20 analysts had given a “Strong Buy” recommendation for the stock.

On Nov. 7, BofA Securities analyst Bryan Spillane reaffirmed a “Buy” rating on Coca-Cola and raised the price target to $80 from $78, reflecting continued confidence in the company’s outlook.

The mean price target of $80.83 represents a 9.9% premium to KO’s current price levels. The Street-high price target of $87 suggests an upside potential of 18.3%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nasdaq Futures Rally as ASML Provides a Boost, Fed Decision and Big Tech Earnings Awaited

- 1 Dividend Stock to Buy Now as Trump Turns Up the Tariff Heat Again

- Nvidia Just Gave You a $2 Billion Reason to Buy CoreWeave Stock

- GameStop Stock Is Now in Overbought Territory as Michael Burry Buys Shares. Is It Too Late to Chase GME Stock Here?