General Motors Company (GM), headquartered in Detroit, Michigan, is a major U.S. automaker. It focuses on designing, building, and distributing vehicles globally via brands such as Chevrolet and Cadillac. Operations span factories and sales networks across multiple countries, encompassing automobiles, trucks, and support services. The company has a market capitalization of $80.58 billion.

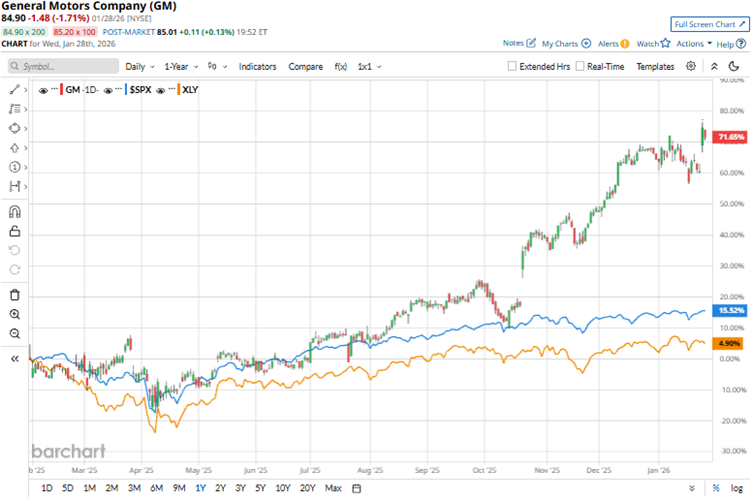

GM’s stock has been trading up due to scaling back of electric vehicle (EV) losses amid policy changes, share buybacks, and onshoring efforts to offset tariffs. Over the past 52 weeks, the stock has gained 69.7%, and over the past six months, it has risen 58.8%. The company’s shares had reached a 52-week high of $87.31 on Jan. 27, but are down 2.8% from that level.

On the other hand, the S&P 500 Index ($SPX) has gained 15% over the past 52 weeks and 9.2% over the past six months. Therefore, the stock has outperformed the broader market over these periods. Turning our focus to the company’s own consumer cyclical sector, we see that the stock has outperformed, as the State Street Consumer Discretionary Select Sector SPDR ETF (XLY) is up 5.2% over the past 52 weeks and 7.7% over the past six months.

On Jan. 27, GM reported mixed results for the fourth-quarter of 2025. The company’s quarterly total revenue dropped 5.1% year-over-year (YOY) to $45.29 billion, missing the Street analysts’ estimate. However, its adjusted EPS for the quarter was $2.51, up 30.4% from the prior-year period and beating Wall Street analysts’ expectations. Moreover, GM’s new energy vehicle (NEV) sales in China reached nearly 1 million units in 2025.

For the current quarter, Wall Street analysts expect GM’s EPS to decrease by 1.1% YOY to $2.75 on a diluted basis. For the fiscal year 2026, analysts expect its EPS to increase 15.9% YOY to $12.28 on a diluted basis. Moreover, EPS is expected to grow 2.7% annually to $12.61 in fiscal 2027.

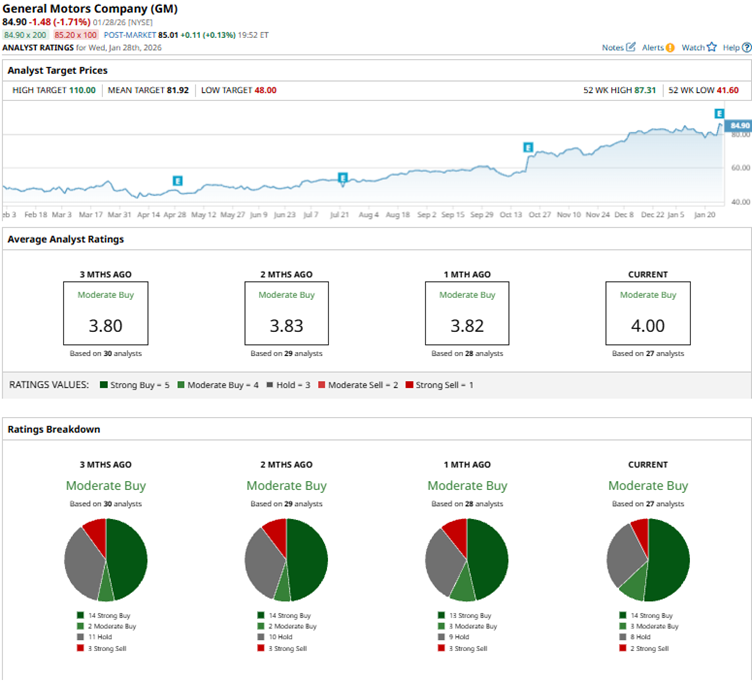

Among the 27 Wall Street analysts covering General Motors’ stock, the consensus is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, three “Moderate Buys,” eight “Holds,” and two “Strong Sells.” The ratings configuration is more bullish than it was a month ago, with 14 “Strong Buy” ratings now, up from 13.

Post the earnings release, UBS analysts maintained their “Buy” rating on the stock, while raising the price target from $97 to $102. On the other hand, Wells Fargo analysts maintained their “Underweight” rating on GM but raised the price target from $48 to $57.

GM’s mean price target of $81.92 indicates a 3.5% downside from current market prices. However, the Street-high price target of $110 implies a potential upside of 29.6%.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart