Volatility is back towards the lowest levels we have seen in 2025 with the VIX Index closing at 16.35 on Wednesday.

When volatility is low, options become cheaper, so today we’re looking for stocks with a low IV Percentile which could be good candidates for a Long Straddle trade.

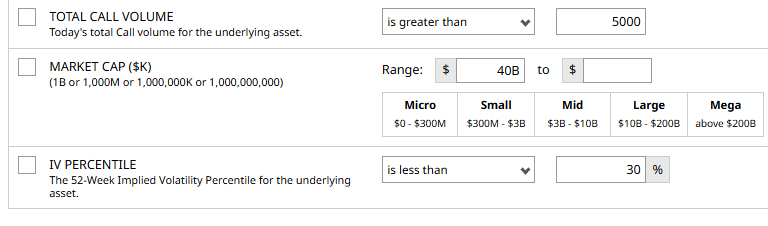

First, let’s find stock with a low IV Percentile using the Stock Screener and the following parameters:

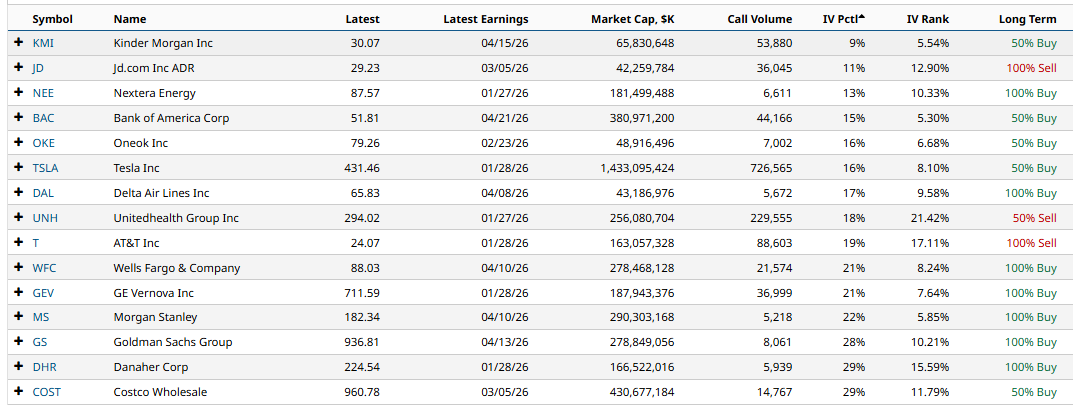

This gives us the following results:

Bank of America (BAC) stands out as a good candidate for a long straddle trade.

BAC Long Straddle

A long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction and / or an increase in implied volatility.

To execute the strategy, a trader would buy a call and a put with the following conditions:

- Both options must use the same underlying stock

- Both options must have the same expiration

- Both options must have the same strike price

Since it involves having to buy both a call and a put, the trader must pay two premiums up-front, which also happens to be the maximum possible loss.

The potential profit is theoretically unlimited, although the trade will lose money each day through time decay if a big move does not occur.

The position means you will start with a net debit and only profit when the underlying stock rises above the upper break-even point or falls below the lower break-even point.

Profits can be made with a smaller price move if the move happens early in the trade.

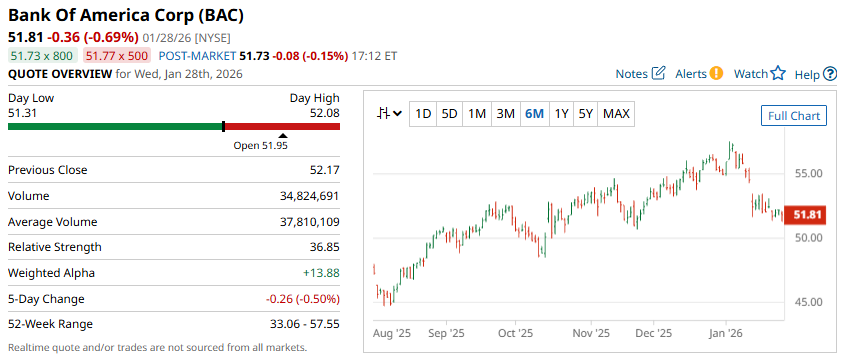

Let’s take a look at how we could set up a Long Straddle on Bank of America stock.

Using the April 17th expiry, the trade would involve buying the $50-strike call and the $50-strike put. The premium paid for the trade would be $533 , which is also the maximum loss.

The maximum profit is theoretically unlimited. The lower breakeven price is $44.67 and the upper breakeven price is $55.33.

However, profits can be made with a smaller move if the move comes earlier in the trade.

Changes to implied volatility will have a big impact on this trade and the interim breakeven prices, so it’s important to have a solid understanding of volatility before placing a trade like this.

The worst-case scenario with this BAC long straddle would be a stable stock price which would see the call and put slowly lose value each day. For a long straddle, I usually set a stop loss at around 20% of capital at risk which would be around $165 and a profit target of around 40%.

I would also look to close the trade by the end of February if a big move hasn’t occurred by then.

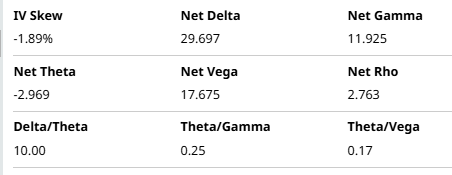

The trade starts with Theta of -3, meaning it will lose roughly $3 per day from time decay, with all else being equal.

The premium paid is equal to 10.29% of the stock price and the probability of profit is estimated at 39.4%.

The Barchart Technical Opinion rating is a 40% Buy with a Weakest short term outlook on maintaining the current direction.

Implied volatility is currently 22.03% compared to a twelve-month low of 19.85% and a high of 61.16%.

Mitigating Risk

Long straddles can lose money fairly quickly if the stock stay flat, and / or if implied volatility drops.

Position sizing is important so that a large loss does not cause more than a 1-2% loss in total portfolio value.

Another good rule of thumb is a 20-30% stop loss.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart