The San Diego, California-based Qualcomm Incorporated (QCOM) has entered 2026 as a diversified artificial intelligence (AI) semiconductor player and not just a handset company. It develops and commercializes wireless technologies such as 3G/4G/5G connectivity, high-performance low-power computing, and on-device AI.

Commanding a market cap of approximately $163.5 billion, it supplies semiconductors and software for mobile devices, automotive systems, Internet of Things (IoT), consumer electronics, industrial uses, and edge networking, alongside licensing essential wireless patents.

Despite the diversified foundation, QCOM's stock performance has remained under pressure. Over the past 52 weeks, Qualcomm’s shares declined 11%, materially underperforming the S&P 500 Index ($SPX), which gained 15% during the same period. The gap persists on a year-to-date (YTD) basis as well. QCOM stock has fallen 10.7% in 2026, while the S&P 500 has gained 1.9%.

Within the technology sector, the relative underperformance becomes even more pronounced. Qualcomm has trailed the State Street Technology Select Sector SPDR ETF (XLK), which surged 27.7% over the past year and added another 3.7% this year.

Sentiment briefly improved on Nov. 5, 2025, when QCOM shares climbed roughly 4% following the release of fourth-quarter 2025 earnings. Revenue rose 10% year over year to $11.27 billion, surpassing analyst estimates of $10.79 billion, while non-GAAP EPS climbed 11.5% to $3, decisively topping the Street’s $2.88 expectation.

Building on this momentum, management has highlighted AI as Qualcomm’s most compelling growth opportunity. The company plans to launch AI accelerator chips, including the AI200 in 2026 and the AI250, both scalable to a full liquid-cooled server rack. Reflecting this confidence, the management expects Q1 fiscal 2026 revenue of $11.8–$12.6 billion and non-GAAP EPS of $3.30–$3.50.

Looking further ahead, analysts forecast a more measured trajectory. For fiscal year 2026, ending in September, consensus estimates call for a 2.9% decline in EPS to $9.78 on a diluted basis. Even so, Qualcomm has exceeded consensus expectations in each of the past four quarters.

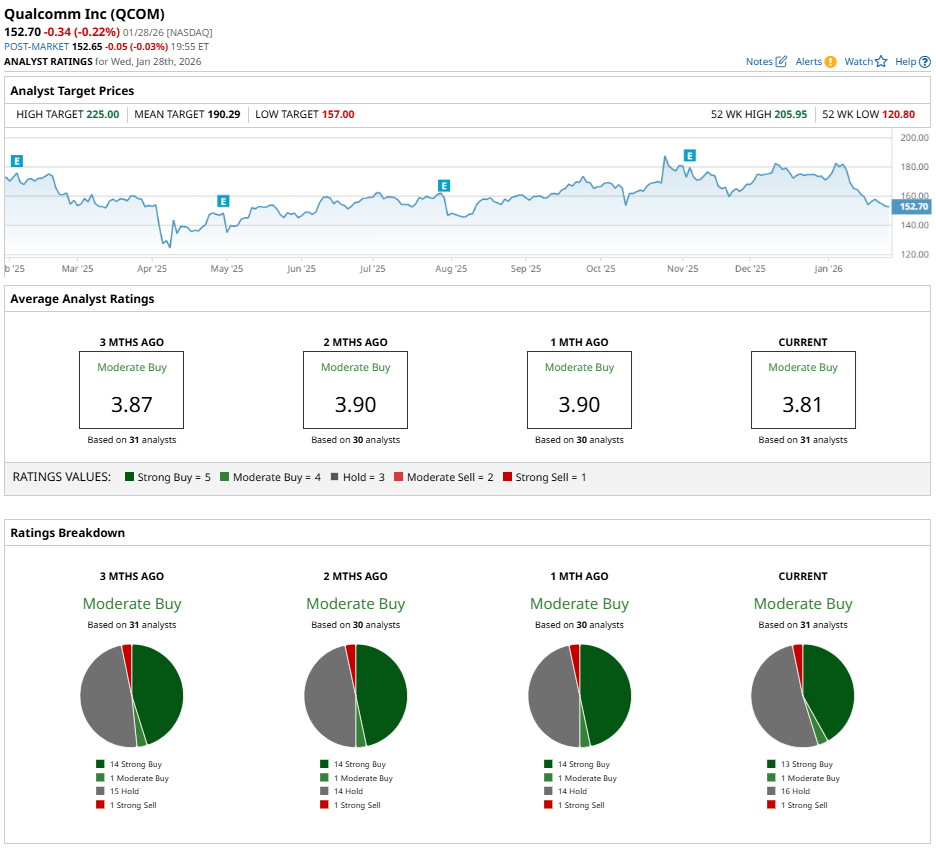

Wall Street’s broader view remains cautiously positive. Among 31 analysts covering the stock, the consensus rating stands at “Moderate Buy.” This includes 13 “Strong Buy,” one “Moderate Buy,” 16 “Hold,” and one “Strong Sell” rating, reflecting optimism tempered by near-term uncertainty.

Importantly, analyst sentiment has remained largely unchanged from three months ago, when 14 analysts assigned “Strong Buy” ratings.

However, on Jan. 9, Mizuho analyst Vijay Rakesh downgraded QCOM stock from “Outperform” to “Neutral” and reduced the price target to $175 from $200. Despite Qualcomm’s strong handset leadership and expanding push into AI hardware, Mizuho sees handset-related headwinds capping near-term upside for the long-dominant mobile chipmaker.

Even with these revisions, pricing metrics still suggest room for appreciation. The mean price target of $190.29 implies potential upside of 24.6%, while the Street-high target of $225 represents a gain of 47.3% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart