Valued at a market cap of $20.4 billion, Amcor plc (AMCR) is a packaging company based in Zurich, Switzerland. It designs and manufactures flexible and rigid packaging products for food and beverage, healthcare, personal care, and other consumer goods markets.

This packaging company has considerably underperformed the broader market over the past 52 weeks. Shares of AMCR have declined 10% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.4%. However, on a YTD basis, the stock is up 5.3%, outpacing SPX’s 1.8% return.

Narrowing the focus, AMCR has also trailed behind the Invesco S&P 500 Equal Weight Materials ETF (RSPM), which rose 9.8% over the past 52 weeks and 10.4% on a YTD basis.

On Nov 5, AMCR shares surged 2.5% after reporting its Q1 results. The company's total revenue increased 71.3% year over year to $5.7 billion, driven by the successful acquisition of Berry Global and strong growth in volumes. Yet, its topline fell short of analyst expectations by 1.4%. Nonetheless, on the earnings front, its adjusted EPS improved 19.1% from the same period last year to $0.19, meeting consensus estimates.

For fiscal 2026, ending in June, analysts expect AMCR’s EPS to grow 13.2% year over year to $4.02. The company’s earnings surprise history is mixed. It met the consensus estimates in three of the last four quarters, while missing on another occasion.

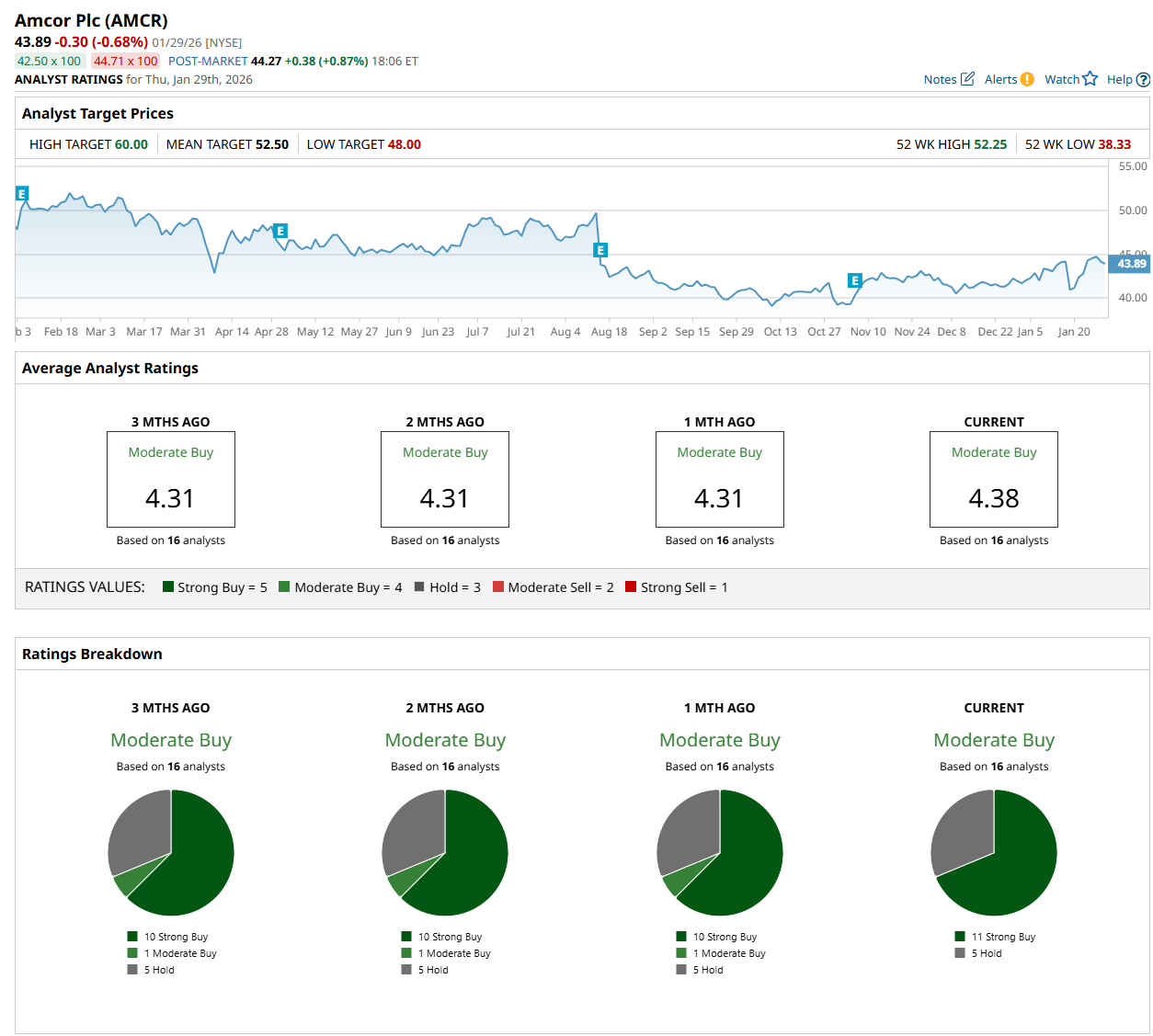

Among the 16 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 11 “Strong Buy” and five “Hold” ratings.

The configuration is slightly more bullish than a month ago, with 10 analysts suggesting a “Strong Buy” rating.

On Jan. 28, Morgan Stanley (MS) analyst Joseph Michael downgraded Amcor to “Equal Weight,” with a price target of $46, indicating a 4.8% potential upside from the current levels.

The mean price target of $52.50 represents a 19.6% premium from AMCR’s current price levels, while the Street-high price target of $60 suggests a 36.7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart