Howmet Aerospace Inc. (HWM), headquartered in Pittsburgh, Pennsylvania, provides advanced engineered solutions for the aerospace and transportation industries. Valued at $84.8 billion by market cap, the company offers engines, fasteners, and structures, as well as forged wheels.

Shares of this engineered metal products leader have outperformed the broader market over the past year. HWM has gained 65.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.4%. In 2026, HWM stock is up 1.9%, surpassing the SPX’s 1.8% rise on a YTD basis.

Zooming in further, HWM’s outperformance is also apparent compared to Invesco Aerospace & Defense ETF (PPA). The exchange-traded fund has gained about 48.1% over the past year. However, the ETF’s 12.2% returns on a YTD basis outshine the stock’s single-digit gains over the same time frame.

HWM's strong performance follows its $1.8 billion acquisition of Consolidated Aerospace Manufacturing, LLC, a leading designer and manufacturer of precision aerospace and defense products. This move bolsters HWM's portfolio, tapping into the aerospace sector's focus on innovation, emissions reduction, and automation.

On Oct. 30, 2025, HWM reported its Q3 results, and its shares closed up more than 2% in the following trading session. Its adjusted EPS of $0.95 exceeded Wall Street expectations of $0.91. The company’s revenue was $2.09 billion, topping Wall Street forecasts of $2.05 billion. HWM expects full-year EPS in the range of $3.66 to $3.68, and revenue ranging from $8.18 billion to $8.20 billion.

For the current fiscal year, ended in December 2025, analysts expect HWM’s EPS to grow 37.2% to $3.69 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

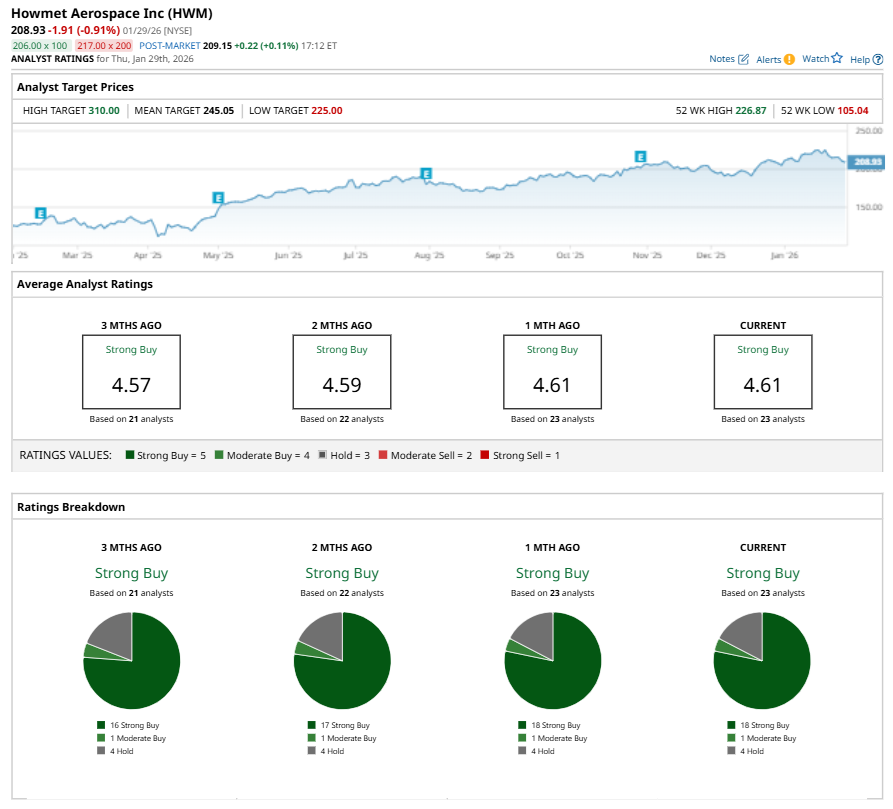

Among the 23 analysts covering HWM stock, the consensus is a “Strong Buy.” That’s based on 18 “Strong Buy” ratings, one “Moderate Buy,” and four “Holds.”

This configuration is more bullish than two months ago, with 17 analysts suggesting a “Strong Buy.”

On Jan. 13, TD Cowen analyst Gautam Khanna maintained a “Buy” rating on HWM and set a price target of $240, implying a potential upside of 14.9% from current levels.

The mean price target of $245.05 represents a 17.3% premium to HWM’s current price levels. The Street-high price target of $310 suggests an ambitious upside potential of 48.4%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart