Palo Alto, California-based HP Inc. (HPQ) provides personal computing, printing, 3D printing, gaming, and other related technologies. Valued at a market cap of $17.8 billion, the company focuses on innovation, cost efficiency, and recurring revenue from supplies while maintaining a strong presence in both consumer and commercial markets.

This tech company has notably lagged behind the broader market over the past 52 weeks. Shares of HPQ have declined 40.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.4%. Moreover, on a YTD basis, the stock is down 13%, compared to SPX’s 1.8% return.

Narrowing the focus, HPQ has also significantly underperformed the State Street Technology Select Sector SPDR ETF (XLK), which surged 26.8% over the past 52 weeks and 2% on a YTD basis.

On Jan. 20, shares of HPQ slipped 2.8% after Morgan Stanley (MS) adopted a more cautious outlook on the U.S. IT hardware sector and lowered its price target on the stock. The bank downgraded its view on the North American IT hardware industry to “cautious” from “in-line,” citing the risk of a potential “perfect storm” driven by weakening business demand, rising component costs, and elevated equity valuations.

For the current fiscal year, ending in October, analysts expect HPQ’s EPS to decline 2.9% year over year to $3.03. The company’s earnings surprise history is mixed. It met or topped the consensus estimates in two of the last four quarters, while missing on two other occasions.

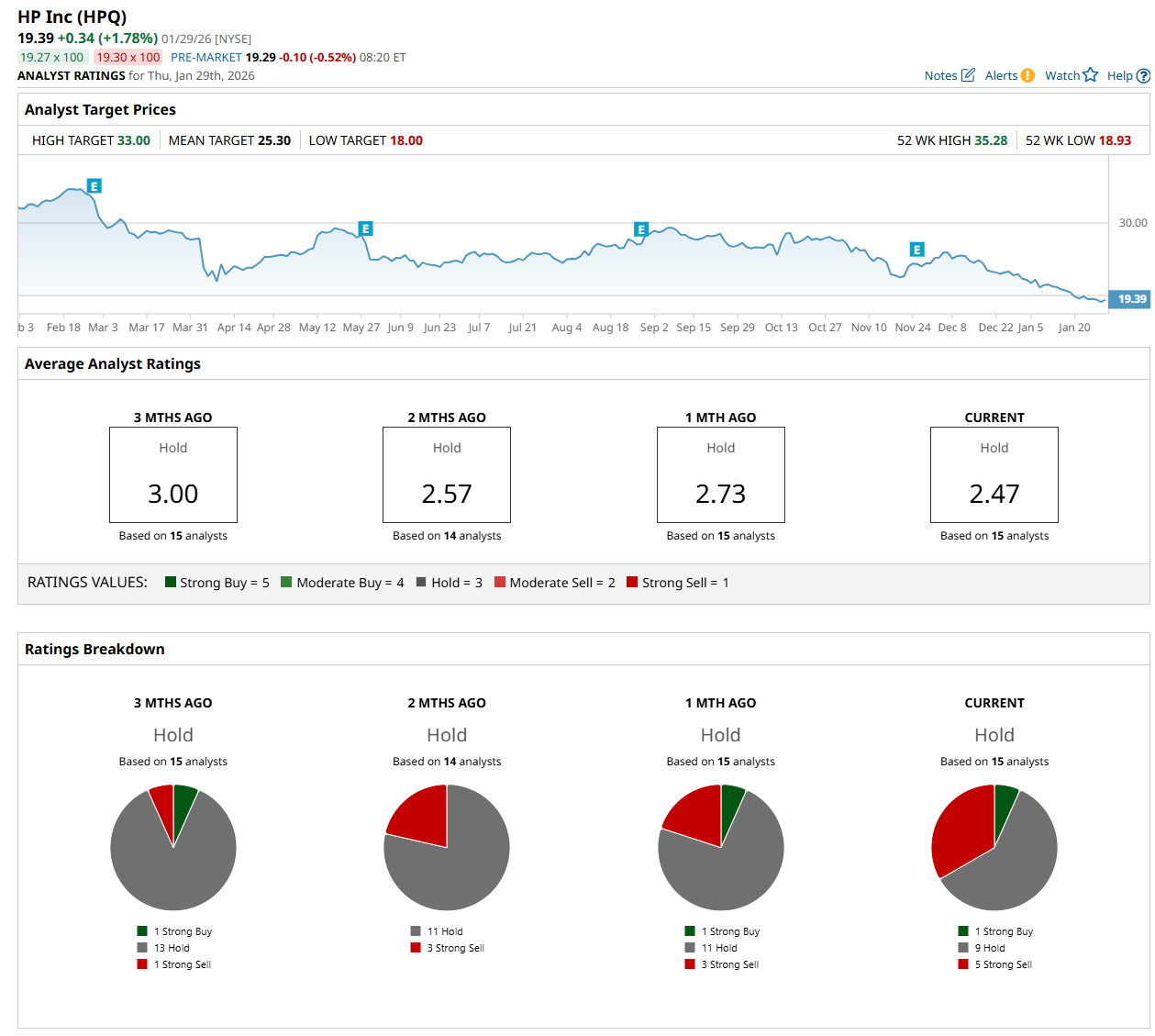

Among the 15 analysts covering the stock, the consensus rating is a "Hold,” which is based on one “Strong Buy,” nine “Hold,” and five “Strong Sell” ratings.

The configuration is more bearish than a month ago, with three analysts suggesting a "Strong Sell” rating.

On Jan. 27, AllianceBernstein Holding L.P. (AB) analyst Mark Newman maintained a "Hold" rating on HPQ and set a price target of $30, indicating a 54.7% potential upside from the current price levels.

The mean price target of $25.30 represents a 30.5% premium from HPQ’s current price levels, while the Street-high price target of $33 suggests a 70.2% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart