After a record-breaking 2025, 2026’s market started off like a rollercoaster. We’re one month in, and there have been seismic movements in both the broader market and the tech sector. Big names like Microsoft are seeing massive volatility, while other AI stocks like Nvidia and Palantir are showing price weakness.

Now, it’s no secret that AI stocks were the favorites last year, but as volatility hits, investors often reset their priorities, focusing on income, upside, and positioning ahead of broader market moves. So, if you’re thinking along the same lines, perhaps it’s time to consider dividend stocks.

Dividend stocks showing early strength tend to stand out perfectly for several reasons: improving fundamentals, growing confidence, or a shift in their balance sheet. These early leaders can offer both income today and the potential for continued gains as the year progresses.

With that in mind, I screened for dividend stocks that combine analyst support with the strongest year-to-date performance so far in 2026. The result is a short list of income stocks that not only pay dividends but also set the pace early in the year.

How I came up with the following stocks

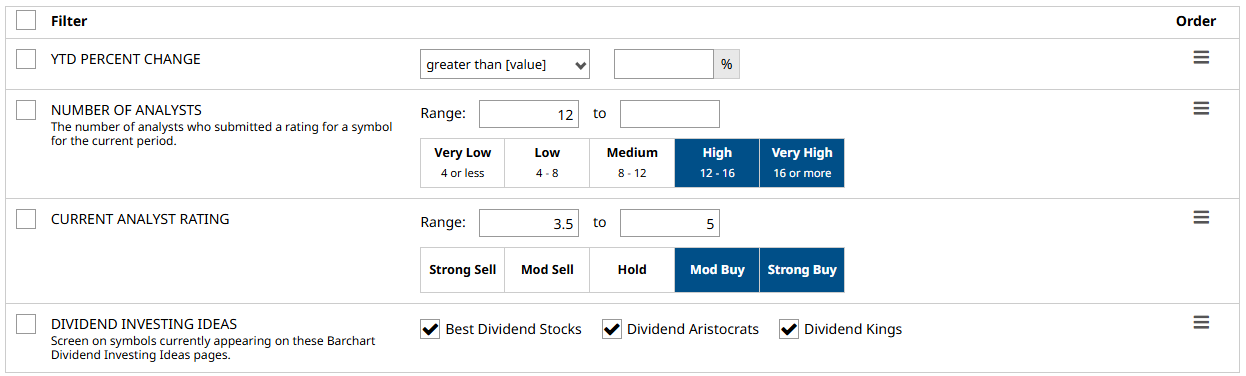

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- YTD Percent Change: Left blank so I can sort it later from highest to lowest.

- Number of Analysts: 12 or higher. More analyst suggests stronger confidence in the rating.

- Current Analyst Rating: 3.5-5. Stocks with Moderate to Strong buy ratings.

- Dividend Investing Ideas: Best Dividend Stocks, Dividend Aristocrats, and Dividend Kings.

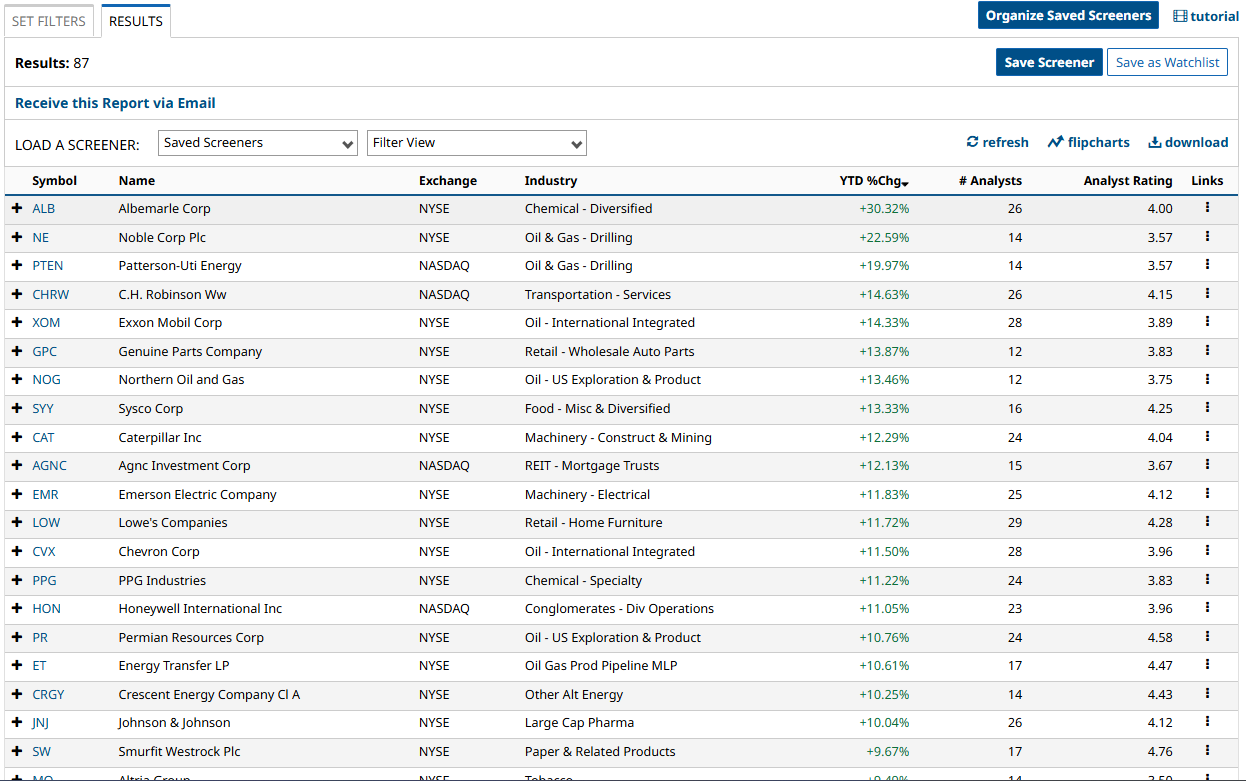

I hit the screen and got 87 results. I will cover three with the highest YTD percent change.

Let’s start with the first dividend stock:

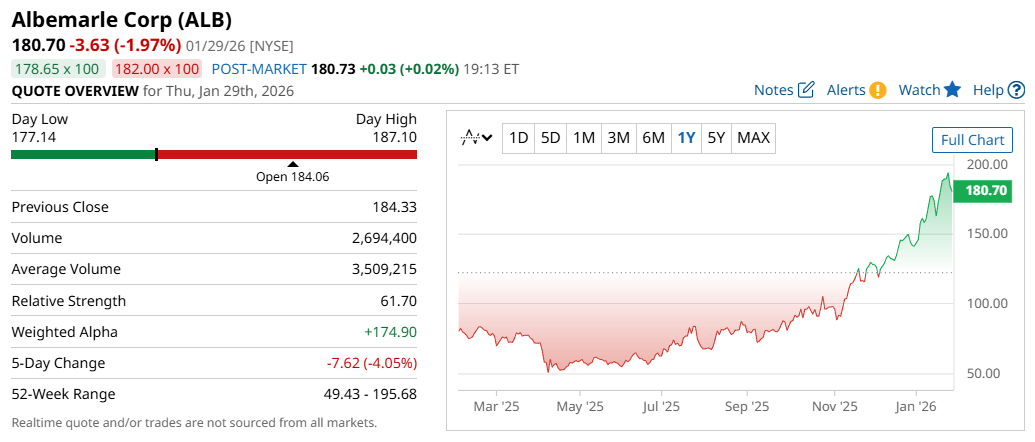

Albemarle Corp (ALB)

Albemarle Corp is a specialty chemicals company and a pioneer in lithium batteries. It supplies lithium for electric vehicles (EV) batteries, energy storage, and related products globally. ALB stock is up the most, YTD (on this list) at around 28%, and over the last 52-weeks, the stock is up nearly 110%.

Not only that, Albemarle has been paying consistently increasing dividends for more than 30 years. Today, it pays a forward annual dividend of $1.62, which translates to around a 0.8% yield.

Meanwhile, a consensus among 26 analysts rates the stock a “Moderate Buy” with as much as 16% upside if ALB stock reaches its $210 high target.

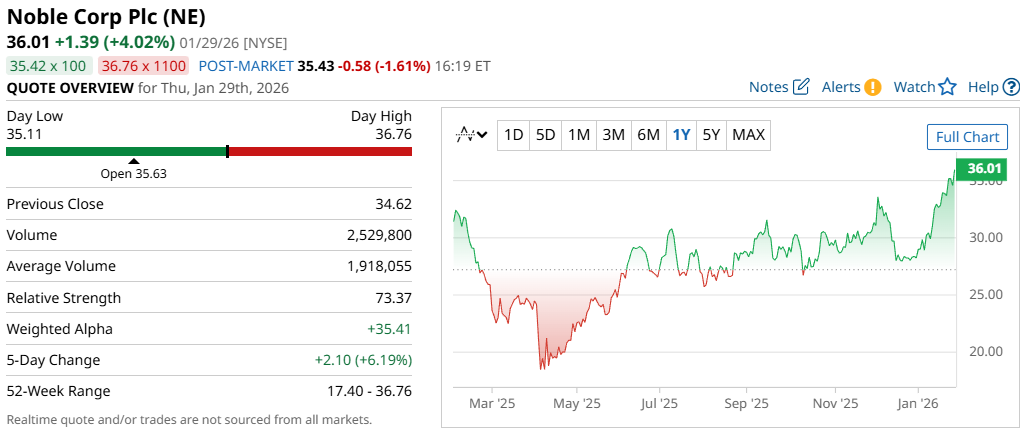

Noble Corp Plc (NE)

The next dividend stock on my list is Noble Corp Plc, a drilling company in the oil and gas industry, backed by a fleet of some of the world’s most advanced offshore drilling equipment. NE stock has grown 27% since the start of 2026, though its 52-week return is a bit weaker at just 12%. That being said, the recent near-term price boost might be a sign of better things to come for this year.

Noble Corp has increased its dividends for three consecutive years, paying a forward annual dividend of $2.00, translating to a yield of nearly 6%. However, its dividend payout ratio is unsustainably high at 173.02%, so investors today will likely expect the stock to continue rising first, and be happy to take the dividend second.

Meanwhile, a consensus among 14 analysts rates the stock a “Moderate Buy”, suggesting a 5% upside if it reaches the projected high price of $38.

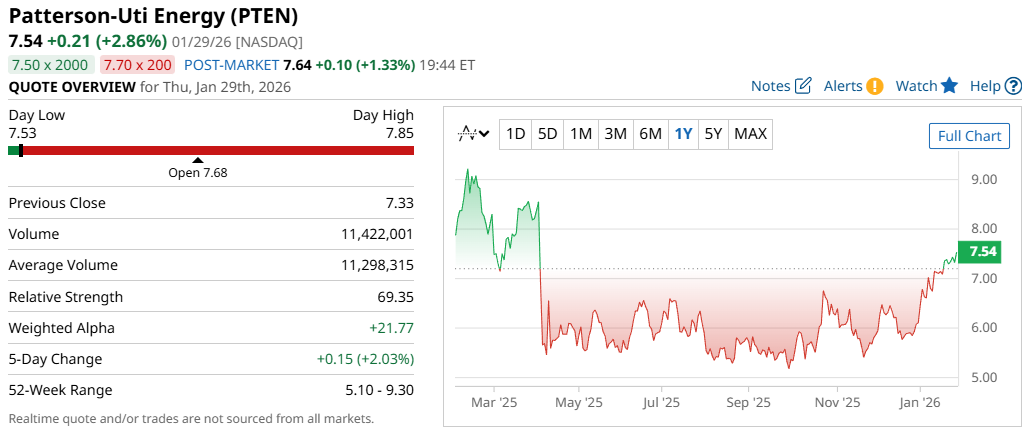

Patterson-Uti Energy (PTEN)

The last dividend stock on my list is Patterson-UTI Energy, a company with a business model similar to Noble Corp's, but focused on onshore oilfield services rather than offshore drilling contracts.

While PTEN stock has recovered well in 2026 with a 23% return, it’s still trading nearly 9% below where it was just a year ago. But after hovering in the sub-$7 range for most of 2025, this year’s price spike is sure to be a welcome change to investors.

The company pays a consistent forward annual dividend of $0.32, translating to a yield of around 4%. While it does not yet have a long dividend track record, the current yield offers income today with potential upside as the business continues to improve.

Speaking of upside, there could be as much as 19% upside if the stock reaches its high target of $9.00. Finally, PTEN stock has a “Moderate Buy” consensus rating based on 14 analyst ratings.

Final Thoughts

These high-performing dividend stocks show that income investing can take many forms, combining yield, momentum, and potential upside. Some offer longer histories of dividend consistency, while others provide higher current income supported by improving fundamentals.

In the end, the “right income investment” is one that fits both your risk tolerance and return targets, of course, backed by solid due diligence.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart