Houston, Texas-based LyondellBasell Industries N.V. (LYB) is a major petrochemical and chemical company. With a market cap of $14.3 billion, it produces and markets key chemical building blocks such as ethylene, propylene, polyethylene and polypropylene, along with a wide range of polymers, specialty chemicals, and fuels, which are used in everyday applications including packaging, automotive components, construction materials, textiles, and consumer goods. The company’s operations are organized into Olefins & Polyolefins, Intermediates & Derivatives, Advanced Polymer Solutions, Refining, and Technology segments, and it also licenses processing technologies to other producers.

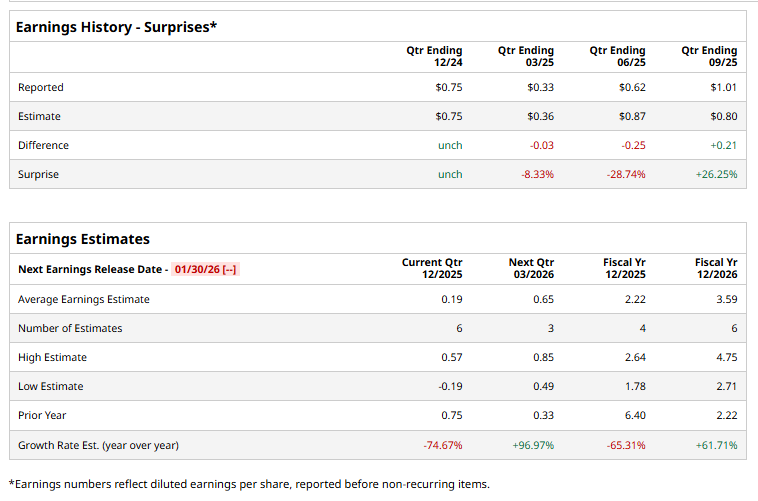

The chemical giant is gearing up to announce its fourth-quarter results soon. Ahead of the event, analysts expect LYB to deliver a non-GAAP profit of $0.19 per share, down 74.7% from $0.75 per share reported in the year-ago quarter. While the company has met or exceeded Street estimates on the bottom line twice over the past four quarters, it has missed projections on two other occasions.

For the current fiscal 2025, analysts project the chemical giant to deliver a non-GAAP EPS of $2.22, down 65.3% from $6.40 in fiscal 2024. Moreover, in fiscal 2026, its earnings are expected to rebound 61.7% year over year to $3.59 per share.

LYB stock prices have tanked 39% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 16.9% returns and the Materials Select Sector SPDR Fund’s (XLB) 10.9% decline during the same time frame.

On Dec. 15, LyondellBasell shares declined more than 2%, following a downgrade by BMO Capital Markets, which lowered its rating from “Market Perform” to “Underperform” and set a price target of $36. The downgrade reflected the analyst’s concerns over near-term headwinds in the chemicals and petrochemicals markets, including weaker global demand, margin pressure from rising feedstock costs, and uncertainty in the energy and industrial sectors.

Analysts remain cautious about the stock’s prospects. LyondellBasell has a consensus “Hold” rating overall. Of the 21 analysts covering the stock, opinions include two “Strong Buys,” one “Moderate Buy,” 14 “Holds,” and four “Strong Sells.” Its mean price target of $50.70 suggests a 14.2% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- CES 2026, Sector Rotation and Other Key Things to Watch this Week

- Tesla Stock Has Been Flat For 2 Months - How to Make a 3.2% Yield in One-Month Puts

- GOOGL Stock Rocked in 2025, But Is Google’s 2026 Forecast as Bright?

- The Saturday Spread: How Basketball Analytics May Help Extract Alpha (CPNG, DBX, BBY)