Valued at a market cap of $363.8 billion, Advanced Micro Devices, Inc. (AMD) is a semiconductor company that designs high-performance processors and graphics solutions used across a wide range of markets, including PCs, gaming, data centers, artificial intelligence, and embedded systems. The Santa Clara, California-based company is expected to announce its fiscal Q4 earnings for 2025 in the near future.

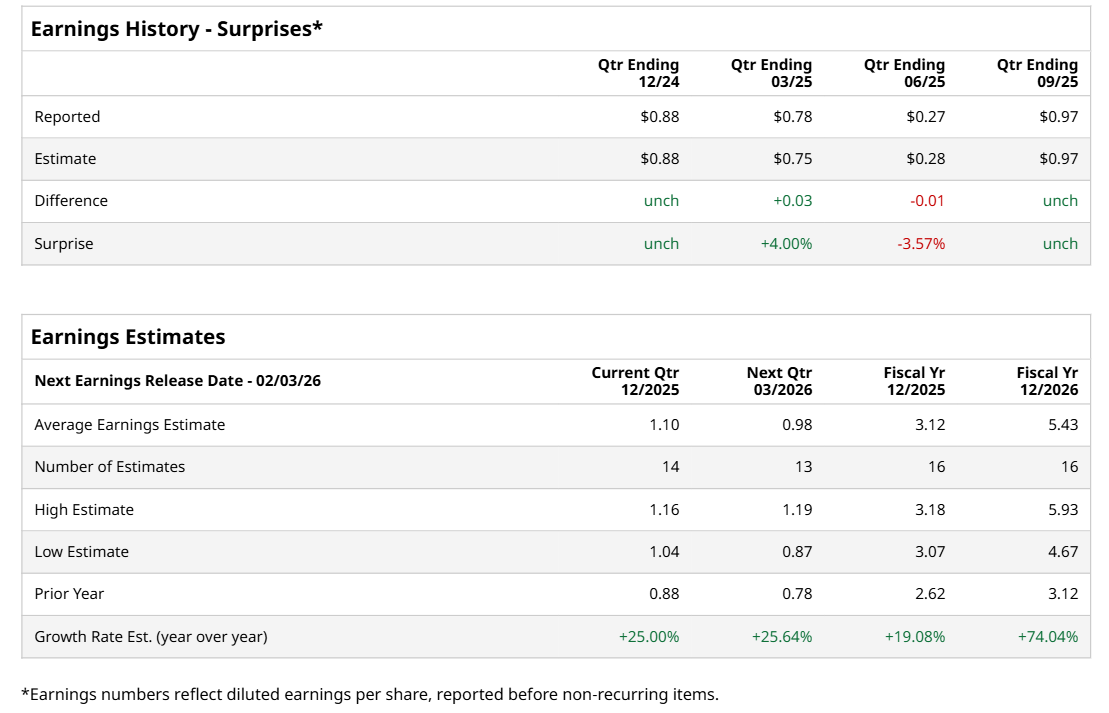

Ahead of this event, analysts expect this semiconductor company to report a profit of $1.10 per share, up 25% from $0.88 per share in the year-ago quarter. The company has met or surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $0.97 per share in the previous quarter came in line with the consensus estimates.

For the current fiscal year, ending in December, analysts expect AMD to report a profit of $3.12 per share, up 19.1% from $2.62 per share in fiscal 2024. Its EPS is expected to further grow 74% year-over-year to $5.43 in fiscal 2026.

AMD has rallied 76.3% over the past 52 weeks, notably outperforming both the S&P 500 Index's ($SPX) 16.2% rise and the State Street Technology Select Sector SPDR ETF’s (XLK) 22.7% uptick over the same time period.

Shares of AMD surged 4.4% on Jan. 2, as investor sentiment strengthened on the back of bullish analyst forecasts and expectations of upcoming product launches. Several leading Wall Street analysts projected as much as a 32% upside in the stock by 2026, extending last year’s strong gains. Optimism was largely driven by AMD’s growing importance in the artificial intelligence ecosystem, supported by robust demand for high-performance computing and data center solutions. The stock also benefited from a broader rally in technology shares, as renewed excitement around AI lifted the entire sector.

Wall Street analysts are moderately optimistic about AMD’s stock, with an overall "Moderate Buy" rating. Among 44 analysts covering the stock, 29 recommend "Strong Buy," three suggest "Moderate Buy,” and 12 advise “Hold” ratings. The mean price target for AMD is $285.05, indicating a 28.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart