Centene Corporation (CNC) is a Missouri-based healthcare company that provides government-sponsored and commercial health insurance plans and related services, especially for underinsured and low-income populations. With a market cap of $20.5 billion, it operates across the United States through Medicaid, Medicare, commercial insurance and specialty services segments, delivering care via physicians, hospitals and ancillary providers and offering pharmacy, dental, behavioral health and vision services.

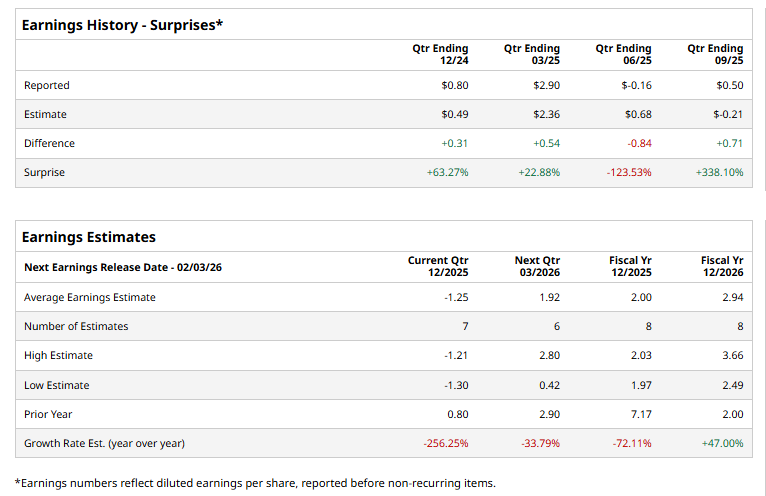

The healthcare services giant is set to release its fourth-quarter results shortly. Ahead of the event, analysts expect CNC to post a non-GAAP loss of $1.25 per share, a drop of 256.3% from the profit of $0.80 per share reported in the year-ago quarter. The company has surpassed Street’s bottom-line estimates in three of the past four quarters and has missed the projections on another occasion.

For fiscal 2025, CNC’s non-GAAP EPS is expected to come in at $2, down 72.1% from $7.17 in 2024. But, in fiscal 2026, its earnings are expected to surge 47% year over year to $2.94 per share.

CNC stock prices have plummeted 27.3% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 16.2% surge and the Health Care Select Sector SPDR Fund’s (XLV) 11.6% rise during the same time frame.

Centene shares rose 4.2% on Jan. 5 after Barclays plc (BCS) upgraded the stock to “Overweight” and lifted its price target to $54 from $44, citing improving prospects in the Affordable Care Act market. The upgrade followed a detailed pricing analysis indicating Centene is well-positioned to expand ACA margins, supported by meaningful premium increases that are unlikely to undermine its competitive position.

The consensus view on CNC stock remains cautious, with an overall “Hold” rating. Out of the 19 analysts covering the stock, three recommend “Strong Buys,” 13 suggest “Holds,” one advocates “Moderate Sell,” and two give a “Strong Sell” rating. CNC currently trades above its mean price target of $41.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart