London-based Pentair plc (PNR) is a top industrial company specializing in sustainable water and fluid solutions. Valued at a market cap of $17.3 billion, it designs, manufactures and markets a broad range of products and systems for water treatment, fluid handling, filtration, separation and pool applications across residential, commercial, industrial and municipal markets. Its offerings include pumps, advanced filtration systems, pressure vessels, valves, controls and pool equipment sold under brands such as Pentair, Everpure, Sta-Rite and Kreepy Krauly.

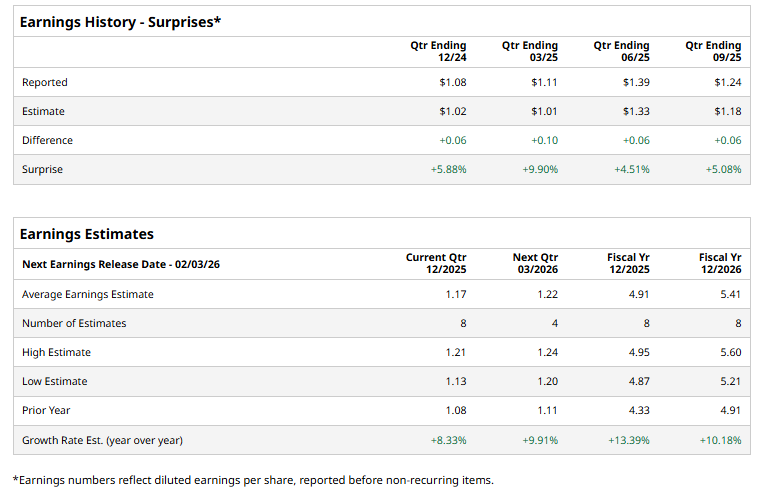

The company is set to unveil its fourth-quarter results shortly. Ahead of the event, analysts expect PNR to report non-GAAP earnings of $1.17 per share, up 8.3% from the profit of $1.08 per share reported in the year-ago quarter. Additionally, the company has surpassed the Street’s bottom-line projections in each of the past four quarters, which is impressive.

For the current year, its earnings are expected to come in at $4.91 per share, up 13.4% from $4.33 per share reported in the year-ago quarter. Moreover, in fiscal 2026, its earnings are expected to rise 10.2% annually to $5.41 per share.

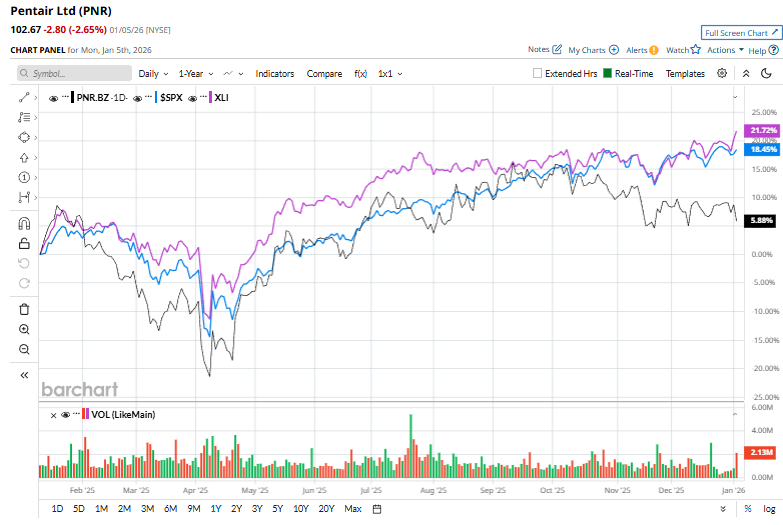

PNR stock has surged 1.6% over the past 52 weeks, trailing the S&P 500 Index’s ($SPX) 16.2% uptick and the Industrial Select Sector SPDR Fund’s (XLI) 20.4% surge over the same time frame.

On Jan. 5, shares of Pentair Plc fell more than 2% after TD Cowen downgraded the stock to “Sell” from “Hold” and set a $90 price target. The downgrade reflected concerns around near-term growth visibility and valuation, with the brokerage citing softer demand trends and limited upside potential as key reasons for the more cautious stance.

Nevertheless, the consensus opinion on PNR is fairly upbeat, with a “Moderate Buy” rating overall. Of the 21 analysts covering the stock, opinions include 12 “Strong Buys,” two “Moderate Buy,” six “Holds,” and one “Moderate Sell.” Its mean price target of $123.31 suggests a 20.1% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart