Despite lingering concerns about Tesla's (TSLA) loosening grip on the European market, Norway remains a bright spot. According to the European Automobile Manufacturers Association (ACEA), Tesla’s December registrations in the country (which can be taken as a proxy for sales) increased by 89% compared to the prior-year period to 5,679 units. The company claimed a 19.1% share of the Norwegian car market in 2025, becoming the top-selling carmaker in the country for the fifth consecutive year.

Is this silver lining enough to justify investing in TSLA stock now?

About Tesla Stock

Headquartered in Austin, Texas, Tesla leads in electric vehicle (EV) innovation through its global gigafactory manufacturing network. These facilities produce vehicles such as the Model 3, Model Y, and the Cybertruck, as well as energy solutions including its Powerwall batteries and Megapack storage systems.

Tesla's operations span vehicle design, autonomous driving (AD) software development through Full Self-Driving (FSD) updates, Supercharger network expansion, and solar energy integration, with a recent focus on scaling Cybertruck production at Giga Texas and enhancing artificial intelligence (AI) driven robotics. The company has a market capitalization of roughly $1.46 trillion.

Tesla faces growing challenges to its once-unrivaled dominance in EVs, as market saturation and policy shifts erode early advantages. Intensified global competition signals a more contested landscape ahead for the company.

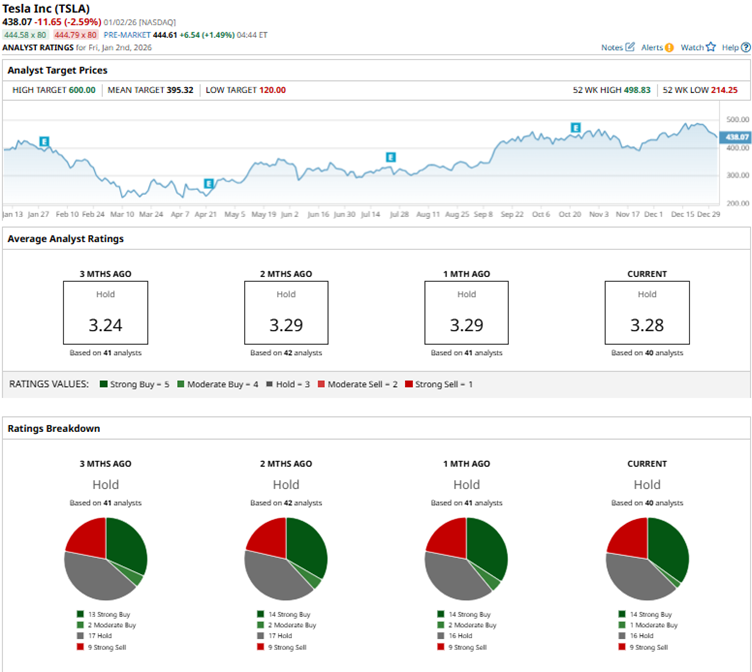

TSLA stock is down by 5% over the past month. However, the stock remains in the green over the longer term. Over the past 52 weeks, the stock has gained 5%, and over the past six months, 37%. TSLA reached a 52-week high of $498.83 in late December but is now down 13% from that level.

Tesla’s stock is trading at an eye-watering valuation. Its forward price-to-earnings multiple is currently 251 times, which is significantly higher than the industry average.

Tesla’s Production Numbers Dropped in Q3, But Deliveries Grew

Tesla’s total production for the third quarter of fiscal 2025 dropped by 5% year-over-year (YOY) to 447,450 units. While Model 3/Y production declined by 2% annually only, the company’s other models recorded a hefty 56% decline from the prior year. On the other hand, Tesla achieved record deliveries of 497,099 units, up 7% YOY, for the quarter. Once again, growth was driven by deliveries of its core Model 3/Y, while deliveries of the other models declined compared to the prior year.

Tesla reported a total revenue of $28.1 billion for the third quarter, up 12% YOY, while its automotive revenues increased by 6% YOY to $21.21 billion. While Tesla’s topline grew in double digits, it was subdued compared to the company’s own standards. Moreover, this slow growth also translated into bottom-line declines.

Tesla’s Q3 total gross margin dropped by 185 basis points to 18%, while its operating margin dropped by 501 basis points to 5.8%. The company’s non-GAAP EPS declined by 31% YOY to $0.50. Tesla cited higher expenses and lower regulatory credit revenue as the reasons for the bottom-line headwinds.

Wall Street analysts are not optimistic about Tesla’s bottom-line growth trajectory. For Q4, analysts expect EPS to decline by 48% YOY to $0.34. For fiscal 2025, EPS is projected to decrease by 45% annually to $1.12, followed by a 59% YOY improvement to $1.78 in the following year.

What Do Analysts Think About Tesla Stock?

This month, analysts at Truist Securities maintained a “Hold” rating on TSLA stock while lowering the price target from $444 to $439. Following the EV company’s fourth-quarter deliveries announcement of 418,227 units, missing estimates, analysts reduced the price target. Despite this, Truist also pointed toward Tesla’s AI projects, particularly the development of FSD, which might be “far more important than auto deliveries for TSLA’s long-term cash generation and stock performance.”

Late last month, Baird analyst Ben Kallo reiterated an “Outperform” rating while maintaining the price target at $548, showing that the firm holds a bullish outlook on Tesla’s prospects.

Wall Street analysts are taking a cautious stance on TSLA stock now, with a consensus “Hold” rating overall. Of the 40 analysts rating the stock, 14 analysts have a “Strong Buy” rating, one analyst offers a “Moderate Buy” rating, 16 analysts play it safe with a “Hold” rating, and nine analysts provide a “Strong Sell” rating. The consensus price target of $395.32 represents an 8% potential downside from current levels. However, the Street-high price target of $600 indicates 39% upside potential from current levels.

Key Takeaways

Tesla’s strength in the Norwegian market could be significant, as EVs are gaining prominence in the country. Reportedly, 96% of cars sold in Norway in 2025 were EVs, up from 89% in 2024 and 82% in 2023. In December, almost all cars sold in the country were EVs. However, Tesla struggled to maintain its position in other key markets, such as France and Sweden.

Moreover, there are concerns surrounding Tesla’s production and delivery numbers. For fiscal 2025, Tesla reported that its production numbers were 1.65 million units, which is lower than the 1.77 million units produced in 2024. Delivery numbers also reported a YOY drop for the period. This shows that Tesla’s operations have come under pressure, recording two consecutive years of annual production and revenue declines.

Given this situation, it might be prudent for investors to observe TSLA stock for now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Get Ready for This AI Data Center Stock to Play Catch Up and Surge in 2026.

- Newmont Mining Breaks Into the Top 100: A Bet on Venezuela’s Comeback?

- This Turnaround Stock Has One of the ‘Best Brands’ in the World. Buy Its Shares in 2026.

- Dell Technologies (DELL) Stock Options Could Be Unusually Mispriced