Headquartered in Cleveland, Ohio, TransDigm Group Incorporated (TDG) designs and manufactures proprietary aircraft components, covering power and control systems, airframe hardware, and select non-aviation products.

Holding a market capitalization of approximately $76.5 billion, the company serves airlines, original equipment manufacturers (OEMs), maintenance, repair, and overhaul providers (MROs), military agencies, and industrial customers.

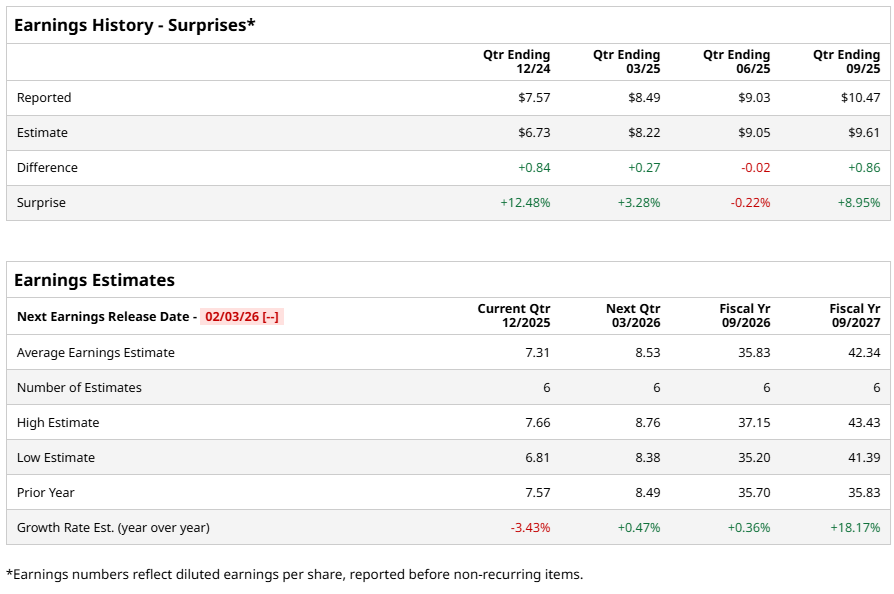

Turning to earnings visibility, TransDigm Group is set to report fiscal 2026 first-quarter results on Tuesday, Feb. 3, before markets open. Analysts expect diluted EPS of $7.31, down 3.4% from $7.57 in last year’s quarter. Still, the company has exceeded EPS estimates in three of the past four quarters, while missing in just one.

Looking beyond the near term, Wall Street projects fiscal 2026 diluted EPS of $35.83, reflecting marginal year-over-year growth. More meaningfully, full-year fiscal 2027 EPS is expected to rise 18.2% from the prior year to $42.34.

Coming to share-price performance, TDG stock has climbed 10.6% over the past 52 weeks and gained 4.1% year-to-date (YTD). In comparison, the S&P 500 Index ($SPX) rose 16.2% over the same 52-week period and 1.5% YTD.

Sector comparisons sharpen the context further. The State Street SPDR S&P Aerospace & Defense ETF (XAR) surged nearly 58% over the past 52 weeks and climbed 10.3% YTD, reflecting robust aerospace and defense tailwinds.

Momentum strengthened materially on Wednesday, Dec. 31, 2025, after TransDigm announced a definitive agreement to acquire Stellant Systems, Inc., a portfolio company of Arlington Capital Partners, for approximately $960 million in cash. The transaction is expected to expand TransDigm’s reach into high-power electronic components critical to aerospace and defense applications.

Markets responded decisively to the news. TransDigm’s shares rose nearly 1% on the day of announcement and added another 2.2% in the subsequent trading session, signaling investor confidence in the deal’s strategic fit and its potential to strengthen earnings durability.

Against this backdrop, Wall Street continues to rate TDG stock a firm “Strong Buy,” unchanged from three months ago. Among 23 analysts covering the stock, 17 recommend “Strong Buy,” while six maintain a “Hold” stance.

TDG’s mean price target of $1,587.67 represents potential upside of 14.7%. Meanwhile, the Street-high target of $1,900 suggests a gain of 37.2% from current levels, underscoring optimism around TransDigm’s earnings durability, acquisition strategy, and long-term value creation.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart