With a market cap of $11.2 billion, Align Technology, Inc. (ALGN) develops and provides Invisalign clear aligners, Vivera retainers, and iTero intraoral scanners and services to patients and dental professionals worldwide. The company operates through two main segments: Clear Aligners, offering a range of Invisalign products for children, teens, and adults, and Imaging Systems & CAD/CAM Services, providing digital scanning, design software, and orthodontic workflow solutions.

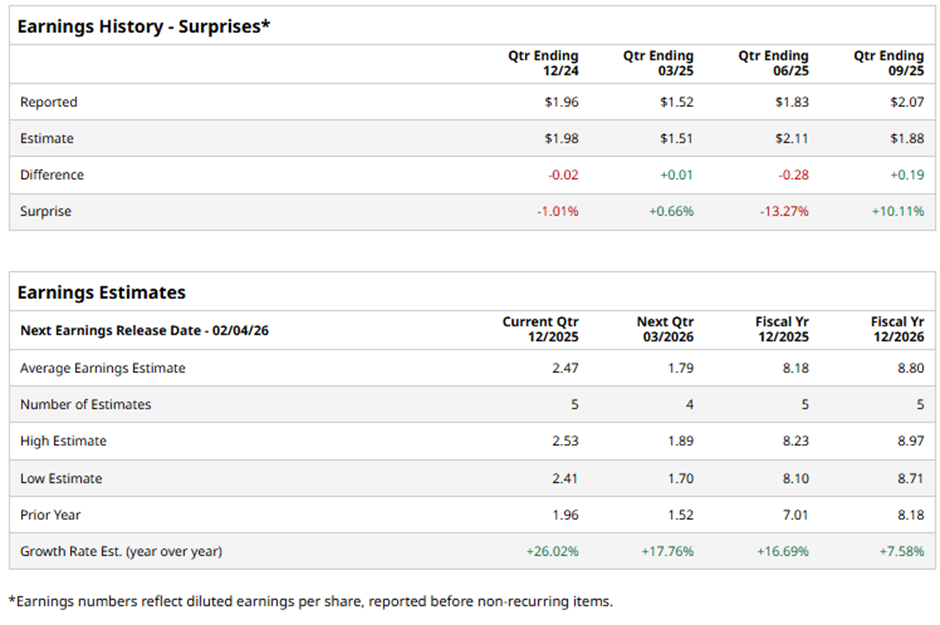

The Tempe, Arizona-based company is expected to unveil its fiscal Q4 2025 results after the market closes on Wednesday, Feb. 4. Ahead of the event, analysts forecast ALGN to post a profit of $2.47 per share, a growth of 26% from $1.96 per share in the same quarter last year. It has surpassed Wall Street's bottom-line projections in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the Invisalign tooth-straightening system maker to report EPS of $8.18, a 16.7% increase from $7.01 in fiscal 2024.

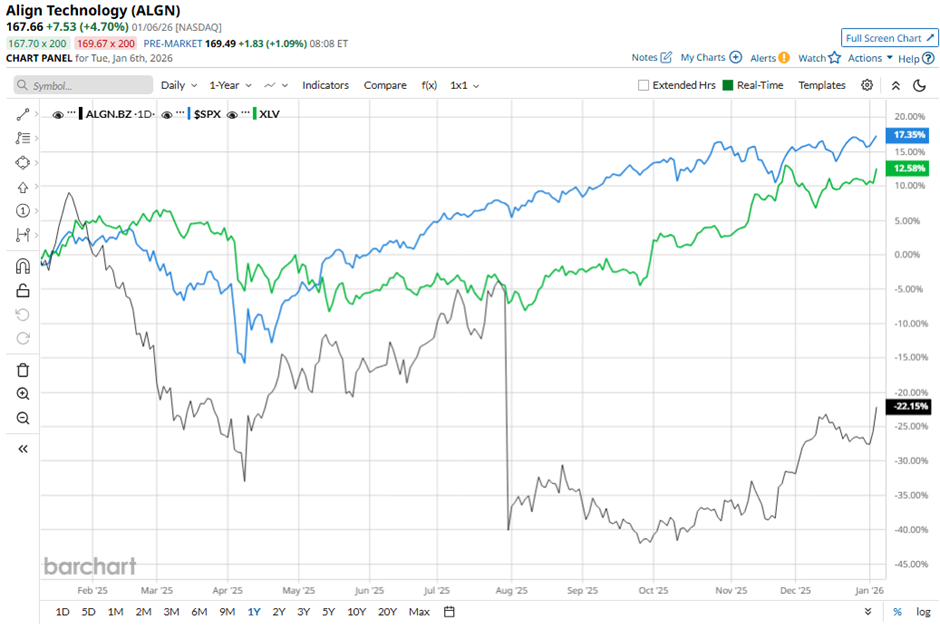

ALGN stock has dropped 22.5% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 16.2% rise and the State Street Health Care Select Sector SPDR ETF's (XLV) 13.3% return over the same period.

Shares of ALGN surged 4.9% following its Q3 2025 results on Oct. 29. Adjusted EPS came in at $2.61 and revenue reached $995.7 million, exceeding the consensus estimates. Investor sentiment was further lifted as Align raised its Q4 revenue forecast to $1.03 billion - $1.05 billion and projected mid-single-digit growth in Clear Aligner volumes.

Analysts' consensus rating on ALGN stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 15 analysts covering the stock, opinions include eight "Strong Buys," six "Holds," and one "Moderate Sell." This configuration is slightly less bullish than three months ago, with nine analysts suggesting a "Strong Buy."

The average analyst price target for ALGN is $171.38, suggesting a potential upside of 2.2% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Twilio Stock Ready for a Major Turnaround in 2026?

- S&P 500, MidCap 400, and SmallCap 600 Welcome New Members as Indexes Rebalance for 2026

- We ‘Can't Determine Whether We are Dealing With a Pet Rock or a Barbie’: Warren Buffett Warns Investors to Only Invest In Industries They Know

- LCID Stock Crashed Last Year, But Will Robotaxis Save the Day for Lucid in 2026?