Simon Property Group, Inc. (SPG), headquartered in Indianapolis, Indiana, stands as a premier real estate investment trust (REIT). The company owns, develops, manages, and leases an extensive global portfolio of top-tier retail assets, encompassing regional malls, Premium Outlet Centers, lifestyle hubs, mixed-use sites, and international holdings in North America, Europe, and Asia. The REIT has a market capitalization of $60.06 billion.

Simon Property is set to report its fourth-quarter results for fiscal 2025 soon. Ahead of the results, Wall Street analysts have tepid expectations about the company’s bottom-line trajectory.

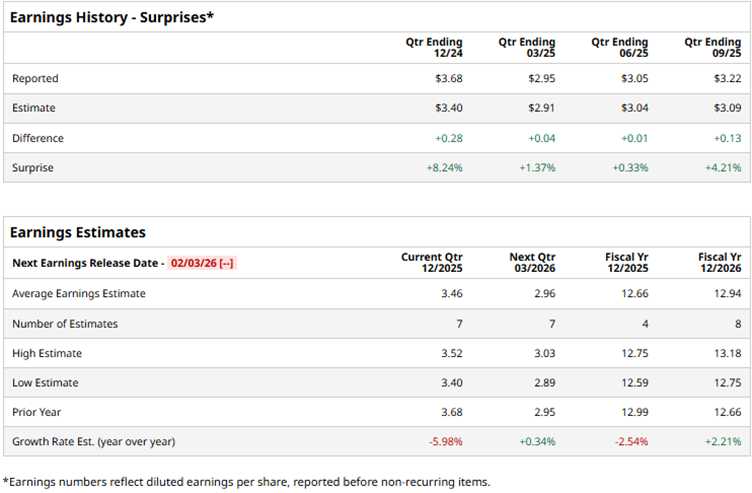

For the quarter about to be reported, analysts expect SPG’s profit to decline by 6% year-over-year (YOY) to $3.46 per diluted share. For fiscal year 2025, profit is projected to decrease by 2.5% to $12.66 per diluted share. It should also be noted that the company has a solid track record of beating consensus estimates in all four trailing quarters. For fiscal 2026, Simon Property’s profit is expected to increase by 2.2% annually to $12.94 per diluted share.

The company’s stock has gained 6.8% over the past 52 weeks and 11.7% over the past six months, based on resilient fundamentals. The S&P 500 Index ($SPX) has gained 16.2% and 10.6% over the same periods, indicating that while the stock has underperformed the broader market over the past year, it has marginally outperformed over the past six months.

Simon Property’s stock is outperforming its own sector. The State Street Real Estate Select Sector SPDR ETF (XLRE) has gained 1% over the past 52 weeks but declined 2.6% over the past six months.

On Nov. 3, 2025, Simon Property reported its third-quarter results for fiscal 2025. The REIT’s total revenue increased 8.2% YOY to $1.60 billion. Its real estate FFO was $3.22 per share for the quarter, up 5.6% from the prior-year period and above the $3.09 per share Wall Street analysts had expected. Simon Property’s stock gained 3.4% intraday on Nov. 4 post the results release.

The company also closed on the acquisition of the remaining 12% interest in The Taubman Realty Group Limited Partnership. With full ownership, Simon Property intends to increase its net operating income by capitalizing on new growth opportunities.

Wall Street analysts have a favorable view of Simon Property’s prospects. Among the 21 analysts covering the stock, the consensus rating is “Moderate Buy.” The rating configuration has remained the same over the past three months. The stock has eight “Strong Buy” ratings and 13 “Holds.”

The mean price target of $194.60 indicates a 4.5% upside from current levels, while the Street-high price target of $225 implies a 20.8% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart