Alibaba (BABA) stock has retreated from its recent highs, falling over 20% from its 52-week peak of $192.67. BABA stock has declined despite encouraging momentum in the company’s cloud business.

Notably, much of the pressure on Alibaba's stock can be traced to margin challenges. Competition across China’s online retail landscape has intensified, forcing Alibaba to lower prices and invest aggressively to defend market share. These competitive dynamics have weighed on profitability, even as revenue remains resilient. At the same time, the company is spending heavily on newer initiatives, including quick commerce, artificial intelligence (AI), and cloud infrastructure, which further compress near-term margins.

Investor sentiment has also been dampened by broader concerns about a potential slowdown in Chinese consumption. Any sustained weakness in consumption would affect Alibaba’s e-commerce business.

That said, the current margin pressure does not undermine Alibaba’s long-term investment case. Management’s increased spending is largely strategic, aimed at strengthening the company’s competitive position and expanding into higher-value growth areas. Over time, these investments could pay off through improved scale, a stronger ecosystem, and more diversified revenue streams.

Cloud and AI Are Emerging as Alibaba’s Core Growth Engine

Alibaba’s cloud business is a major growth catalyst. Cloud services continue to grow strongly. As this segment matures and becomes a larger contributor to overall revenue, it could help offset softness in retail and gradually restore profitability.

Alibaba’s recent financial results highlight an acceleration in growth. In the last reported quarter, Alibaba Cloud posted revenue growth of 34%, while revenue from external customers rose 29%. The segment's growth was driven by strength in public cloud services, where demand for AI-related products continues to surge. Revenue from Alibaba’s AI-related offerings is growing at a triple-digit rate and now accounts for more than 20% of revenue from external customers, with its contribution steadily increasing quarter by quarter.

Importantly, adoption of Alibaba’s AI products is expanding beyond early adopters to a broader base of enterprise customers. Businesses are increasingly deploying value-added AI applications, including tools such as coding assistance, which are deeply integrated into daily workflows. This trend supports revenue growth and strengthens customer stickiness over time.

Looking ahead, the outlook for Alibaba’s cloud business remains positive. The company’s full-stack AI capabilities are becoming a meaningful competitive advantage, enabling it to gain share across multiple cloud segments.

Another important tailwind is the deepening use of AI by existing customers. As enterprises deploy more advanced AI workloads, demand is rising not only for AI-specific services but also for core cloud infrastructure, including compute and storage. Overall, higher AI adoption and broader cloud consumption will likely drive Alibaba’s cloud business in the coming quarters.

Alibaba’s Quick Commerce Business’ Unit Economics Improving

Alibaba’s quick commerce business is another growth catalyst for the company. Moreover, the segment is showing an improvement in unit economics. The business has benefited from better fulfillment efficiency, higher average order values, and stronger customer retention. Together, these factors are lowering per-order costs while increasing revenue per transaction, creating a more sustainable economic model.

The expansion of the quick commerce segment has helped accelerate monthly active consumer growth on the Taobao app, strengthening user engagement across the platform. As traffic and activity increase, Alibaba has been able to further monetize its customer base, supporting steady expansion in customer management revenues.

Looking ahead, management plans to deepen the integration between quick commerce and the rest of the Alibaba ecosystem. By leveraging shared logistics, data, and merchant networks, the company aims to further enhance operating efficiency and improve unit economics. This strategy positions Alibaba to gain market share. Notably, market share gains and improving unit economics should translate into stronger margins over time.

Does the Pullback Make BABA Stock Attractive?

Near-term volatility in Alibaba shares may persist, particularly if consumer demand remains uneven and margin pressure continues. However, the company’s expanding cloud and AI businesses, rising demand for higher-value services, and improving unit economics in quick commerce provide a solid foundation for long-term growth.

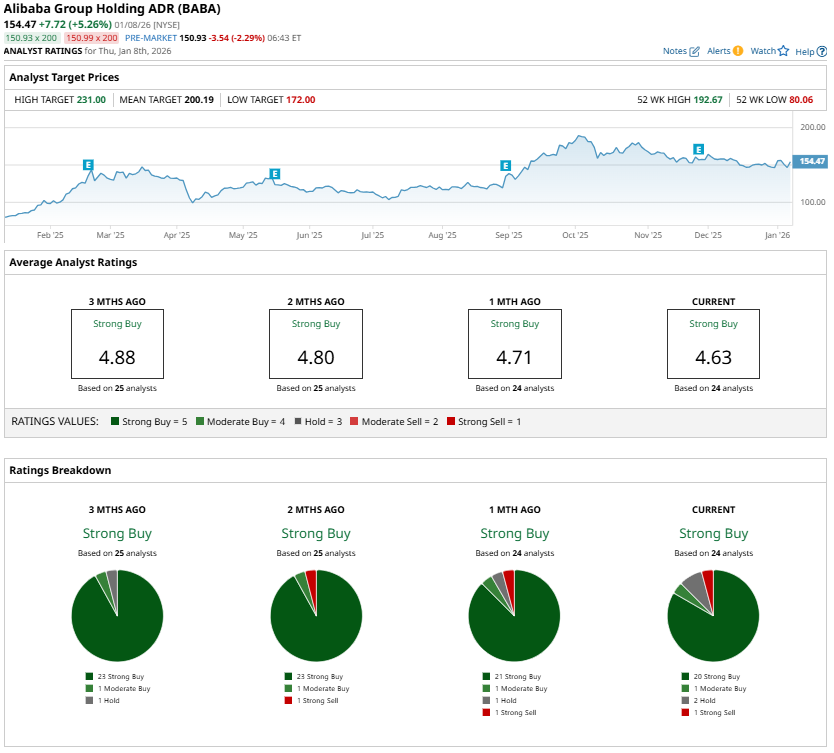

Thus, the recent pullback offers investors an opportunity to buy. Wall Street analysts are also optimistic, and Alibaba currently carries a “Strong Buy” consensus rating.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart