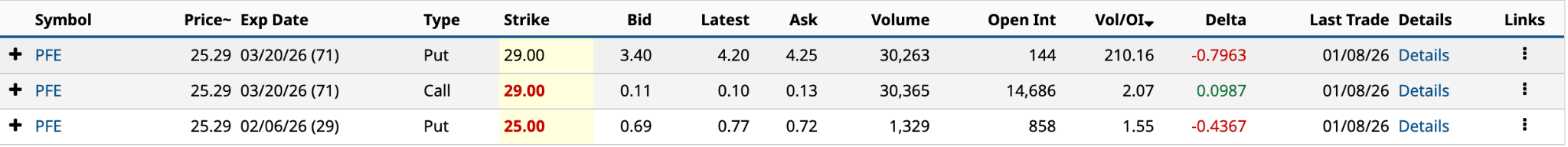

Yesterday, Pfizer (PFE) delivered something you’ll rarely see: Its March 20 $29 put had the highest unusual options activity on the day with a Vol/OI (volume-to-open-interest) ratio of 210.16, 35% higher than the Alphabet (GOOG) option in second place.

Pfizer is one of the most frustrating stocks for bulls. Once upon a time, it was printing money thanks to COVID-19. Now, it can’t get out of the $20s. Its shares are down 59% since the 2021 all-time high of $61.71. For those who don’t own PFE, it’s hard to justify the investment.

This is where options come in.

As I said, the March 20 $29 put had a Vol/OI ratio of 210.16, representing volume of 30,263 and an open interest of 144. Somebody was willing to make a big bet on the $144 billion market cap.

When I consider what to write about when discussing unusual options activity, I rarely choose the stock with the highest Vol/OI ratio. It just seems too obvious. In this instance, however, two options strategies immediately came to mind. Here’s why.

Have an excellent weekend. Go Indiana!

The Options Behind the Strategies

In addition to the March 20 $29 put, Pfizer had two other unusually active options yesterday.

While the other two had Vol/OI ratios that qualify as unusually active, I couldn’t ignore the jump in volume for the March 20 put. You’ll notice that $29 call had the same expiration date and similar volume. These two options underlie a Long Straddle, which I will address.

In the meantime, let’s consider Pfizer’s options history.

Its 30-day average options volume is 142,695. Yesterday, it was 1.39 times that amount, and the highest volume since Dec. 17. However, it wasn’t close to the highest volume in the past three months, which was 890,898, more than six times higher than Thursday.

With earnings expected to be released on Feb. 3, it’s probably too early for a volume buildup. The 890,898 in daily volume was on the second trading day after it reported its Q3 2025 results on Nov. 4, and it also saw options volume of 376,442 on the day of the earnings release.

On Dec. 16, before the markets opened, Pfizer reaffirmed its 2025 guidance and provided modest 2026 guidance, with adjusted earnings per share of $2.90 at the midpoint, down from $3.08 in 2025. The shares fell for two consecutive days after the news, then traded primarily in a tight range between $25 and $25.50.

And here we sit.

The Long Straddle

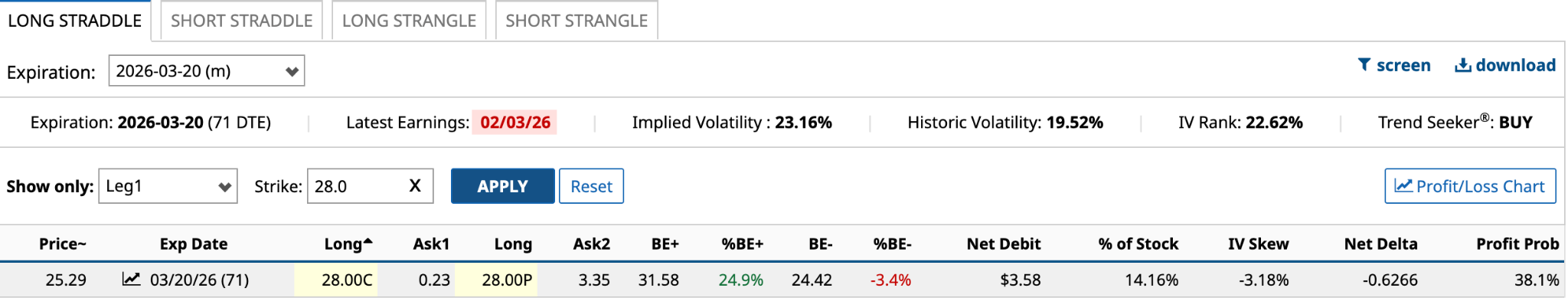

As noted earlier, the March 20 $29 put and call are the two components of a long straddle.

This strategy assumes volatility increases and the stock moves significantly in either direction. You are long both the call and the put. You are successful if the share price at expiration is above the upside breakeven or the downside breakeven.

In this instance, with a net debit of $4.38, the upside and downside breakevens are $33.38 and $24.62, respectively.

Here’s what the $28 long straddle looks like:

As you can see, there is a 38.1% chance that the share price at expiration will be above $31.58 or below $24.42. The $29 long straddle’s profit probability is approximately 37%. That’s not great.

Working in your favor, however, is the 71-day DTE (days to expiration). Typically, you would look for a DTE between 30 and 45 days, giving you enough time for the move to happen in either direction, but not so much that the option’s value accelerates lower.

Now, one might think, “If I’m bullish, why not just buy the call and forget about the put?” Because, given an expected move of 6.96%, the downside breakeven is much more likely to be realized than the upside.

Let’s assume the $1.76 expected move materializes. The share price at expiration would be $27.05. That’s well below the $31.58 breakeven on the call. It would expire worthless. On the downside, the share price would be $23.53, 3.6% below the downside breakeven of $24.42, for a $89 profit. Based on the $29 strikes, the profit would be $109, or an annualized return of 128.0% [$109 / $438 net debit * 365 / 71].

Not bad.

The Bull Put Spread

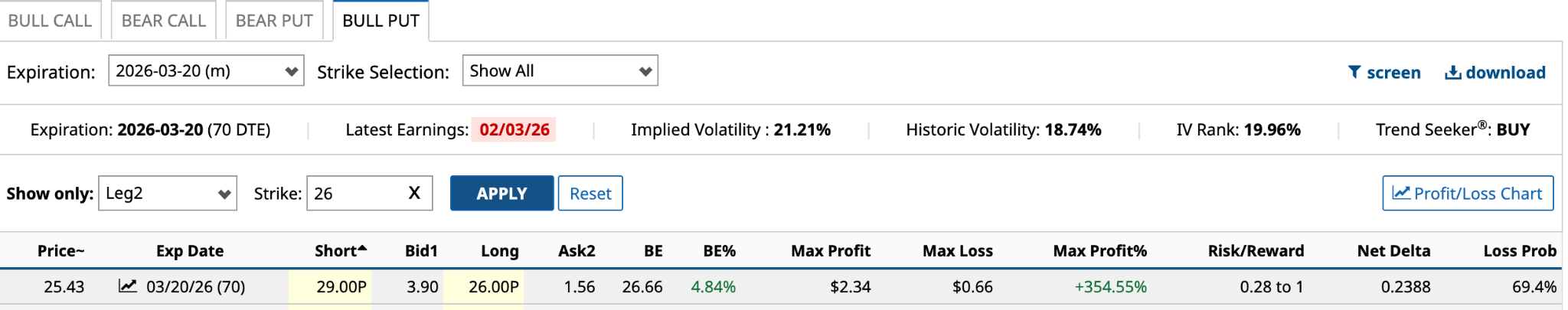

The second of two strategies, the bull put spread, is bullish and expects the share price to move higher. It involves selling a put option (in this case, the $29 put) and buying a put at a lower strike price of $26.

You receive $390 in premium income for selling the short put, offset by the $156 cost of buying the long call. That's a net credit of $234, so the most you could lose on this bet is $66 [$29 short put strike price - $26 long put strike price * 100 + $234 net credit].

As a result, the risk-to-reward ratio is 0.28 to 1, meaning you are spending $28 to potentially earn $100. You would realize a maximum profit of $234 if the share price is above $29 at expiration. That’s a 354.55% return (1,848.73% annualized).

You might think, “Yes, but the chance of success is around one in three.” True.

However, your breakeven point of $26.66 is only 4.84% above the $25.43 share price, with an expected 6.96% move in either direction. You could still make money if the share price is above $26.66 at expiration but below $29.

Of the two option strategies, the bull put spread is better suited to risk-averse investors.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unusual Options Activity in Pfizer: 2 Strategies Traders Are Jumping On

- Microsoft Stock Is Trading in a Range - Shorting Out-of-the-Money Puts Works

- Follow the Smart Money: 2 Undervalued Stocks With Aggressive Share Buybacks and Unusual Options Activity

- This Covered-Call Google ETF Yields 41%. These 2 Option Trades Are Even Better.