The Mosaic Company (MOS), headquartered in Tampa, Florida, manufactures and distributes concentrated phosphate and potash crop nutrients. Valued at $8.7 billion by market cap, the company owns and operates mines that produce key agricultural products like diammonium phosphate, monoammonium phosphate, and ammoniated phosphate, as well as manufactures phosphate-based animal feed additives under the Biofos and Nexfos brands.

Shares of this leading producer of concentrated phosphate and potash have underperformed the broader market over the past year. MOS has declined 3.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. However, in 2026, MOS stock is up 14.2%, surpassing the SPX’s 1.4% rise on a YTD basis.

Narrowing the focus, MOS’ underperformance is also apparent compared to VanEck Agribusiness ETF (MOO). The exchange-traded fund has gained about 14.5% over the past year. However, MOS’ returns on a YTD basis outshine the ETF’s 10.3% gains over the same time frame.

MOS' underperformance is driven by about 20% decline in North American phosphate shipments in Q4, along with weak potash demand due to pressure on grower economics and early winter weather, leading to a negative reaction by investors.

For the current fiscal year, ended in December 2025, analysts expect MOS’ EPS to grow 28.3% to $2.54 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

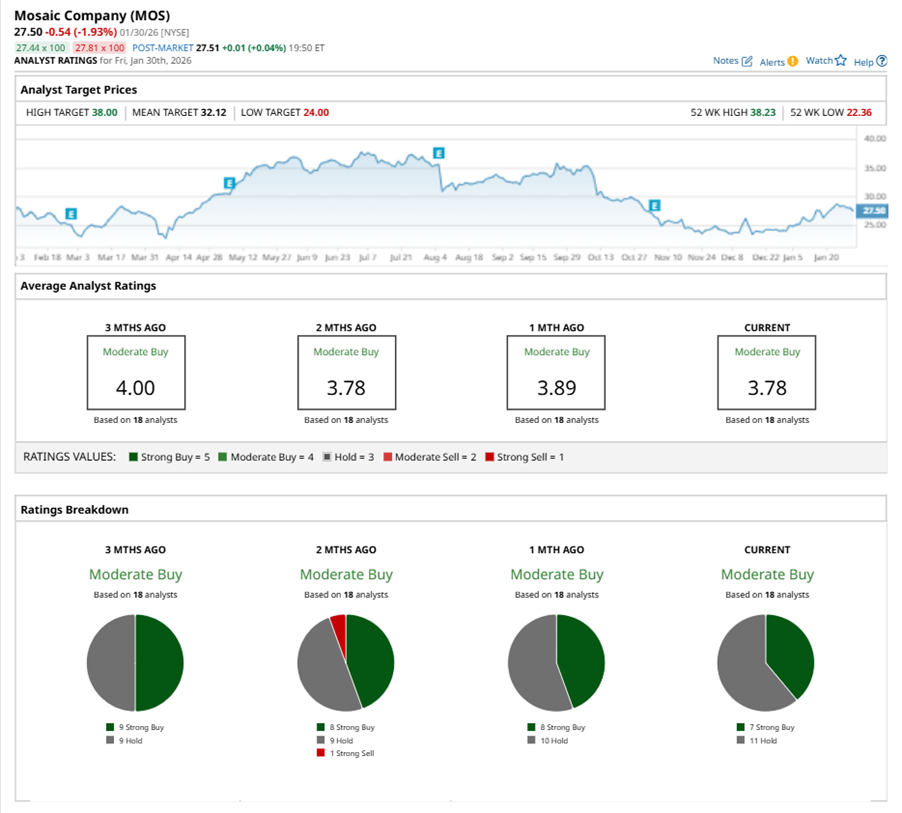

Among the 18 analysts covering MOS stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, and 11 “Holds.”

This configuration is less bullish than a month ago, with eight analysts suggesting a “Strong Buy.”

On Jan. 23, Wells Fargo & Company (WFC) analyst Michael Sison kept an “Equal Weight” rating on MOS and lowered the price target to $27.

The mean price target of $32.12 represents a 16.8% premium to MOS’ current price levels. The Street-high price target of $38 suggests an ambitious upside potential of 38.2%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Groundhog Day Gloom? Why the Nasdaq Is Shaking Off Phil's Shadow and Facing Reality

- SoFi’s Earnings Growth Looks Strong. Is This Dip a Buying Opportunity?

- This Is the Most Oversold Dividend Aristocrat Worth Buying

- MicroStrategy Is Trading Below NAV Again. Should You Buy MSTR Stock Here or Stay Far, Far Away?