Willis Towers Watson Public Limited Company (WTW) is a global advisory, broking, and solutions firm that provides a broad range of services in risk management, insurance brokerage, human capital consulting, benefits administration, actuarial and retirement solutions, and investment advisory, with headquarters in the United Kingdom. The company has a market cap of around $28.8 billion.

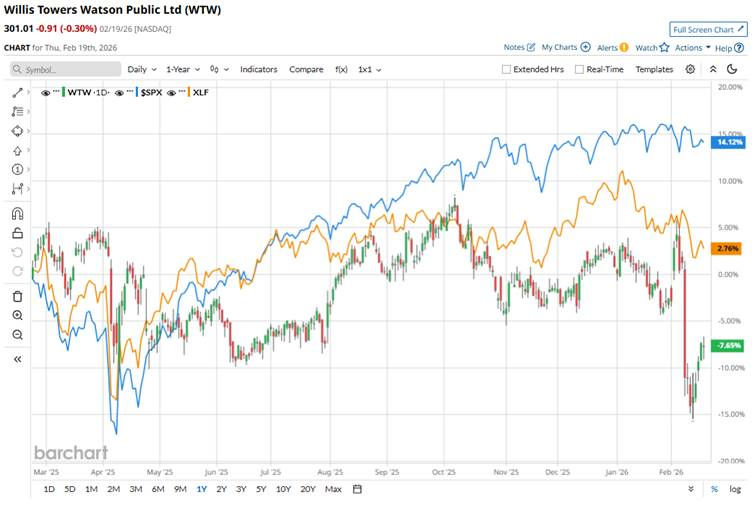

Shares of the company have underperformed the broader market over the past 52 weeks. WTW has declined 7.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.7%. On a YTD basis, shares of the company are down 8.4%, compared to SPX’s marginal gains.

Looking closer, shares of the company have lagged behind the State Street Financial Select Sector SPDR ETF’s (XLF) marginal decline over the past 52 weeks and 4.8% slump this year.

Willis Towers Watson stock has faced downward pressure this year, driven by investor reaction to mixed earnings results that showed slowing revenue growth and increased competition. Also, there has been investor concern about potential disruption from artificial intelligence in the insurance and brokerage space, which has weighed on broker valuations and triggered sector-wide sell-offs.

For the fiscal year ending in December 2026, analysts expect Willis Towers Watson’s EPS to rise 14.3% year-over-year to $19.53. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

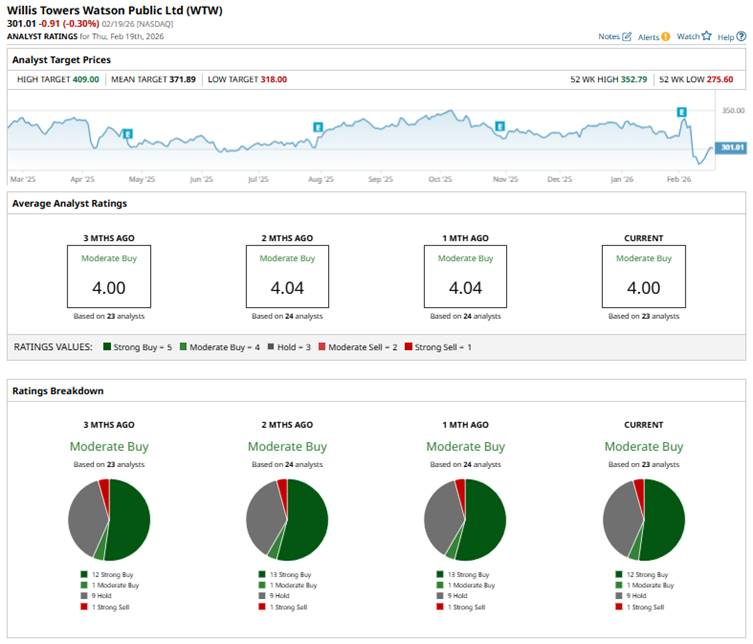

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” nine “Holds,” and one “Strong Sell.”

This configuration is slightly less bullish than one month ago, when there were 13 “Strong Buy” ratings.

Earlier this month, Mizuho raised its price target on Willis Towers Watson to $392 from $388 while maintaining an “Outperform” rating.

The mean price target of $371.89 represents a 23.5% premium to WTW’s current price levels. The Street-high price target of $409 suggests a nearly 35.9% potential upside.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear IonQ Stock Fans, Mark Your Calendars for February 25

- As Tesla Launches FSD Subscriptions, Should You Buy, Sell, or Hold TSLA Stock?

- Why Michael Saylor Isn’t Worried About MicroStrategy Stock Unless Bitcoin Drops Below $8,000

- This High-Yield Dividend King Has 56 Years of Raises and Wall Street Is Screaming ‘Buy’