Applied Digital Corporation (APLD) is standing squarely at the epicenter of the artificial intelligence (AI) surge. As a developer and owner of AI-focused data centers, the company is riding the infrastructure wave that powers the boom. In just the past year, the stock delivered a three-digit return, firmly placing it among the year’s standout performers.

However, on Wednesday, Feb. 18, APLD stock slipped 4.9% after SEC filings revealed that NVIDIA Corporation (NVDA) had sold its entire stake. The AI chip maker had originally invested in 2024, and it previously held 7,716,050 shares valued at approximately $177 million. But markets notice when a technology titan exits.

Yet, Nvidia’s exit does not dictate everyone else’s strategy. Several analysts saw the recent dip as an attractive entry point rather than a structural crack. Roth Capital reaffirmed its “Buy” rating and maintained a $58 price target on APLD stock, stating that the development does not alter Applied Digital’s fundamental business outlook.

Roth Capital also pointed to tangible progress since the Nvidia-led financing. Applied Digital has secured new co-location leases with CoreWeave (CRWV) and a major hyperscaler, and management expects a third agreement soon. The firm attributed the stock price decline to “headline risk” instead of operational weakness.

More importantly, it disclosed that it purchased shares during the pullback. So, let us discuss if you could, too.

About Applied Digital Stock

Headquartered in Dallas, Texas, Applied Digital designs, builds, and operates digital infrastructure tailored for high-performance computing and AI workloads. The company commands a market cap of roughly $8.8 billion and delivers data center hosting, GPU-powered computing, and infrastructure services for crypto mining and AI applications.

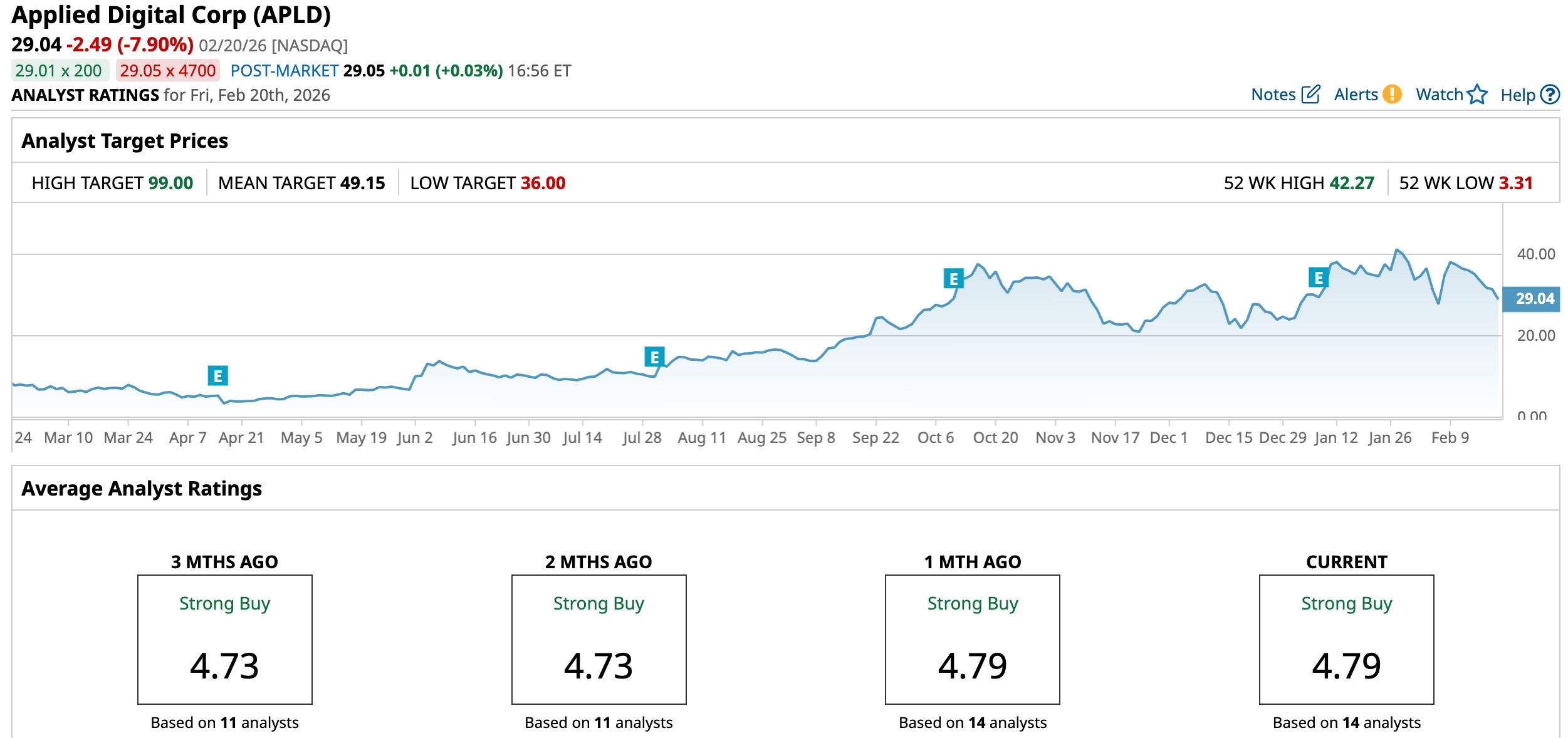

Over the past month, the stock plummeted 18.9%, reflecting volatility and post-news digestion. Zooming out to the last 52 weeks, APLD stock surged 182.47%, and in just the past six months, it climbed 82.9%.

From a valuation standpoint, the stock is trading at 25.43 times sales, a multiple that exceeds the industry average of 3.13 times, and signals a premium.

Applied Digital Surpasses Q2 Earnings

On Jan. 7, Applied Digital reported its fiscal 2025 Q2 results that exceeded expectations on both revenue and earnings. Revenue jumped 250.1% year-over-year (YOY) to $126.6 million, surpassing analyst estimates of $110.3 million. Approximately $85 million of that increase stemmed from the HPC Hosting Business.

Owing to that, in the two subsequent trading sessions, the stock rose 8.1% and then 18%, respectively. Management credited the completion of the first building at Polaris Forge1 and the rapid energization of the Polaris Forge 1 data center, which began generating lease revenue ahead of schedule.

The business now stands on the cusp of sustained earnings and positive cash flow. Adjusted net income reached $115 thousand, compared with an adjusted net loss of $1.5 million in the prior-year quarter.

Adjusted EBITDA rose 229.7% from the year-ago level to $20.2 million. Meanwhile, adjusted EPS registered $0, handily beating the expected loss per share of $0.21. In the prior-year period, the company posted a loss per share of $0.01.

Looking forward, executives expect continued expansion as additional campuses come online through 2026 and 2027 under long-term hyperscale leases. On the other hand, analysts forecast Q3 fiscal 2026 loss per share to narrow 37.5% year-over-year (YOY) to $0.10. For full-year 2026, they project a 55% improvement to a $0.36 loss per share.

What Do Analysts Expect for Applied Digital Stock?

Roth Capital does not stand alone in its optimism toward Applied Digital. Last month, Northland raised its price target on APLD stock from $40 to $56 and maintained its “Outperform” rating.

The firm acted after management delivered what it described as “exciting commentary” during the Q2 earnings call. Specifically, leadership disclosed advanced discussions with a new top-of-the-stack investment-grade hyperscaler for up to three sites totaling approximately 900 megawatts (MW).

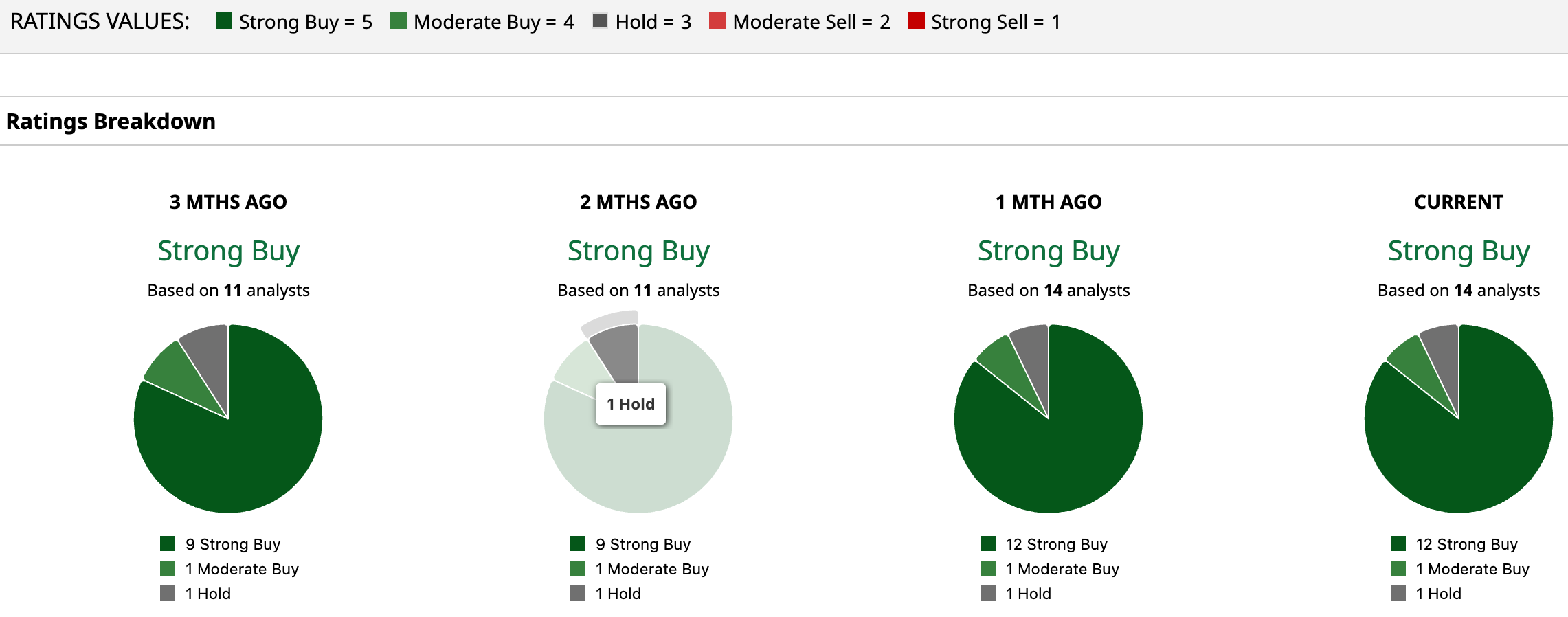

Wall Street has currently assigned the stock an overall “Strong Buy” rating. Among 14 analysts covering the stock, 12 have assigned a “Strong Buy” rating, one issues a “Moderate Buy,” and one suggests “Hold.”

To that end, the average price target of $49.15 represents potential upside of 69%. Meanwhile, the Street-high target of $99 suggests a gain of 241% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart