Intercontinental Exchange, Inc. (ICE) is a leading financial services company that operates global financial exchanges, clearing houses, and associated technology and data services. ICE owns and manages a diverse portfolio of regulated marketplaces, including futures, options, and equities exchanges and provides data, analytics, and mortgage technology solutions to financial institutions, corporations, and governments worldwide. The company, which also owns the New York Stock Exchange (NYSE), is headquartered in Atlanta, Georgia. It has a market cap of $99.1 billion.

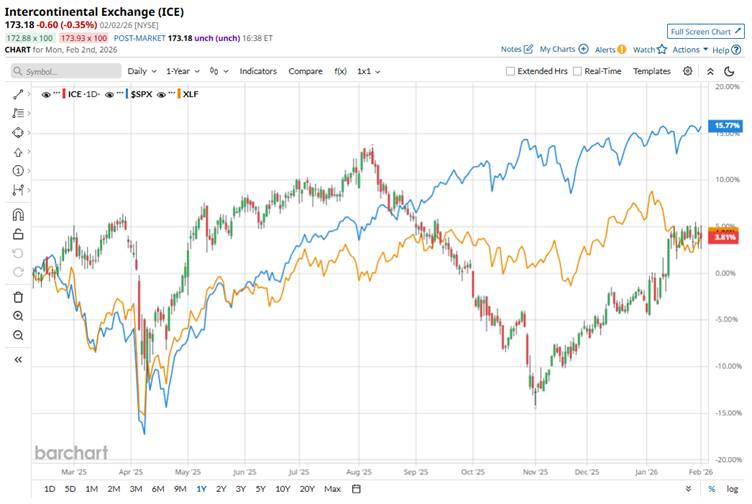

The stock has underperformed the broader market over the past year but has outpaced it this year. The stock has soared 8.4% over the past 52 weeks and 6.9% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 15.5% gains over the past year and 1.9% returns on a YTD basis.

Narrowing the focus, Intercontinental Exchange has outperformed the State Street Financial Select Sector SPDR ETF's (XLF) 1.4% decline in 2026 and around 5% gains over the past 52 weeks.

In the third quarter of 2025, Intercontinental Exchange reported net revenues of about $2.4 billion, a 3% year-over-year increase, while adjusted EPS was $1.71, about 10% higher than Q3 2024. The company released these results on Oct. 30, 2025. The stock saw some downward price action following the Q3 2025 earnings release, with shares down 1.4% on Oct. 30 and 1.5% on Oct. 31.

Notably, Intercontinental Exchange’s Q4 2025 and full-year 2025 earnings are scheduled to be released on Feb. 5, 2026.

For the full fiscal 2025, analysts expect ICE to deliver an EPS of $6.92, up 14% year-over-year. Moreover, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

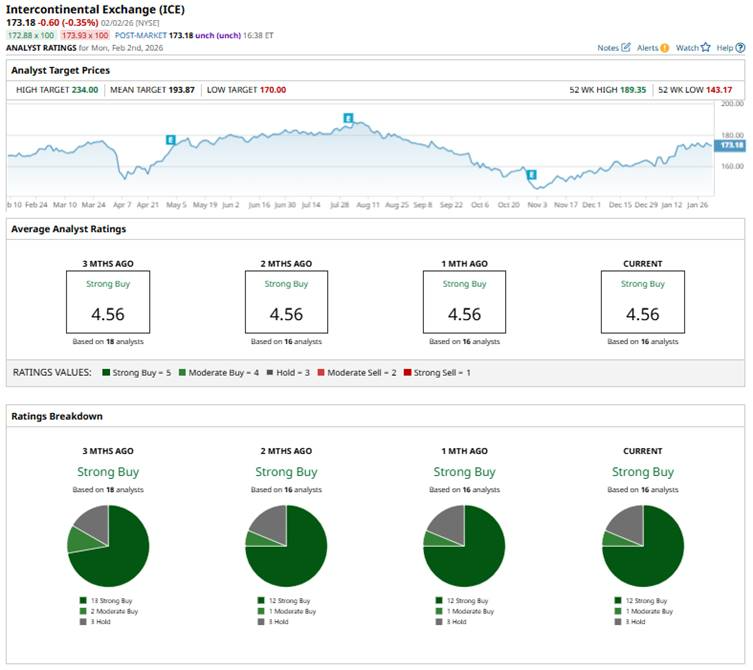

Among the 16 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and three “Holds.”

This configuration is slightly less bullish than three months ago, when there were 13 “Strong Buy” ratings.

Last month, RBC Capital reiterated an “Outperform” rating and $180 price target on Intercontinental Exchange, aligning with strong bullish consensus.

ICE’s mean price target of $193.87 represents a 11.9% premium. Meanwhile, the Street-high target of $234 suggests a notable 35.1% upside potential from current price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart