Valued at a market cap of $255.8 billion, Applied Materials, Inc. (AMAT) is a leading California-based supplier of equipment, software, and services used in the manufacturing of semiconductors and advanced electronic displays. Founded in 1967, the company plays a critical role in enabling chipmakers to produce smaller, faster, and more energy-efficient integrated circuits.

Over the past year, the tech titan has delivered a standout performance, leaving both the broader market and its sector peers in the dust. Shares of AMAT have surged 78.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.4%. Moreover, on a YTD basis, the stock is up 24%, compared to SPX’s 1.1% return.

Even within the high-performing semiconductor space, AMAT has shone, outpacing the Invesco Semiconductors ETF’s (PSI) 59.8% rise over the past 52 weeks and 19.1% rally in 2026.

Applied Materials has posted strong momentum, with its stock reaching new highs, driven largely by accelerating demand from artificial intelligence investments. As a leading supplier of wafer fabrication equipment, the company plays a critical role in producing chips for AI data centers, consumer electronics, autos, and industrial applications. Looking ahead to 2026, the company is well-positioned to benefit from rising demand for advanced logic, DRAM, and high-bandwidth memory equipment, though valuation concerns may temper near-term upside.

For the current fiscal year, which ends in October, analysts expect AMAT’s EPS to grow 2% year over year to $9.61. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

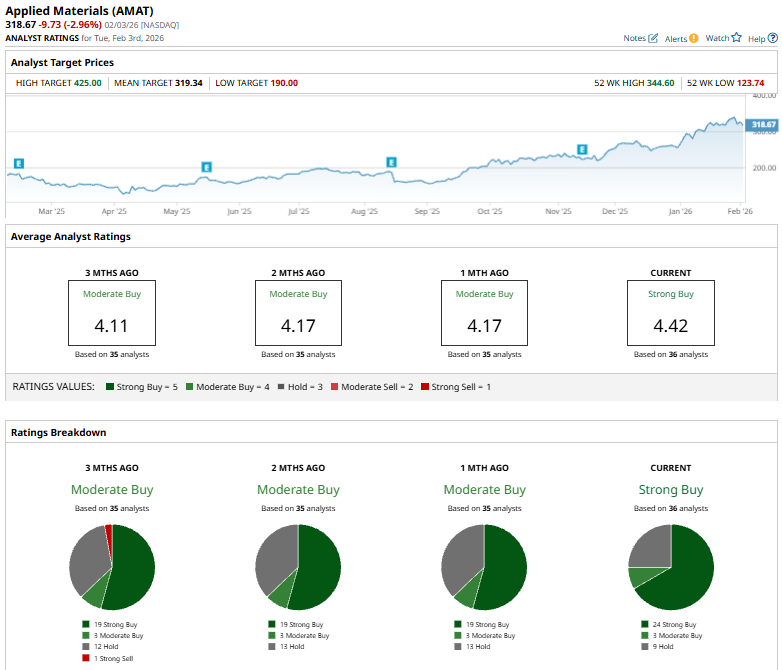

Among the 36 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 24 “Strong Buy,” three “Moderate Buy,” and nine "Holds.”

This consensus is bullish than a month ago when the stock had an overall “Moderate Buy” rating.

Applied Materials is gaining strong momentum as an AI-focused stock, highlighted by Mizuho Securities analyst Vijay Rakesh upgrading it from “Neutral” to “Outperform” on Jan. 27 with a $370 price target. The firm expects AMAT, the world’s second-largest wafer fabrication equipment supplier, to benefit from rising chipmaking investments in the U.S., Taiwan, and Japan, forecasting global WFE spending growth of 13% in 2026 and 12% in 2027.

Its mean price target of $319.34 implies a marginal premium from the current market prices. Its Street-high price target of $425 suggests an upside potential of 33.4%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why This Analyst Just Raised Their Price Target on Broadcom Stock

- Strategy Inc Bear Call Spread Could Net 15% in Two Weeks

- Stock Index Futures Steady After Tech-Led Selloff, U.S. ADP Jobs Report and Alphabet Earnings in Focus

- General Motors Just Raised Its Dividend 20%. Does That Make GM Stock a Buy?