With the market taking a bearish turn today, it’s a great time to look at some bearish options trades.

In this article, we'll show you two bear call spread trades you can make this Thursday.

A bear call spread is a type of vertical spread, meaning that two options within the same expiry month are being traded.

A bear call spread is a type of vertical spread, meaning that two options within the same expiry month are being traded.

One call option is being sold, which generates a credit for the trader. Another call option is bought to provide protection against an adverse move.

The sold call is always closer to the stock price than the bought call.

As the name suggests, this trade does best when the stock declines after the trade is open.

However, there can be many cases where this trade can make a profit if the stock stays flat and even if it rises slightly.

Bear call spreads are risk defined trades. There are no naked options here, so they can be traded in retirement accounts such as an IRA.

Traders should have a bearish outlook on the stock and ideally look to enter when the stock has a high implied volatility rank.

Two stocks came up on my screens today as possible bear call spread candidates.

Two Bear Call Spread Candidates

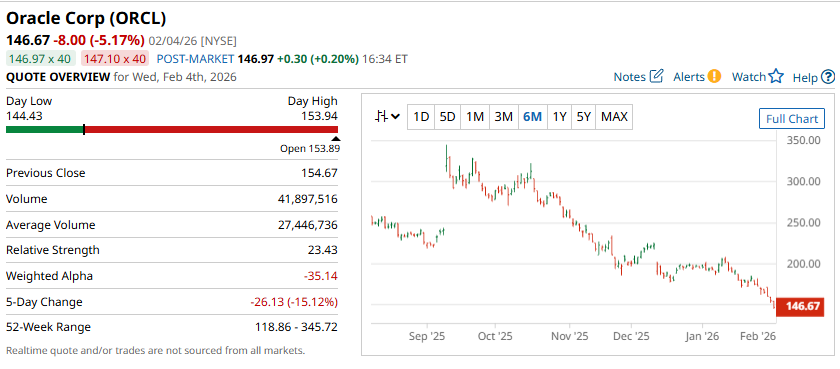

Oracle (ORCL) is sitting below the 21, 50 and 200-day moving averages and the Barchart Technical Opinion rating is an 88% Sell with a Strongest short term outlook on maintaining the current direction.

Relative Strength is below 30%. The market is in oversold territory. Watch for a potential trend reversal.

Looking at the chart there are plenty of areas of potential resistance around 180.

Oracle Corporation is one of the largest enterprise-grade database, middleware and application software providers.

Oracle has expanded its cloud computing operations over the last couple of years.

The company offers cloud solutions and services that can be used to build and manage various cloud deployment models.

Built upon open industry standards such as SQL, Java and HTML5, Oracle Cloud provides access to application services, platform services and infrastructure services for a subscription.

Through its Oracle Enterprise Manager offering, the company manages cloud environments.

Oracle's software and hardware products and services include Oracle Database, Oracle Fusion Middleware, Java and Oracle Engineered Systems.

Oracle Engineered Systems include Exadata Database Machine, Exalogic Elastic Cloud, Exalytics In-Memory Machine, SPARC SuperCluster, Virtual Compute Alliance, Oracle Database Appliance, Oracle Big Data Appliance and ZFS Storage.

Implied volatility is high at around 68.66% giving Oracle an IV Percentile of 99%.

Let’s look at how a bear call spread trade might be set up on ORCL stock.

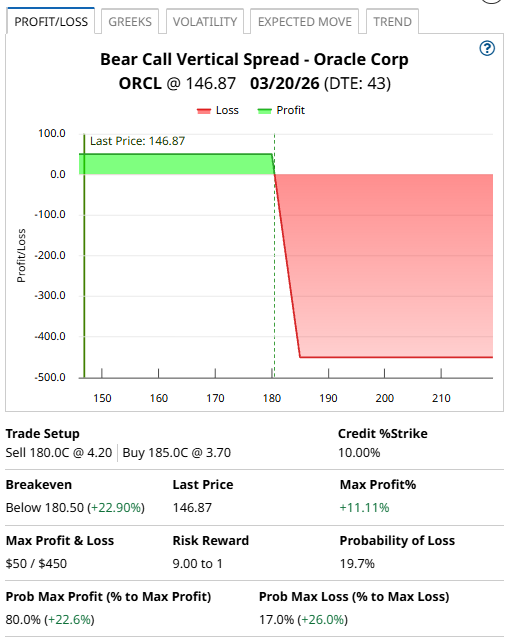

ORCL Bear Call Spread: March $180 – $185 Bear Call Spread

As a reminder, A bear call spread is a defined risk option strategy that profits if the stock closes below the short strike at expiry.

To execute a bear call spread an investor would sell an out-of-the-money call and then buy a further out-of-the-money call. You can find ideas like this using the bear call spread screener.

This particular idea involves selling the March expiry $180 strike call and buying the $185 strike call.

Selling this spread results in a credit of around $0.50 or $50 per contract. That is also the maximum possible gain on the trade. The maximum potential loss can be calculated by taking the spread width, less the premium received and multiplying by 100. That give us:

5 – 0.50 x 100 = $450.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 11.11%.

The spread will achieve the maximum profit if ORCL closes below $180 on March 20, in which case the entire spread would expire worthless allowing the premium seller to keep the $50 option premium.

The maximum loss will occur if ORCL closes above $185 on March 20, which would see the premium seller lose $450 on the trade.

The breakeven point for the bear call spread is $180.50 which is calculated as $180 plus the $0.50 option premium per contract.

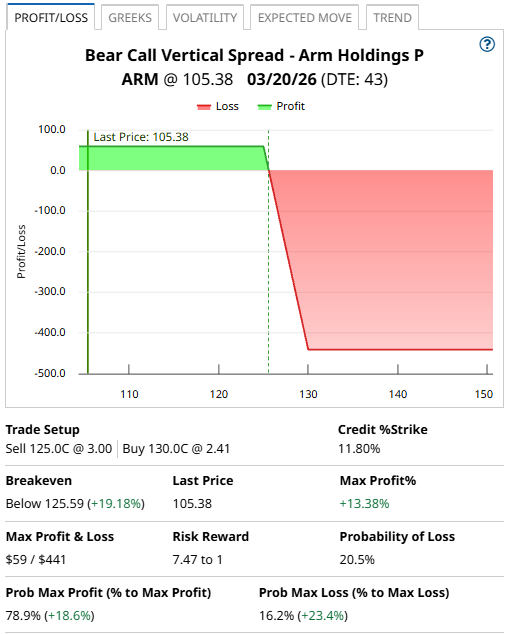

Let’s look at another idea, this time on Arm Holdings (ARM) which was another stock that came up on my bearish scans.

ARM Bear Call Spread: March $260 – $270 Bear Call Spread

This bear call spread trade also involves using the March expiration on ARM and selling the 125-130 call spread.

Selling this spread results in a credit of around $0.59 or $59 per contract. That is also the maximum possible gain on the trade. The maximum potential loss can be calculated by taking the spread width, less the premium received and multiplying by 100. That give us:

5 – 0.59 x 100 = $441.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 13.38%.

The spread will achieve the maximum profit if ARM closes below $125 on March 20, in which case the entire spread would expire worthless allowing the premium seller to keep the $59 option premium.

The maximum loss will occur if ARM closes above $130 on March 20, which would see the premium seller lose $441 on the trade.

The breakeven point for the bear call spread is $125.59 which is calculated as $125 plus the $0.59 option premium per contract.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

For the ORCL bear call spread, I would set a stop loss if the stock traded above $170.

For the ARM trade, I would close for a loss if the stock broke through $120.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart