With a market cap of $14.4 billion, CF Industries Holdings, Inc. (CF) is a global manufacturer of hydrogen and nitrogen-based products serving the energy, fertilizer, emissions abatement, and industrial markets across North America, Europe, and other international regions. It produces key products such as ammonia, urea, urea ammonium nitrate, and ammonium nitrate for agricultural and industrial customers.

Shares of the Northbrook, Illinois-based company have underperformed the broader market over the past 52 weeks. CF stock has risen 10.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained nearly 14%. However, shares of CF Industries have increased 19.8% on a YTD basis, outpacing SPX's 1.3% return.

Looking closer, the fertilizer maker stock has lagged behind the State Street Materials Select Sector SPDR ETF's (XLB) 16.8% gain over the past 52 weeks.

Shares of CF Industries fell 4.2% following its Q3 2025 results on Nov. 5 as investors focused on higher cost pressures, particularly the rise in realized natural gas costs to $2.96 per MMBtu from $2.10 per MMBtu a year earlier. Sales volumes declined year-over-year to 4.5 million tons from 4.8 million tons due to lower beginning inventories, raising concerns about near-term volume momentum even as net sales grew to $1.66 billion.

For the fiscal year that ended in December 2025, analysts expect CF's EPS to grow 32.2% year-over-year to $8.91. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

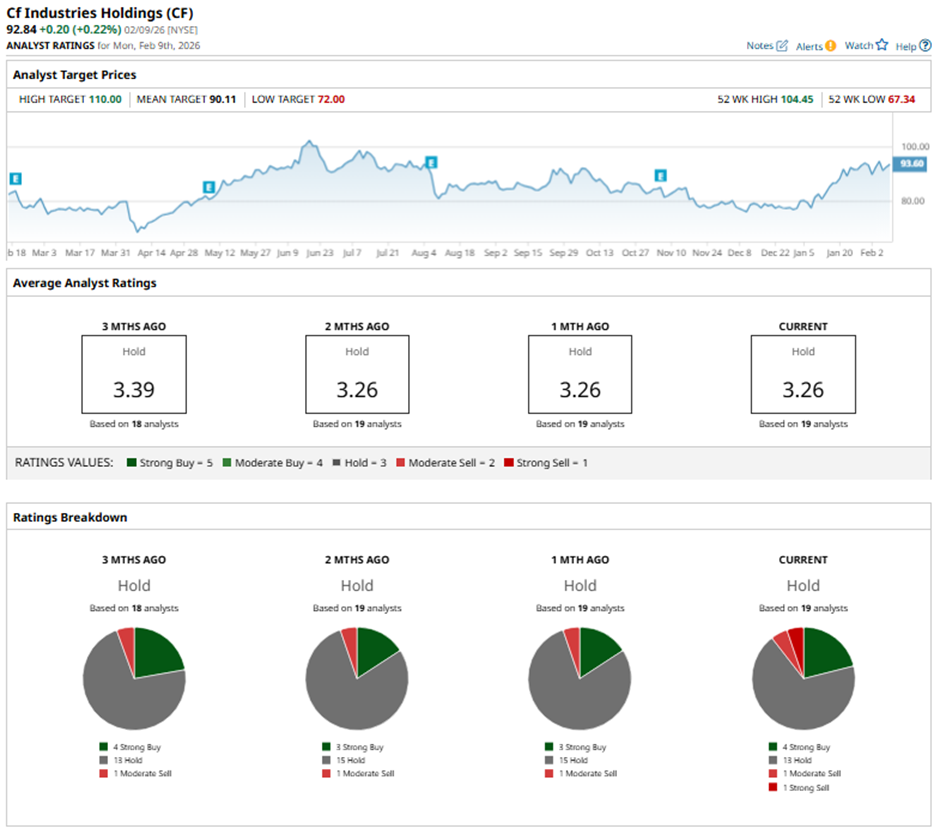

Among the 19 analysts covering the stock, the consensus rating is a “Hold.” That’s based on four “Strong Buy” ratings, 13 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

On Jan. 30, Joshua Spector of UBS maintained a “Hold” rating on CF Industries Holdings and set a price target of $86.

As of writing, the stock is trading above the mean price target of $90.11. The Street-high price target of $110 implies a potential upside of 18.5% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart