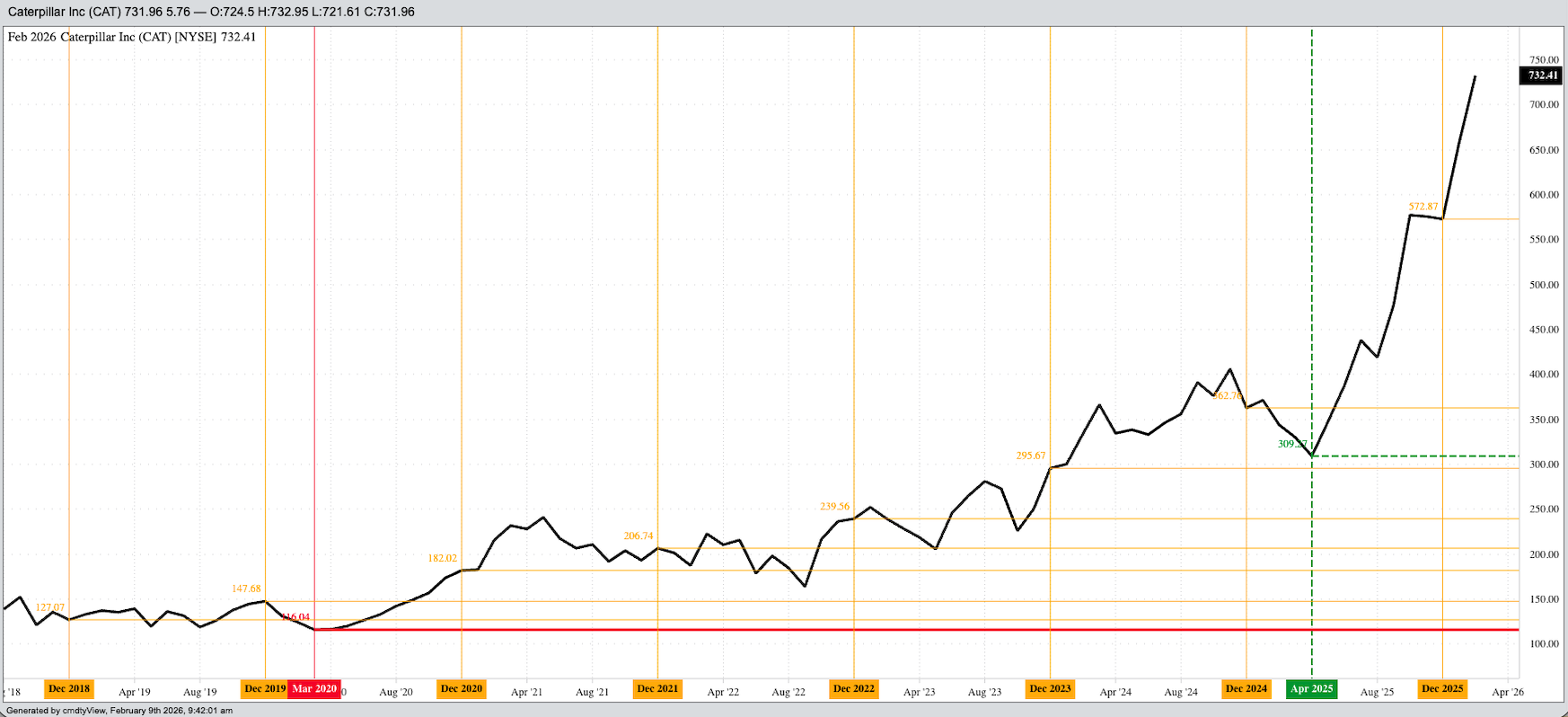

- Based on monthly closes only, Caterpillar gained 85% from its April 2025 low through its December 2025 settlement.

- Caterpillar also extended its string of year-over-year gains to 7, dating back to a lower annual close at the end of December 2018.

- Through the first 6 weekly closes of 2026, Caterpillar had added another 28%.

As I mentioned last time, trade in commodities isn’t for everyone, yet many long-term investors want to be able to take part in the meteoric rallies we’ve seen in a number of sectors of the commodity complex over the last few years. Softs had their time in the spotlight as lumber, orange juice, coffee, and cocoa have taken turns climbing to new all-times, mostly due to weather with a little trade war trouble thrown in for good measure (lumber). We’ve seen the Livestock sector sizzle as well with both live and feeder cattle reestablishing what high prices look like while lean hogs are poised to follow.

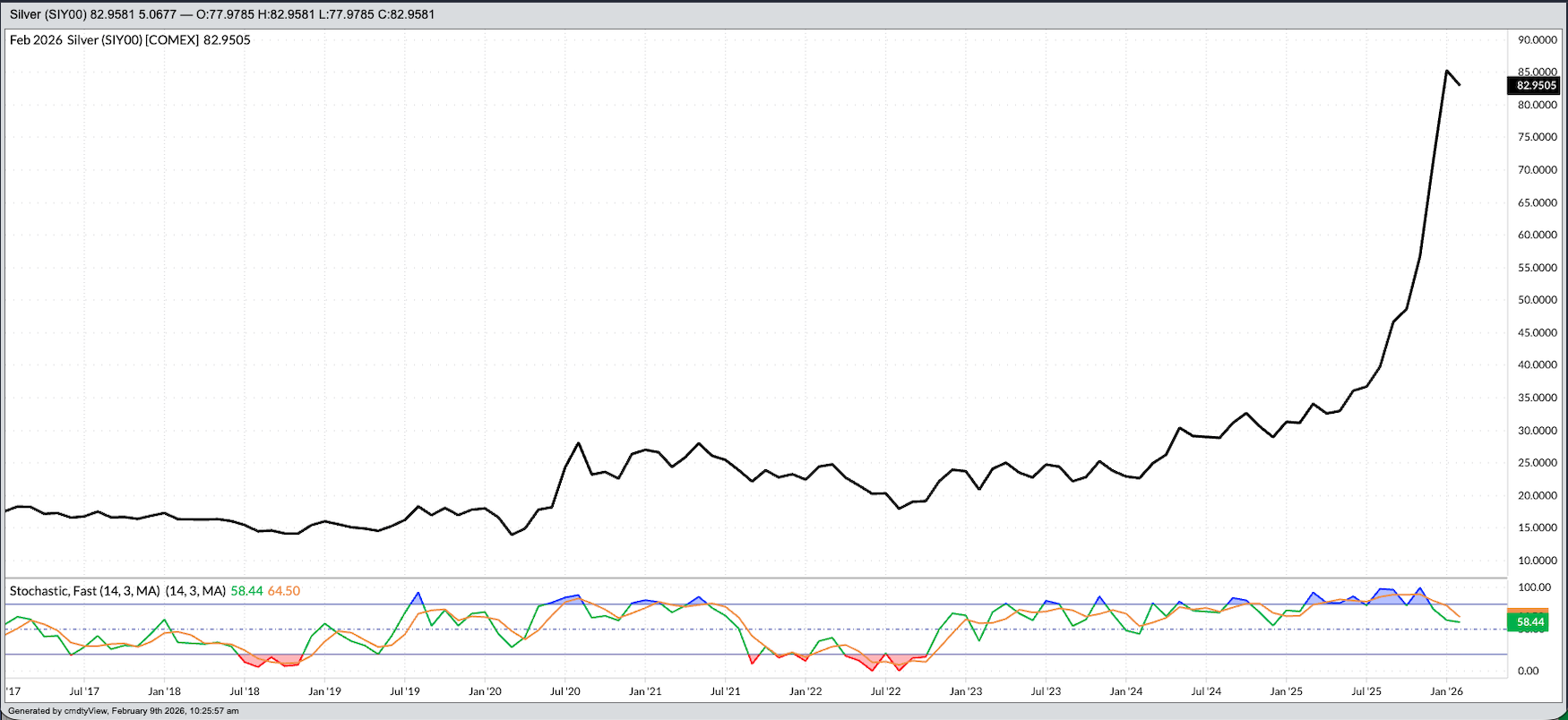

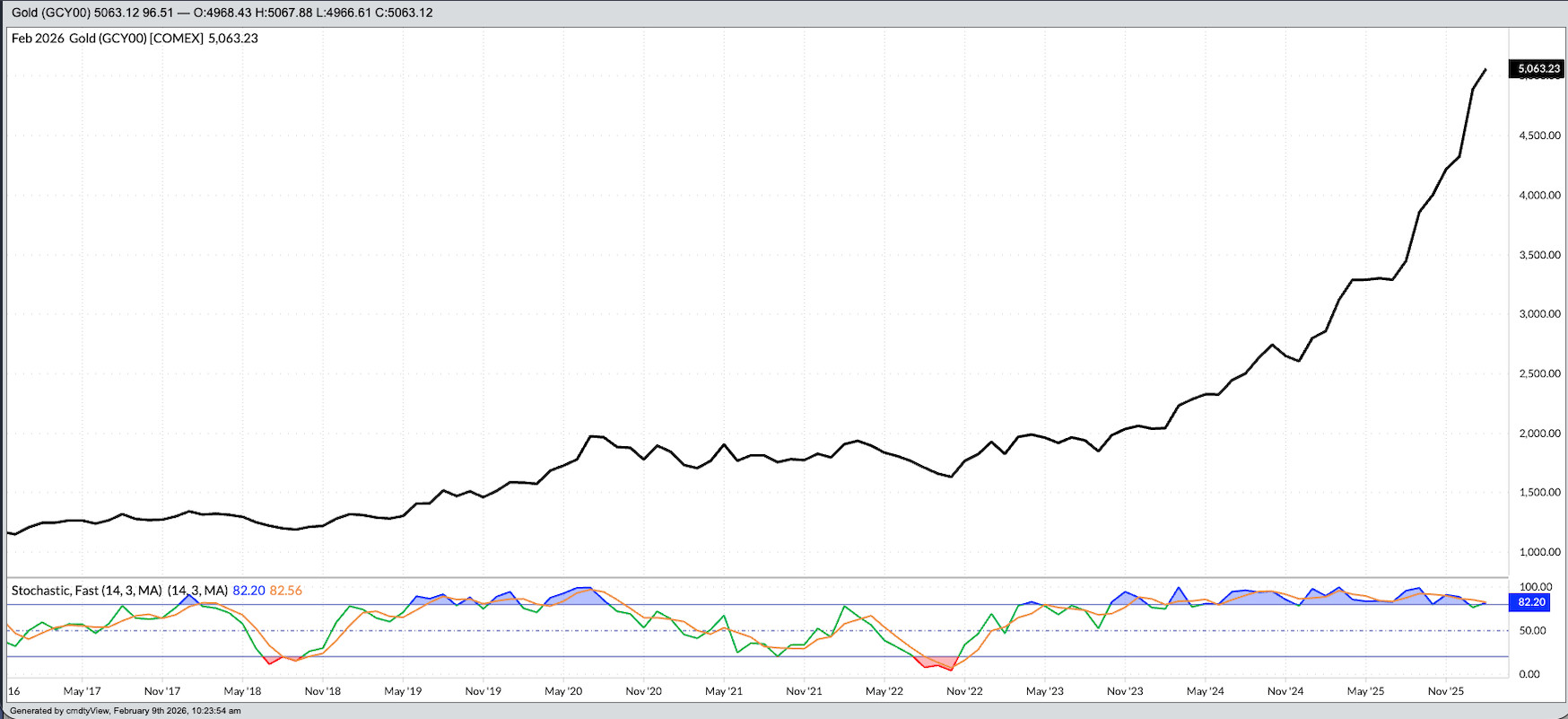

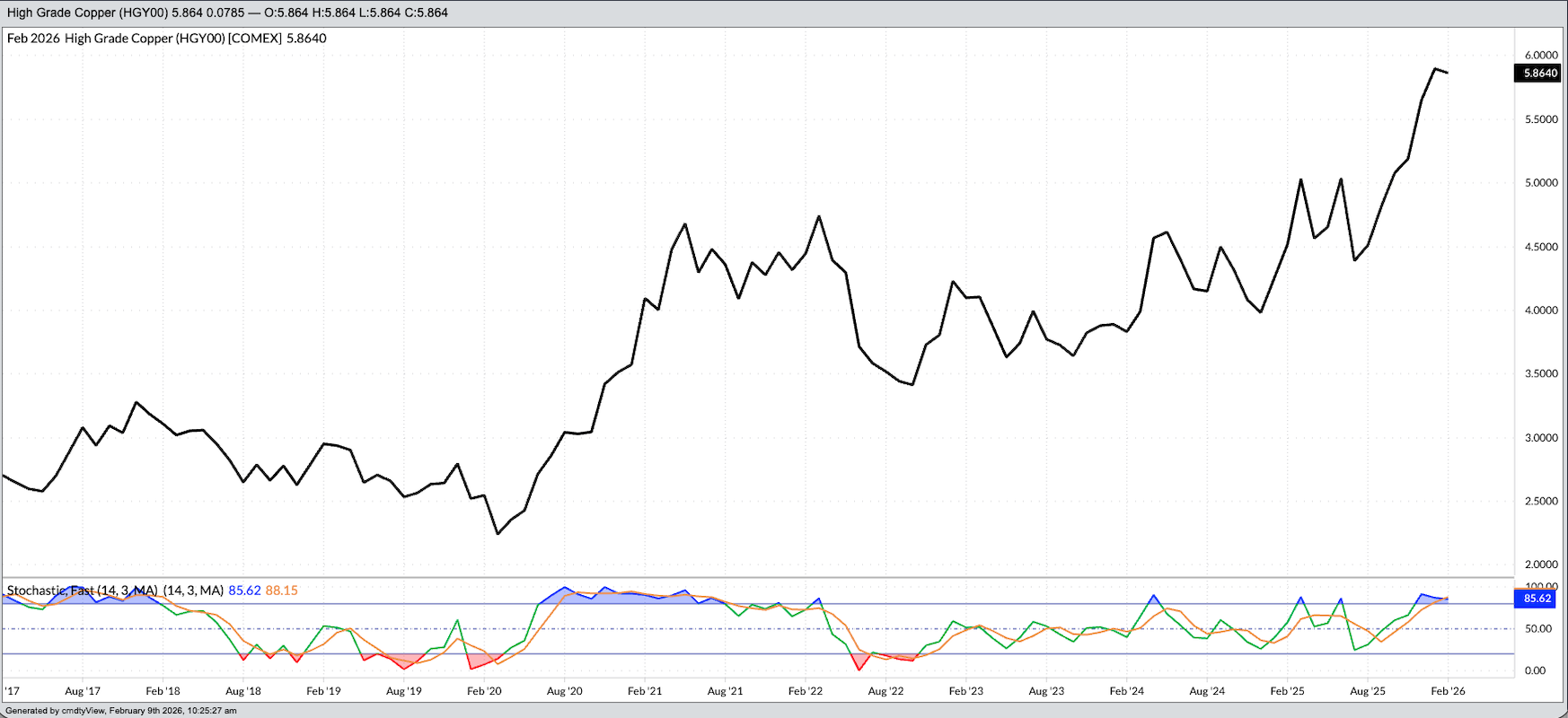

And then we have Metals making an extraordinary move the last few years with gold, silver, copper, and platinum all reaching record highs of late. And while there has been a bit of a hiccup of late, the sector is expected to continue to find buying interest as markets exhibit classic characteristics of both short-supply and demand-driven situations.

Which brings us to Caterpillar (CAT). The company’s stock soared during 2025, finishing the year at $572.87, up 85% from its April 2025 low monthly close of $309.27. The December 2025 settlement extend the company’s string of annual gains to 7, since the lower yearly close at the conclusion of 2018. As for a low monthly settlement during that time span, we see March 2020 – the Covid month – with $116.04. From that low through the December 2025 settlement the stock is up 393%. But that isn’t the whole story as CAT has added another 28% through the first week of February 2026.

As we look at the monthly close-only chart for CAT we see a similarity to the charts for metals, most notably Cash Indexes for Gold (GCY00) and Silver (SIY00). This is the connection: Given some investors don’t want to deal with actual commodity markets, they will look at ETFs (as mentioned in my piece on Grains), stocks of mining companies, or stocks of companies tied to the mining industry. This is where Caterpillar fits end. According to research, the company has seen incredible demand for heavy equipping for mining, so much so it has reportedly created a backlog. Additionally, CAT’s energy department has also seen increased demand for its diesel and natural gas generators providing back up power sources. As for the comment much of this stems from an “uptick in infrastructure spending”, we can see this on the long-term monthly copper chart (HGY00). (Recall Dr. Copper is an economic indicator market.)

How long will this trend last? It’s impossible to say. For now, I’ll leave it with my Market Rule #1: Don’t get crossways with the trend, based on Newton’s First Law of Motion applied to markets: A trending market will stay in that trend until acted upon by an outside force. That change could come from a number of directions, but to paraphrase former United States Supreme Court Justice Potter Stewart’s threshold test for obscenity, “We’ll know it when we see it.”

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart