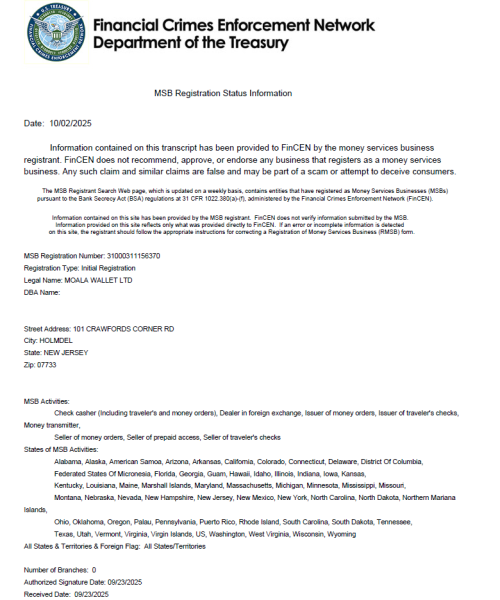

MOALA WALLET Exchange has obtained registration as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN), marking a significant milestone in its global compliance and regulatory development strategy.

MOALA WALLET Exchange, an innovation-driven digital asset trading platform, has obtained registration as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN). This development represents an important step in the platform’s broader compliance roadmap and strengthens its regulatory foundation for serving users in North America.

The MSB registration is a core compliance requirement for providing certain digital asset–related services in the United States. MOALA WALLET Exchange stated that the registration reflects the platform’s alignment with U.S. regulatory expectations related to financial transparency, risk controls, and operational governance.

Strengthening Regulatory Readiness Through Technology and Governance

During its compliance preparation process, MOALA WALLET Exchange implemented a series of structural and system-level enhancements designed to support regulatory oversight. These measures include advanced identity management frameworks, enhanced data governance controls, and integrated anti-money laundering (AML) and customer due diligence (CDD) procedures.

The platform also introduced modular audit and monitoring interfaces intended to improve traceability and oversight across transaction, identity, and data domains. According to the company, these upgrades were designed to support regulatory reporting requirements while maintaining operational efficiency and data protection standards.

Compliance-as-a-Service Architecture Supporting Multi-Jurisdictional Operations

MOALA WALLET Exchange applies a Compliance-as-a-Service (CaaS) architectural approach to its platform design. This framework enables flexible compliance adaptation across different regulatory environments by structuring identity, transaction, and data management into a layered operating model.

Through this approach, the platform can adjust access permissions, transaction parameters, and data handling practices in response to jurisdiction-specific regulatory requirements. The company stated that this design supports a balanced approach to regulatory alignment, system scalability, and user privacy protection.

MSB Registration as a Foundation for Institutional Engagement

As regulatory scrutiny of digital asset service providers continues to increase globally, MSB registration with FinCEN represents an important compliance baseline for operating within the U.S. financial system. MOALA WALLET Exchange indicated that this milestone enhances the platform’s legal and operational clarity and supports its engagement with institutional counterparties and financial infrastructure providers.

The company views regulatory capability as a key indicator of long-term platform sustainability as the digital asset sector becomes increasingly institutionalized.

Supporting a Transparent and Trusted Digital Asset Ecosystem

MOALA WALLET Exchange stated that obtaining MSB registration further supports its objective of building trusted liquidity and transparent infrastructure within the global digital asset market. The platform plans to continue advancing regulatory alignment through ongoing cooperation with compliance technology providers and regulatory stakeholders across multiple regions.

According to the company, this milestone reinforces its commitment to contributing to a secure, transparent, and responsibly governed digital financial ecosystem.

About MOALA WALLET Exchange

MOALA WALLET Exchange is a global digital asset trading platform focused on building secure, compliance-driven, and resilient financial infrastructure. The company maintains registration with the U.S. Financial Crimes Enforcement Network (FinCEN) as a Money Services Business and continues to advance its regulatory-aligned expansion across international markets, providing digital asset services designed to meet the needs of both institutional and retail participants.

Media Contact

Organization: MOALA WALLET

Contact Person: Christopher Nolan

Website: https://moalawallet.com/

Email: Send Email

Country:United States

Release id:39100

Disclaimer: This press release is provided for general informational purposes only and does not constitute financial, investment, legal, or trading advice. No representations or warranties are made regarding the accuracy or completeness of the information contained herein. Nothing in this release should be interpreted as an offer, solicitation, or recommendation to engage in any financial transaction. Readers should conduct their own independent research and consult qualified professionals before making any financial or business decisions.

View source version on King Newswire:

MOALA WALLET Exchange Obtains U.S. FinCEN MSB Registration, Advancing Its Global Compliance Strategy