Divexa Exchange has strengthened its U.S. regulatory posture by aligning its governance framework with SEC-informed compliance standards and securing official MSB registration with FinCEN.

United States, 9th Dec 2025 – Divexa Exchange has reached a significant milestone in its U.S. regulatory development, enhancing its compliance governance to align with regulatory expectations shaped by the U.S. Securities and Exchange Commission (SEC) and securing its official registration as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN).

This dual achievement reinforces the platform’s institutional readiness and its commitment to operating responsibly within the evolving U.S. digital-asset regulatory landscape.

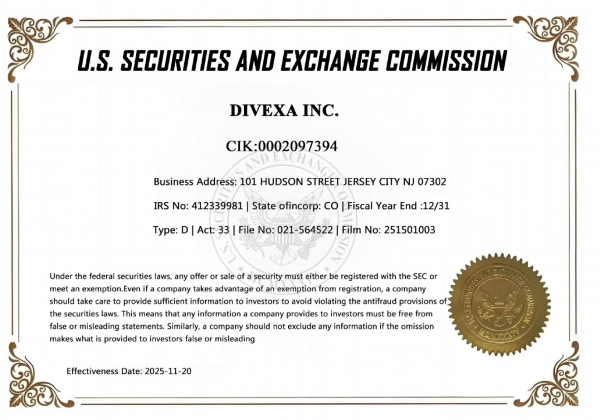

Strengthened Governance Aligned With SEC Regulatory Standards

Divexa Exchange has reinforced its internal controls, disclosure processes, and operational documentation to reflect regulatory principles informed by SEC guidance.

These enhancements focus on:

- Segregation of operational and customer assets

- Strengthened auditability and record-keeping practices

- Enhanced governance structures for supervisory transparency

- Expanded internal policies consistent with federal regulatory expectations

These measures enhance Divexa Exchange’s regulatory readiness and strengthen its ability to operate within the evolving U.S. supervisory landscape.

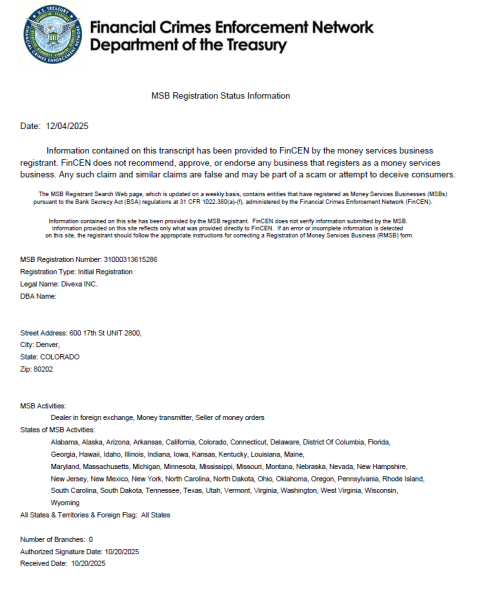

MSB Registration Strengthens U.S. Compliance Standing

Divexa Exchange is officially registered with FinCEN as a Money Services Business, fulfilling a core regulatory requirement for digital-asset operations relating to:

- Anti-money laundering (AML)

- Customer due diligence (CDD)

- Funds transfer monitoring

- Operational transparency

The registration provides a recognized compliance foundation for Divexa Exchange’s activities within the United States and supports deeper collaboration with financial institutions and corporate partners.

Technical Enhancements Supporting Dual Compliance

To support U.S. regulatory expectations, Divexa Exchange implemented several infrastructure upgrades, including:

- Privacy-preserving ZK-KYC identity verification

- Cross-chain data isolation mechanisms

- Multi-layer governance and auditing interfaces

- Strengthened risk-management procedures

These upgrades enhance both compliance capability and operational resilience, ensuring a safer and more transparent trading environment.

Commitment to Responsible Global Growth

According to Grant Ellison, Director of Global Strategy at Divexa Exchange,

“Strengthening our compliance architecture and achieving MSB registration represent important steps in our long-term vision. These developments reinforce our commitment to maintaining a regulatory-aligned platform that prioritizes transparency, integrity, and institutional-grade standards.”

As the digital-asset sector moves toward heightened regulatory oversight, Divexa Exchange continues to advance its governance framework to meet global expectations and contribute to building a secure, transparent, and trusted financial ecosystem.

About Divexa Exchange

Divexa Exchange is a global digital-asset trading platform offering secure, efficient, and intelligent services to users worldwide. Its ecosystem includes derivatives and spot trading, new token listings, conservative yield products, and advanced tools for digital-asset management. Supported by multi-layer security, real-time monitoring, Proof of Reserves transparency, and strict regulatory alignment, Divexa Exchange is committed to enabling safe and confident participation in digital finance.

Media Contact

Organization: Divexa Exchange

Contact Person: Nick Carter

Website: https://divexa.com

Email: Send Email

Country:United States

Release id:38780

Disclaimer: This press release is for informational purposes only and does not constitute investment advice. The inclusion of a business on the MSB Registrant Search Web page is not a recommendation, certification of legitimacy, or endorsement of the business by any government agency. Users should consult licensed financial professionals before engaging in digital asset transactions.

View source version on King Newswire:

Divexa Exchange Achieves Key U.S. Regulatory Milestone With Strengthened SEC-Oriented Compliance Framework and MSB Registration