Lincoln Financial Group and New York Life Rank Highest in a Tie

A combination of limited direct engagement with insureds and a failure to offer the variety of products and services those policyholders seek have resulted in relatively low customer satisfaction scores for the group life insurance industry. According to the J.D. Power 2021 U.S. Group Life Insurance Study,℠ released today, satisfaction with group life insurance trails two-thirds of other U.S. service industries evaluated by J.D. Power.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211102005053/en/

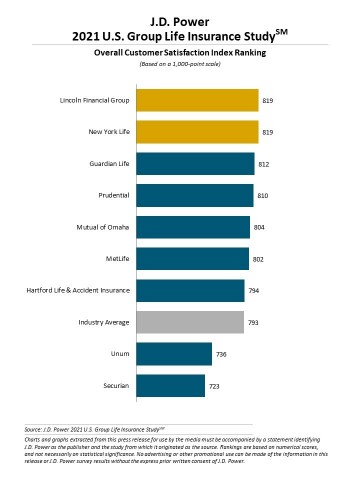

J.D. Power 2021 U.S. Group Life Insurance Study (Graphic: Business Wire)

"There is really an education problem in the group life insurance marketplace,” said James Beem, managing director of global healthcare intelligence at J.D. Power. “Data shows a clear pattern of policyholders not really understanding what’s available to them. For example, three of the four most important attributes in driving overall satisfaction—overall price, availability of additional products and services, and variety of coverage options—are also among the lowest-ranked in the study. This spotlights a clear area for improvement and a huge opportunity for carriers to drive better engagement, create cross-sell opportunities and improve brand perception simply by focusing on these fundamental issues.”

Study Ranking

Lincoln Financial Group and New York Life rank highest in a tie among group life insurance providers, each with a score of 819. Guardian Life (812) ranks third.

The J.D. Power 2021 Group Life Insurance Study measures the experiences of customers of the largest life insurance providers in the United States. The study measures overall customer satisfaction based on performance in six factors (in alphabetical order): application and orientation; communication; interaction; price; product offerings; and statements.

The study is based on responses from 2,126 group life insurance customers. It was fielded from July through September 2021.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021146.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20211102005053/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com