Reported Problem Incidence Doubles as Website Issues and Processing Problems Proliferate

With more than 10 million new brokerage accounts opened in 2020 as mainstream investor interest skyrocketed during the pandemic, retail brokerage firms struggled to deliver a seamless customer experience. According to the J.D. Power 2021 U.S. Self-Directed Investor Satisfaction Study,SM released today, the number of problems cited by customers doubled during the past year, with website issues, processing and trade execution failures and account statement errors leading the way.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210427005105/en/

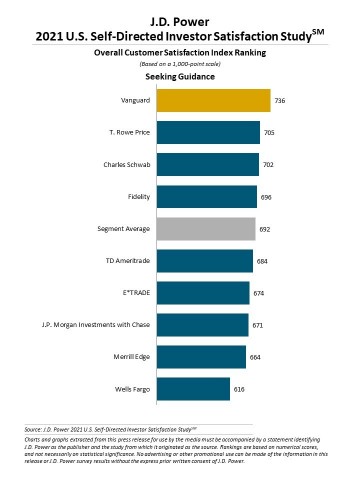

J.D. Power 2021 U.S. Self-Directed Investor Satisfaction Study (Graphic: Business Wire)

“The significant influx of new investors—and increased trading volumes and overall engagement from clients—clearly put a strain on the system and a spotlight on some of the most critical areas that firms need to address if they want to continue to attract and retain self-service investors,” said Michael Foy, senior director and head of wealth intelligence at J.D. Power. “With virtually every firm now offering free trading and new investors showing lower levels of brand loyalty, firms that get the customer satisfaction formula right have a chance to set themselves apart from the competition.”

Following are key findings of the 2021 study:

- Frequent glitches sap customer satisfaction: Problem incidence has doubled in the past year, affecting 11% of all do-it-yourself investors and 12% of those in the seeking guidance segment of self-directed investors. The most frequent sources of problems are websites, processing and/or trade execution and account statements. Both overall customer loyalty and customer advocacy have increased significantly among investors who do not experience these problems.

- Robinhood leads in new accounts but struggles to build trust: Robinhood, the easy-to-use, mobile-friendly online brokerage that found itself at the center of the GameStop stock frenzy in January and February of this year, claimed 27% of all new do-it-yourself account openings, more than any other firm in this year’s study. While its market share has grown, its strength in digital channels and value for fees was offset by poor performance on trust, people and problem resolution.

- Investor education remains best resource, but brokerages not delivering: Overall customer satisfaction scores are 148 points higher (on a 1,000-point scale) among do-it-yourself investors and 155 points higher among those seeking guidance when they strongly agree that their brokerage firm provides useful guidance or advice. Despite this significant boost to customer satisfaction, fewer than half of self-directed investors say their firm provides useful guidance or advice.

- Meeting clients’ holistic financial needs: Overall customer satisfaction is highest when investors use four or more products with a wealth management firm, which can include services such as investment accounts, banking relationships and mortgages. Among do-it-yourself investors, satisfaction scores are 103 points higher when investors use four or more products than when they use just one. Among investors seeking guidance, that customer satisfaction differential is 76 points. Besides increasing satisfaction, deepening the client relationship is more critical than ever for firms needing to generate revenue in a free-trading environment.

The U.S. Self-Directed Investor Satisfaction Study, now in its 19th year, evaluates key satisfaction drivers and firm performance among both investors seeking guidance (those who don’t have a dedicated financial advisor but do have access to interact with a registered investment professional) and true do-it-yourself investors (those who do not interact with professional advisors).

Study Rankings

Vanguard (736) ranks highest in self-directed investor satisfaction among investors seeking guidance. T. Rowe Price (705) ranks second and Charles Schwab (702) ranks third.

Vanguard (736) ranks highest in self-directed investor satisfaction among do-it-yourself investors. Charles Schwab (727) ranks second and T. Rowe Price (721) ranks third.

The U.S. Self-Directed Investor Satisfaction Study, which was redesigned for 2021, measures self-directed investors’ satisfaction with their investment firm based on performance in seven factors (in order of importance): trust; digital channels; the ability to manage wealth how and when I want; products and services; value for fees; people; and problem resolution.

The 2021 study is based on responses from 4,895 investors who make all their investment decisions without the counsel of a full-service dedicated financial advisor. The study was fielded from December 2020 through February 2021.

For more information about the 2021 U.S. Self-Directed Investor Satisfaction Study, visit https://www.jdpower.com/business/resource/us-self-directed-investor-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021036.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20210427005105/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com