Full-Service Investors Who Strongly Believe Their Firm is Committed to ESG More Likely to Promote Brand and Invest More Assets

With nearly $700 billion in financial assets poised to be transferred to the next generation in Canada by 2026, full-service wealth management firms need to do a better job of catering to the needs and values of this emerging demographic of younger investors or risk losing current and future business. According to the J.D. Power 2021 Canada Full-Service Investor Satisfaction Study,SM released today, Millennials and Gen Z1 investors who strongly believe their investment firm is committed to ESG (environmental, social and corporate governance) investing are twice as likely to increase their investment compared with those who don’t perceive this commitment (31% vs. 16%, respectively).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210506005033/en/

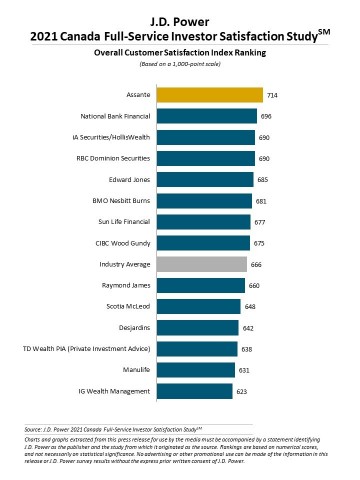

J.D. Power 2021 Canada Full-Service Investor Satisfaction Study (Graphic: Business Wire)

Younger investors who strongly believe their investment firm is committed to ESG are much more willing to act as avid brand ambassadors while those who say they don’t see a commitment become detractors. The study also shows that 22% of investors under age 40 clearly see the commitment for ethical investing from their full-service investment firm, while 46% say they either have doubts about their firm’s commitment to ESG or don’t know about it. This trend is echoed among older age groups as well.

“We are at the tipping point of a massive generational wealth transfer,” said Mike Foy, senior director and head of wealth intelligence at J.D. Power. “Investors in Canada—especially younger ones—increasingly want their investments to align with not only their financial goals but also their values. Wealth management firms and advisors have a critical role to play in helping them do this, and they can’t afford to wait for clients to ask them about it.”

Following are some key findings of the 2021 study:

- Most investors say their needs aren’t being met: Only 36% of investors say their wealth management needs are completely being met by their firm and this has a significant effect on their level of satisfaction (+173 points on a 1,000-point scale). When investors are using more advanced products related to their needs, such as estate planning and philanthropic giving, their perception about their needs being met increases to 43% from 32%.

- Overlooking the next generation: Among a significant portion of investors consisting of Pre-Boomers and Boomers, 59% say they were not asked by their advisor about the needs of beneficiaries, and only 23% say the advisor initiated a conversation between the client and their beneficiary. These conversations have a significant effect on investor satisfaction—710 among those who had a conversation vs. 652 among those who did not—but also present a missed opportunity to further engage the next generation of investors.

- Younger investors crank up digital interaction: Investors under age 40—a group already more digitally engaged than older investors—have substantially increased their usage of digital channels to interact with their advisor or firm since the onset of the pandemic. The digital channels most frequently cited as being used more often are email (29%), mobile app (22%) and website (20%).

- Pandemic fueled investment amendments: A notable 40% of all investors indicate they are financially worse now than before the pandemic. More than half (57%) of Millennial and Gen Z investors say they have made changes to their finances during the past year, compared with just 30% of Gen X and Boomer investors. Even among the most affluent investors with more than $500,000 in assets, 33% have amended their financials due to the pandemic, further stressing the importance of financial advisors to stay in touch with clients as their needs and circumstances change.

Study Ranking

Assante ranks highest in overall investor satisfaction with a score of 714. National Bank Financial (696) ranks second, and iA Securities/HollisWealth (690) ranks third.

The Canada Full-Service Investor Satisfaction Study, now in its 16th year, is redesigned for 2021. As a result of the study redesign, scores are not comparable to those of previous years. The study measures overall investor satisfaction with full-service investment firms in seven factors (in order of importance): people; trust; products and services; value for fees; ability to manage wealth how and when I want; problem resolution; and digital channels.

The study is based on responses from 3,577 investors who make some or all of their investment decisions with a financial advisor. The study was fielded from December 2020 through February 2021.

For more information about the Canada Full-Service Investor Satisfaction Study, visit

https://canada.jdpower.com/financial-services/canada-full-service-investor-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021044.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modelling capabilities to understand consumer behaviour, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

About J.D. Power and Advertising/Promotional Rules: http://www.jdpower.com/business/about-us/press-release-info

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210506005033/en/

Contacts

Media Relations Contacts:

Gal Wilder, Cohn & Wolfe; 416-602-4092; gal.wilder@cohnwolfe.ca

Nicole Herback, Cohn & Wolfe; 403-200-1187; nicole.herback@cohnwolfe.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com