The following release has been released earlier this morning in Australia on the ASX:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210913005299/en/

(Graphic: Business Wire)

Dear Investors,

On behalf of global leading tungsten producer and developer, Almonty Industries Inc’s (“Almonty” or the “Company”) (ASX:AII / TSX: AII / OTCQX: ALMTF / Frankfurt: ALI.F), I am very pleased to provide an update on activities at the Company’s tungsten mines.

Sangdong Tungsten Mine in South Korea (Sangdong)

The construction of Sangdong is on budget and on schedule. The road and river diversion is expected to be completed in early October. Both pieces of infrastructure are rated accordingly under our ESG programme for a 100-year event.

Underground mine development continues as planned, and we have, as of last week, completed 17.5% of the scheduled 3,748m. Our shotcrete batch plant continues to impress with a rebound rate of 6% and even at times as low as 3%. To put that into perspective a rebound rate for sloping walls or vertical walls typically runs between 5-10%. Rebound is the part of the shotcrete that does not adhere to the surface during application, causing some material to ricochet. The loss of material and subsequent clean-up can slow down work on site while increasing costs, so it´s important to minimize it. This is a great example of the depth of talent that is evident within the Almonty in house team, utilizing learnings and experiences from our >100 years of operations at Almonty’s Panasqueira Tungsten and Tin Mine in Portugal. As previously outlined, Almonty’s key operational team from Panasqueira has and will continue to have a key role in the construction, commissioning, ramp-up and production at Sangdong which we believe will strongly de-risk the project.

Over US$14m has now been spent at the Sangdong site against the project cost which equates to approximately 13.8% of total project cost (including US$6m for guarantee fees). The lock cycle tests have all been successfully completed by Metso Outotec and they now move forward with the engineering study for the processing plant. The second payment deposit is expected to be made by Almonty in October for the mills and their delivery is still on track for January 2022.

Once Sangdong is in production from Q4 2022, Almonty is expected to produce approximately 30% of all tungsten outside of China and approximately 7-10% of global supply.

On August 5th the South Korean Government announced that it would be increasing the national stockpile which includes Tungsten from 57 days to 100 days. We are now in dialogue with the Authorities in regard to their Tungsten requirements. https://m.post.naver.com/viewer/postView.naver?volumeNo=32205181&memberNo=374543&vType=VERTICAL

Panasqueira Tungsten and Tin Mine in Portugal (Panasqueira)

The Panasqueira Tungsten and Tin Mine in Portugal has begun its transition over to renewable energy with 28% of energy currently supplied from our onsite solar installation. Reliance on renewable energy will continue to increase as further solar and wind power is brought on-line. Ultimately the company is targeting 80% of its energy use from renewable energy.

As previously outlined, as Almonty is striving to become a globally significant mining company, it is critical that we continue our strong focus on ESG. Almonty is proud of the progress made towards our ESG programme at Panasqueira and those proposed at Sangdong. All new facilities at Sangdong are designed and will be built in compliance with IFC/ Equatorial Principal standards (https://equator-principles.com/). Additionally, Sangdong power will be sourced from 100% renewable energy as the Company targets carbon neutrality.

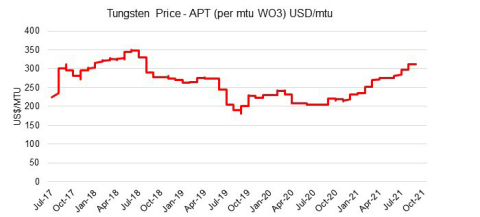

Tungsten Price

We also note that the tungsten price has risen to US$315/MTU which is +50% higher than this time last year and a 2 year high. The Company notes estimates from brokers and third-party providers that the tungsten price is expected to be >US$350/MTU in the near term. Please refer to a chart of the tungsten price.

For and on behalf of the Board,

Lewis Black

President and Chief Executive Officer

Telephone: +1 647 438-9766

Email: info@almonty.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20210913005299/en/

Contacts

Lewis Black

President and Chief Executive Officer

Telephone: +1 647 438-9766

Email: info@almonty.com