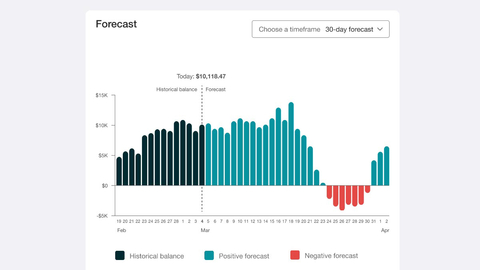

Today, U.S. Bank announced a new innovative offering to meet small business owners’ desire for a better line of sight into their future cash flow. A new online banking tool will enable the bank’s small business clients to see a 90-day forecast of their cash flow, with the ability to leverage clients’ external data in addition to their U.S. Bank accounts. The tool is now available to clients from their online dashboard.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221003005830/en/

A new online banking tool from U.S. Bank will enable the bank’s small business clients to see a 90-day forecast of their cash flow, with the ability to leverage clients’ external data in addition to their U.S. Bank accounts. The tool is now available to clients from their online dashboard.

“Cash flow is a top concern for today’s business owners. Giving our clients the ability to forecast their cash flow outlook, including, in the future, the capability to consider various scenarios, will provide them with vital information to make smart decisions for today and the future,” said Irv Henderson, U.S. Bank’s Chief Digital Officer for Small Business. “This is just the newest example of how we are enhancing our leading banking and payments solutions by bringing together digital capabilities and the power of data in tools that are simple to use and provide valuable and actionable insights for our clients.”

The cash flow tool provides a forecast of account balances up to 90 days ahead, as well as a 90-day historical view, giving clients important information to help plan for their business. The tool allows clients to leverage both internal and external data sources to gain more comprehensive cash flow insights. U.S. Bank will also continue to invest in the tool and expects to introduce future functionality that will allow clients to create “what if” scenarios and view the potential impact on their future cash flow.

This tool is the latest feature to be introduced as part of U.S. Bank’s Business Essentials, an integrated “all-in-one” suite of banking and payments solutions that are simple and convenient for businesses to use to manage and run their operations.

About U.S. Bank

U.S. Bancorp, with approximately 70,000 employees and $591 billion in assets as of June 30, 2022, is the parent company of U.S. Bank National Association. The Minneapolis-based company serves millions of customers locally, nationally and globally through a diversified mix of businesses: Consumer and Business Banking; Payment Services; Corporate & Commercial Banking; and Wealth Management and Investment Services. The company has been recognized for its approach to digital innovation, social responsibility, and customer service, including being named one of the 2022 World’s Most Ethical Companies and Fortune’s most admired superregional bank. Learn more at usbank.com/about.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221003005830/en/

Contacts

Rick Rothacker, U.S. Bank Public Affairs & Communications

richard.rothacker@usbank.com | 704.574.8878