RudderStack, the leading platform for building customer data stacks trusted by many of the world’s leading brands, today announced $56 million in Series B funding. The round was led by New York-based global venture capital and private equity firm Insight Partners along with continued support from Kleiner Perkins and S28 Capital. The investment will be used to accelerate growth and enable data engineers everywhere to build the infrastructure required to help their businesses understand their users and serve their needs. To date, the company has raised a total of $82 million.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220131005630/en/

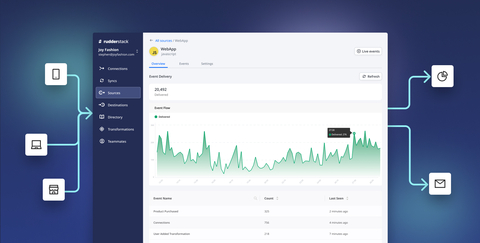

RudderStack customer data platform user interface (Graphic: Business Wire)

RudderStack was founded in 2019 by Soumyadeb Mitra, CEO and Shvet Jain, executive chairman of the company and partner at S28 Capital. Today, thousands of companies are using RudderStack’s platform as a key component in their customer data stacks to power the collection, enrichment, and activation of customer data. The company’s data pipelines that sync data into the cloud data warehouse and to downstream apps help free up engineering time to focus on building data products that create value for customers.

“The rise of the cloud data warehouse has made it, in theory, easier than ever to collect, process, and analyze customer data. However, in practice, engineering teams are struggling to support their organizations as they seek to derive more value from their data,” said Soumyadeb. “At RudderStack, we enable data engineers to build future-proof customer data infrastructure. We are uniquely positioned to support companies that are simply looking to collect data from their website or application and send it to downstream SaaS destinations or those looking to employ predictive machine learning models to better serve their customers.”

Praveen Akkiraju, Managing Director at Insight Partners, is joining the RudderStack board. “What makes RudderStack unique is its end-to-end data pipelines for customer data optimized for data warehouses. This best-in-class architecture enables data engineers to eliminate data silos across teams and accelerates their ability to build data pipelines to unlock advanced analytics and machine learning use cases,” said Akkiraju. “We are thrilled to lead this round and join Souymadeb and his team as they build an amazing customer data platform and company.”

Since its founding, RudderStack has grown at a rapid pace. In 2021, the company’s revenue and customer base expanded by over 300%, with the addition of customers such as AllBirds, Wealthfront and Crate & Barrel. The RudderStack team has tripled in size to support this growth.

About RudderStack

RudderStack is the warehouse-first, customer data platform built for developers that was incubated at S28 Capital. The company takes a new approach to building and operating customer data infrastructure, making it easy to collect, unify, transform, and store customer data as well as securely route it to a wide range of common, popular tools. To learn more, visit rudderstack.com.

About Insight Partners

Insight Partners is a leading global venture capital and private equity firm investing in high-growth technology and software ScaleUp companies that are driving transformative change in their industries. Founded in 1995, Insight Partners has invested in more than 400 companies worldwide and has raised through a series of funds more than $30 billion in capital commitments. Insight's mission is to find, fund, and work successfully with visionary executives, providing them with practical, hands-on software expertise to foster long-term success. Across its people and its portfolio, Insight encourages a culture around a belief that ScaleUp companies and growth create opportunity for all. For more information on Insight and all its investments, visit insightpartners.com or follow us on Twitter @insightpartners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220131005630/en/

RudderStack announces $56 million in Series B funding to enable data engineers everywhere to build the infrastructure required to help their businesses. @insightpartners led the round with continued support from @kleinerperkins and @S28capital.

Contacts

Kristen Glass, Director of Product Marketing | RudderStack | +1 925 324 7106 | kristen@rudderstack.com