New partnerships and integrations cap off a year of rapid momentum and record growth

SIMON Markets LLC (SIMON), a fintech company that offers an end-to-end digital suite of tools to help financial advisors understand, manage, and analyze complex alternative investment products, today announced business highlights underscoring its continued growth during Q4 2021.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220203005897/en/

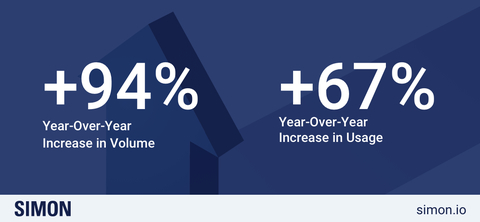

SIMON Markets Q4 Highlights (Graphic: Business Wire)

The company reports year-over-year increases in volume of +94% and usage of +67%. During the quarter, the company announced multiple new strategic partnerships to expand its product offering for financial professionals and released significant enhancements to its digital platform to improve the way advisors manage client accounts. Catering to a growing demand for risk-managed and alternative solutions, SIMON is focused on giving financial professionals access to a broad suite of products with powerful analytics and seamless integrations to help make well-informed portfolio allocation decisions.

“SIMON closed out 2021 with several milestones that underscore the velocity of the growth we’re experiencing—we introduced a partnership with +SUBSCRIBE to power our new marketplace for alternatives, collaborations with Envestnet, FIDx, and Fidelity that expand the reach of our platform’s capabilities across wealth managers and RIAs, and an integration with Rowboat Advisors that enhances the capabilities of our portfolio allocation tool, SIMON Spectrum,” said Jason Broder, CEO of SIMON. “Everything we’re doing is to empower advisors, and in turn, the investors they serve. We’re delivering tools that make it easier to navigate and manage a wider range of products with confidence. We have a lot to look forward to as we continue rolling out enhancements in 2022.”

Recent Press Releases:

- SIMON Integrates with Rowboat Advisors’ Cutting-Edge Portfolio Optimization Software to Enhance Portfolio Allocation Tool for Wealth Managers • The integration amplifies SIMON’s digital analytics offering to power portfolio analytics needs for risk-managed and alternative investment solutions (Press Release, 12/16/21)

- Envestnet Insurance Exchange Powered By Collaboration Between FIDx & SIMON • FIDx & SIMON to Integrate to Deliver a Unified Platform Experience for Annuities, Simplifying Income & Protection Solutions for Client Portfolios (Press Release, 12/01/21)

- Fidelity Institutional® Announces New Structured Investment Offering & Trading Capabilities for Wealth Management Firms • Fidelity® becomes first clearing and custody firm to provide solution for structured investments through integration with SIMON Markets in WealthscapeSM | Firm introduces new trading capabilities including updates to Bond BeaconSM, fractional share trading, multi-leg options, and security swaps across accounts (Press Release, 11/17/21)

- Envestnet & SIMON Partner to Enable Advisors to Offer Structured Investments as Fee-Based Solutions • Envestnet Simplifies the Delivery & Lifecycle Management of Income-and-Protection-Focused Products by Integrating SIMON’s End-to-End Suite of Digital Tools Across its Ecosystem (Press Release, 11/16/21)

- SIMON Partners with +SUBSCRIBE to Launch Alternative Investment Fund Marketplace for Wealth Managers • SIMON expands its industry leading, advisor-facing technology platform to launch the wealth industry’s first digital end-to-end alternative fund marketplace, providing access to a full suite of investment opportunities from leading asset managers | Powered by +SUBSCRIBE’s state-of-the-art electronic subscription document technology, the marketplace will enable financial advisors to centralize their activity across direct fund and feeder fund investments (Press Release, 11/03/21)

About SIMON

Launched in 2018, SIMON helps financial advisors build the portfolio of tomorrow by giving them access to more investment opportunities. The SIMON platform offers a marketplace for risk-managed and alternative solutions, including structured investments, annuities, and traditional and progressive alternatives. With education and analytics breaking down the complexity inherent in these products, and a centralized workflow for lifecycle management, financial advisors can learn, transact, and manage client portfolios with confidence.

Over 100,000 financial professionals with $5 trillion in client assets turn to SIMON to stay ahead in an ever-evolving investment landscape. SIMON is an independently operating fintech company, with seven original investors—Barclays, Credit Suisse, Goldman Sachs, HSBC, J.P. Morgan, Prudential, and Wells Fargo. Growth equity firm WestCap became an investor in 2021. To learn more about SIMON, visit www.simon.io and follow the company on Instagram, LinkedIn, and Twitter.

Securities products and services offered by SIMON Markets LLC, a broker-dealer registered with the SEC, Member FINRA / SIPC. Annuities and insurance services provided by SIMON Annuities and Insurance Services LLC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220203005897/en/

Contacts

Media Contact:

Francie Rawson

SIMON Markets LLC

francie@simonmarkets.com

877.317.4666