Audi Financial Services and Ford Credit Rank Highest in Respective Segments

With leasing volume now accounting for just 19% of total new-vehicle sales, lenders and dealers need to be more targeted and purposeful than ever in their communication strategies to retain lessees and securing conquest opportunities. According to the J.D. Power 2022 U.S. End of Lease Satisfaction Study,SM released today, highly personalized communications based on detailed lease journey analytics are essential to recapturing existing customers and winning new ones.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220331005259/en/

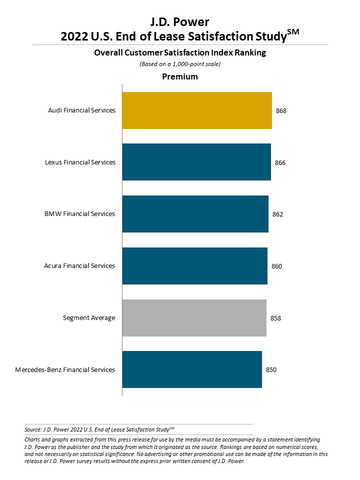

J.D. Power 2022 U.S. End of Lease Satisfaction Study (Graphic: Business Wire)

“The days of the one-size-fits-all lease loyalty strategy are long gone,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power. “In this market, lenders, dealers and OEMs really need to understand the unique individual journeys of their customers and develop tailored, highly targeted outreach strategies creating the greatest opportunity to retain them. Ultimately, successful customer retention and conquest strategies are coming down to detailed analytics. Lease providers need to understand the different customer journeys—whether it’s first-time lessees or returning lessees—and offer available incentives to the right customers, at the right moments, via the right communication channels to keep lease volumes flowing.”

Study Rankings

Audi Financial Services ranks highest in end of lease satisfaction in the premium segment, with a score of 868 (on a 1,000-point scale). Lexus Financial Services (866) ranks second and BMW Financial Services (862) ranks third.

Ford Credit ranks highest in end of lease satisfaction in the mass market segment, with a score of 864. Honda Financial Services (853) ranks second and GM Financial (852) ranks third.

The 2022 U.S. End of Lease Satisfaction Study identifies lease-end practices and timely marketing opportunities that optimize lease retention for the same brand and at the same dealer. The study is based on responses from 3,075 mass market and premium vehicle lease customers who are within six months of lease end. It was fielded in November-December 2021.

For more information about the U.S. End of Lease Satisfaction Study, visit https://www.jdpower.com/business/financial-services/us-end-lease-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2022027.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20220331005259/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com