Safeco Ranks Highest in Service Satisfaction, COUNTRY Financial Ranks Highest in Shopping Satisfaction

The streamlined user experience, seamless customer support and improved navigation that was supposed to define the digital transformation of the property and casualty (P&C) insurance industry—and improve customer satisfaction—has been overpowered by rising rates. According to the J.D. Power 2022 U.S. Insurance Digital Experience Study,SM released today, overall customer satisfaction with insurers’ digital offerings declines this year, despite significant investments in customer-facing websites and mobile apps.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220524005053/en/

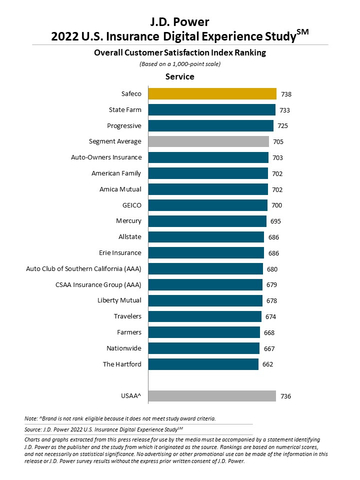

J.D. Power 2022 U.S. Insurance Digital Experience Study (Graphic: Business Wire)

“Although insurers keep upping the ante on technology, improvements are being offset by frustration among customers who are going online to shop for a better rate—and not finding one,” said Robert M. Lajdziak, director of insurance intelligence at J.D. Power. “We’re also seeing a clear trend in which more than half of digital insurance shoppers are choosing not to use digital tools or educational resources to help them through the shopping process. This further exacerbates the decline in customer satisfaction.”

The study, which was redesigned this year, evaluates digital consumer experiences among both P&C insurance shoppers seeking quotes and existing customers conducting typical policy-servicing activities. The study examines the functional aspects of desktop, mobile web and mobile apps based on four factors: ease of navigation; speed; visual appeal; and information/content. The study was conducted in collaboration with Corporate Insight, the leading provider of competitive intelligence and user experience research to the financial services and healthcare industries.

“While insurers are spending a great deal on tech on an industry-wide basis, we’re seeing very uneven execution between brands, particularly in the area of mobile apps, where the top performers are really breaking new ground, but the bottom performers are keeping overall customer satisfaction scores low,” said Michael Ellison, president of Corporate Insight. “We’re also starting to notice some noteworthy year-over-year volatility among the brands in the study, which shows that smart investments in good technology can drive rapid performance improvement.”

Following are key findings of the 2022 study:

- Frustration with rising prices casts long shadow: Overall customer satisfaction with the P&C insurer digital shopping experience is just 499 (on a 1,000-point scale), down 16 points from a year ago. Overall customer satisfaction with the digital service experience is 705, which is down one point from 2021. The decline in shopping satisfaction is driven by growing customer frustration with rising rates and the inability to find premium cost relief through shopping for a new policy.

- Shopping tools go largely unused: The use of digital shopping tools—which help guide insurance shoppers to discounts, policy details and special coverage or unique benefits—is associated with a boost of 137-211 points in satisfaction, depending on which shopping tool is used. However, 54% of insurance shoppers did not use any shopping tools during their quote processes.

- Apps can be great, but not all apps were created equal: In account servicing, the study finds significant gaps in mobile app performance. The average satisfaction score among the top-performing 25% of respondents using a mobile app is 885—significantly higher than any other channel. However, satisfaction with the bottom 25% of respondents using a mobile app falls 358 points to 527.

- Traditional insurers hold their own vs. InsurTechs on digital service: Overall customer satisfaction with digital account servicing is the same among traditional insurers and digital native InsurTech brands. While InsurTechs outperform on speed and visual appeal metrics, traditional carriers are making up the difference with better information/content and access to human support when customers need it.

Study Rankings

Safeco ranks highest in the service segment with a score of 738. State Farm (733) ranks second and Progressive (725) ranks third.

COUNTRY Financial ranks highest in the shopping segment with a score of 525. Auto Club of Southern California (517) and Auto-Owners Insurance (517) rank second in a tie.

The 2022 U.S. Insurance Digital Experience Study is based on 10,671 evaluations and was fielded in February-March 2022.

For more information about the U.S. Insurance Digital Experience Study, visit https://www.jdpower.com/business/insurance/us-insurance-digital-experience-study.

See the online press release at http://www.jdpower.com/pr-id/2022055.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About Corporate Insight

Corporate Insight delivers competitive intelligence, user experience research and consulting services to the nation’s leading financial and health institutions. As the recognized industry leader in customer experience research since 1992, CI has been the trusted partner to corporations seeking to improve their digital capabilities and user experience. Their best-in-class research platform and unique approach of analyzing the actual customer experience helps corporations advance their competitive position in the marketplace. To learn more, visit http://www.corporateinsight.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20220524005053/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com