New Features Include 24/7 Trading and Additional Coins

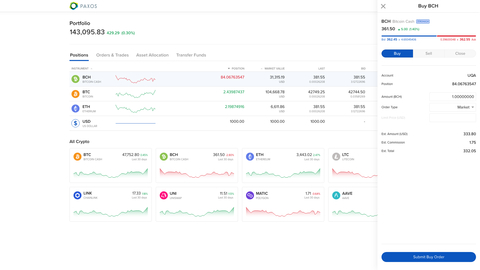

Interactive Brokers (Nasdaq: IBKR), an automated global electronic broker, today introduced the ability for customers to access 24/7 crypto trading through an enhanced web application available from Paxos Trust Company. Clients who elect to manage the funding of their crypto account themselves can pre-fund their crypto accounts at Paxos during regular US banking hours and then trade Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), plus additional coins around the clock.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220809005087/en/

New Crypto Web Application Available from Paxos Trust Company (Photo: Business Wire)

“This gives our clients a simple and low-cost way to access crypto markets at any time,” said Steve Sanders, EVP of Marketing and Product Development at Interactive Brokers. “With the added ability to pre-fund accounts, our clients have greater flexibility to react to market events and manage their cryptocurrency exposure.”

The new features let clients:

- Trade crypto 24/7 in their Paxos account

- Trade additional cryptocurrencies offered by Paxos, including BTC, ETH, LTC, BCH, plus several others

- Hold both USD and crypto in their Paxos account

- Access additional order types in their Paxos account

While other crypto exchanges and brokers charge trading fees as high as 2.00% of trade value or more, Interactive Brokers customers trading with Paxos pay low crypto commissions of just 0.12% - 0.18% of trade value, depending on monthly volume, with a USD 1.75 minimum per order. In addition, there are no added spreads, markups, or custody fees.

The new crypto features are available to US residents and clients of Interactive Brokers in over 100 countries with individual or joint accounts, as well as certain types of institutional accounts. In addition, clients of Interactive Brokers can trade crypto alongside stocks, options, futures, bonds, and funds on a single unified platform. Cryptocurrency trading is available through the company’s trading platforms, including Trader Workstation, Client Portal, IBKR Mobile, and IBKR GlobalTrader, IBKR’s simple new mobile app for global stock trading, as well as through the Paxos web application.

For more information, visit ibkr.com/crypto.

About Interactive Brokers Group, Inc.:

Interactive Brokers Group affiliates provide automated trade execution and custody of securities, commodities and foreign exchange around the clock on over 150 markets in numerous countries and currencies, from a single unified platform to clients worldwide. We service individual investors, hedge funds, proprietary trading groups, financial advisors and introducing brokers. Our four decades of focus on technology and automation has enabled us to equip our clients with a uniquely sophisticated platform to manage their investment portfolios. We strive to provide our clients with advantageous execution prices and trading, risk and portfolio management tools, research facilities and investment products, all at low or no cost, positioning them to achieve superior returns on investments. For the fifth consecutive year, Barron’s ranked Interactive Brokers #1 with 5 out of 5 stars in its March 25, 2022, Best Online Brokers Review.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220809005087/en/

Contacts

Contacts for Interactive Brokers Group, Inc. Media: Katherine Ewert, media@ibkr.com