Despite macroeconomic uncertainty and cost-cutting pressures, investment in technology continues to be of the highest priority for the financial services industry. Omdia’s Financial Services Spotlight Service finds almost eight in ten financial institutions across banking, financial markets, insurance and payment issuers/acquirers and will increase their IT budgets for 2023-2024 (versus six in ten during 2022-2023) and more than half predict double digit growth in their IT spend.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231010791513/en/

Omdia: As financial services strive to be a digital-first industry, 78% of financial institutions expect to increase IT budgets in 2023-2024

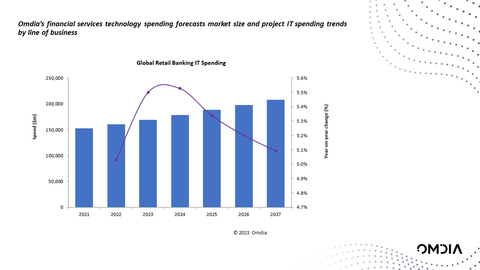

Omdia’s survey results reveal that retail banks’ top IT priorities are operations, product development and digital banking. This is reflected in Omdia’s Retail Banking Technology Spending Forecasts, which forecasts a CAGR of 5.7% for operations, 5% for account and product management and 5.5% for digital banking through to 2027.

Sixty percent of payment issuers/acquirers are increasing their spend in alternative payments as real-time payments (RTP) near a crucial tipping point toward mainstream adoption. IT spending on business RTP is expected to grow at a CAGR of 6.8% through to 2027. Fifty percent of issuers indicate that RTP is in a top priority for product development, ahead of debit/credit cards and digital wallets, while retail payments in-store, account-to-account (A2A) and ecommerce payments top the list of products enabled by real-time payments.

“As the financial services industry continues to evolve, regulatory initiatives are driving major change and forcing banks to invest in new systems,” said Cem Allan Nurkan, Head of Enterprise Technology Research, Omdia. “Omdia’s survey found ‘incorporating regulatory change more easily’ was among the top drivers for IT investment in its core banking with 39% of respondents selecting it within their top three priorities. Consequently, risk and compliance will see the strongest growth overall during 2022–27, with a CAGR forecast of 5.8%, this is linked to the increasing regulatory requirements with PSD3, DORA and ‘Basel III endgame’ all on the horizon for financial institutions to contend with.”

The Financial Services Spotlight Intelligence Service is taken from Omdia’s extensive fintech market data.

For additional up-to-date insights and research or for more information, click here.

ABOUT OMDIA

Omdia, part of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets and actionable insights empower organizations to make smart growth decisions. To learn more, visit www.omdia.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231010791513/en/

Contacts

Media

Fasiha Khan / T: +44 7503 666806 / E: fasiha.khan@omdia.com