Capital Group/American Funds Ranks Highest in Digital Experience Satisfaction

The unstable financial markets in the United States during the past few years have people keeping a wary eye on their retirement accounts and, increasingly, they are doing so via mobile apps. According to the J.D. Power 2023 U.S. Retirement Plan Digital Experience Study,℠ released today, improved market performance has helped lift overall satisfaction with retirement plan digital tools. However, for those firms that want to differentiate and increase customer satisfaction in good markets and bad, more work needs to be done on digital, especially when it comes to mobile apps.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230914226070/en/

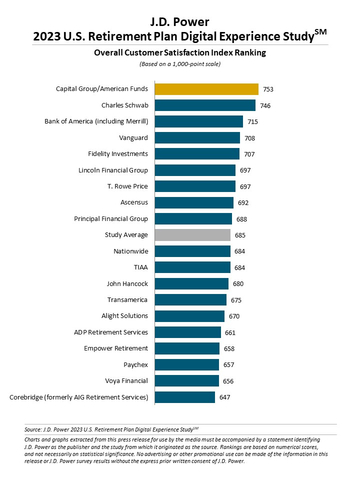

J.D. Power 2023 U.S. Retirement Plan Digital Experience Study (Graphic: Business Wire)

“The good news is that overall satisfaction with the retirement plan digital experience is up considerably this year, but when we compare those scores to similar customer-facing industries such as wealth management, property and casualty insurance and automotive, it’s clear that retirement plans still have a lot of opportunities to improve their digital offerings,” said Craig Martin, managing director and global head of wealth and lending intelligence at J.D. Power. “Consistently, we’re finding that improved digital experiences are critical to strong financial performance. Participants who have a great digital experience vote with their dollars, with roughly double the amount of participants rolling in assets from other plans and more than triple the amount saying they will keep their money with their current provider if their job situation were to change. The effects of the digital experience to the business are impossible to ignore and will only become more important when an inevitable market downturn occurs and satisfaction is affected.”

Following are some key findings of the 2023 study:

- Retirement plan digital experience improves but continues to lag other industries: Overall satisfaction with retirement plan digital experiences increases to 685 (on a 1,000-point scale) this year, a 22-point increase from 2022. However, just 38% of retirement plan participants give their plans high marks for their digital capabilities. Overall satisfaction lags significantly behind other industries in which J.D. Power conducts studies, such as wealth management (701),1 property and casualty insurance (702)2 and automotive (718).3

- Mobile apps take center stage as critical tool for retirement investors: Retirement plan mobile apps have shown substantial increases in adoption and continue to drive higher levels of satisfaction when they are used. Nearly half (47%) of participants have downloaded their retirement plan’s mobile app, up from 35% in 2021, and 38% have used the mobile app in the past 30 days, up from 27% in 2021. Overall satisfaction with retirement plan mobile apps is 728, which is 38 points higher than for mobile websites and 72 points higher than for desktop websites.

- Strong digital experiences drive strong bottom line: More than one third (34%) of retirement plan participants who give their provider the highest marks for their digital experience have rolled over money from other retirement accounts, compared with just 20% among clients who give their retirement plans poor ratings on their digital experience. Likewise, the percentage of participants who say they “definitely will” keep assets with their current provider in the event of a job change is 48% among those giving their retirement plans the highest ratings for digital, which compares with just 15% among those with low digital satisfaction.

“The digital playbook for retirement firms could not be any clearer,” said Jonathan Sundberg, director, digital solutions at J.D. Power. “More clients than ever are interacting with their brands via mobile apps, and when they do, virtually every mark of customer engagement, retention and asset acquisition increases. Right now, a handful of standout firms are really delivering well when it comes to the mobile digital experience, but many more still have a great deal of work to do to get to the level of experience participants expect based on their interactions in other industries.”

Study Ranking

Capital Group/American Funds ranks highest in retirement plan digital satisfaction, with a score of 753. Charles Schwab (746) ranks second and Bank of America (including Merrill) (715) ranks third.

The U.S. Retirement Plan Digital Experience Study, formerly known as the U.S. Retirement Plan Participant Satisfaction Study, measures customer satisfaction across four factors: information/content; navigation; speed; and visual appeal. The study is based on responses of 5,804 retirement plan participants and was fielded in May-June 2023.

For more information about the U.S. Retirement Plan Digital Experience Study, visit

https://www.jdpower.com/business/financial-services/us-retirement-plan-digital-experience-study.

See the online press release at http://www.jdpower.com/pr-id/2023113.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power 2022 U.S. Wealth Management Digital Experience Study

2 J.D. Power 2023 U.S. Insurance Digital Experience Study

3 J.D. Power 2023 U.S. Manufacturer Website Evaluation Study- Summer

View source version on businesswire.com: https://www.businesswire.com/news/home/20230914226070/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com