Double-digit dip in institutional planning deflates August reading

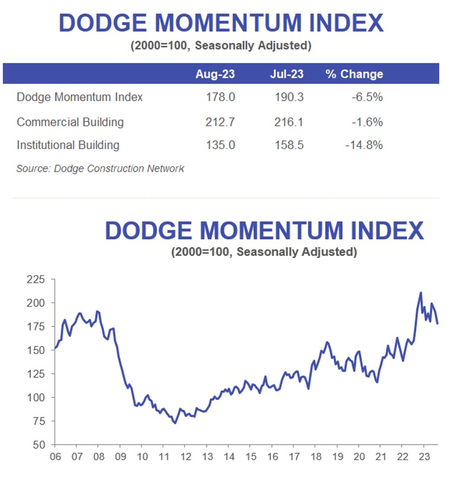

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, declined 6.5% in August to 178.0 (2000=100) from the revised July reading of 190.3. Over the month, the commercial component of the DMI fell 1.6%, while the institutional component fell 14.8%.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230908858204/en/

The Dodge Momentum Index (DMI) declined 6.5% in August to 178.0 (2000=100) from the revised July reading of 190.3. (Graphic: Business Wire)

“Overall activity remains above historical norms, but weaker market fundamentals continue to undermine planning growth,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. “It’s likely that the full year of tightening lending standards and high interest rates has begun to affect institutional planning, which has otherwise been resistant to these market headwinds. Also, planning in the sector continues to revert from the strong spike in activity back in May. As we move into the final four months of 2023, both commercial and institutional planning will continue to be constrained.”

August saw a deceleration in education, healthcare and amusement planning activity, fueling the sizable decline in the institutional sector. Meanwhile, stronger hotel planning offset weaker office activity, causing a milder regression in the commercial segment over August. Year over year, the DMI remained 4% higher than in August 2022. The commercial and institutional components were up 3% and 7%, respectively.

A total of 22 projects valued at $100 million or more entered planning in August. The largest commercial projects to enter planning included the $322 million Phase 5 of the Northern Virginia Gateway Data Center in Fredericksburg, Virginia, and the $225 million Kroger’s Distribution Center in Las Vegas, Nevada. The largest institutional projects to enter planning included the $420 million Westborough Life Sciences Park in Westborough, Massachusetts, and the $168 million Freeman Health System Hospital in Pittsburg, Kansas.

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

Watch Associate Director of Forecasting Sarah Martin discuss August’s DMI here.

About Dodge Construction Network

Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem. Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230908858204/en/

Contacts

Cailey Henderson | 104 West Partners | dodge@104west.com