Demographic shifts, occupier demand, and employment forecasts bode well for the future of the office

Cushman & Wakefield today released a new report, The Bright Side of Office: Opportunities in the Urban Core. The report explores some of the optimistic factors working in favor of office space in North American urban centers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240131116370/en/

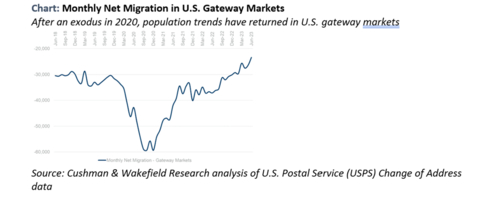

1. The population out-migration trends in large cities that accelerated early during the pandemic are returning to long-term norms. (Photo: Business Wire)

“Cushman & Wakefield has not been naïve about the current state and future of office in North America. Rather, the company, dating back to 2020, recognized that increased remote work would create sustained impacts on occupier demand and that the nature of office would need to evolve as a result,” said David Smith, Head of Americas Insights, Cushman & Wakefield. “We also anticipated that some portion of existing office stock would be obsolete, that the glidepath to recovery would take some time and that owners should be realistic about the outlook for 2024.”

Acknowledging those headwinds, this report examines several positive factors that are working in favor of a recovering office market.

-

The population out-migration trends in large cities that accelerated early during the pandemic are returning to long-term norms.

While the pandemic disproportionately impacted urban cores of cities, some of the demographic shifts at the height of the pandemic were temporary. Stated another way, people still want to live in large, vibrant cities.

-

The supply-side boom is quickly unwinding, and new office deliveries will be historically low in the middle of this decade.

Top-tier office product is very much in demand. There is going to be Less new construction will be delivered, however, welcoming opportunities arise for renovated offices and assets slightly further down the value chain.

- Occupiers have been right sizing their portfolios, but much of the effects of increased remote and hybrid work environments have filtered through the system.

Although increased remote and hybrid work is shifting occupier demand, and reducing willingness of employees to commute, but much of that impact has already filtered through the system. Portfolio right-sizing will moderate in coming years. Occupiers are committed to the office as a part of their business strategy, even if they are offering more employee flexibility than they did five years ago. The office is still a central part of the economy and a driver of productivity, career development, culture and innovation.

Office employment declined in the second half of 2023; it is still 1.9 million jobs above its pre-pandemic level. Once it resumes growing, look for occupiers to need more office space for their growing workforces.

“As we adapt and recover, we’re seeing some bright spots for urban office markets,” said Smith. Occupiers and employees are adjusting, supply is adapting, and the economy will create jobs in the coming years.”

Click here to download the full report.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in approximately 400 offices and 60 countries. In 2022, the firm reported revenue of $10.1 billion across its core services of property, facilities and project management, leasing, capital markets, and valuation and other services. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity and Inclusion (DEI), Environmental, Social and Governance (ESG) and more. For additional information, visit www.cushmanwakefield.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240131116370/en/

Contacts

Mike Boonshoft

212-841-7505