Fiserv Small Business Index aggregates consumer spending activity across millions of U.S. small businesses, using transactional sales data to gauge growth

Index will publish during the first week of each month, providing timely insight into the prior month’s activity

Fiserv, Inc. (NYSE: FI), a leading global provider of payments and financial services technology, today launched the Fiserv Small Business Index™, a first-of-its-kind indicator for assessing the performance of small businesses in the United States at national, state, and industry levels.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240109986972/en/

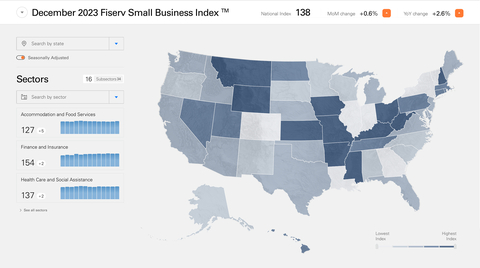

Fiserv Small Business Index - December 2023 (Graphic: Business Wire)

The Fiserv Small Business Index will be published during the first week of every month, delivering deeper insights more rapidly than existing measurements and empowering users to respond to emerging trends.

The index is differentiated by its direct aggregation of consumer spending activity within the U.S. small business ecosystem. Rather than relying on survey or sentiment data, the Fiserv Small Business Index is derived from point-of-sale transaction data, including card, cash, and check transactions in-store and online, across approximately 2 million U.S. small businesses.

“Small businesses are the backbone of our economy, generating 44% of U.S. gross domestic product and accounting for almost half of all jobs in the country,” said Frank Bisignano, Chairman, President and Chief Executive Officer of Fiserv. “With the Fiserv Small Business Index we are delivering swift, comprehensive and actionable intelligence based on consumer spending activity, providing a reliable new signal of the performance of U.S. small businesses.”

Each month, the Fiserv Small Business Index will provide information and analysis to help business owners, lenders, policymakers, economists, analysts and investors quickly understand the trajectory of certain sectors within the small business ecosystem, benchmark sales performance, make well-informed decisions, and adapt to an ever-changing market.

Benchmarked to 2019, the Fiserv Small Business Index provides a numeric value measuring consumer spending, with an accompanying transaction index measuring customer traffic. Through a simple interface, users can access data by region, state, and/or across business types categorized by the North American Industry Classification System (NAICS). Computing a monthly index for 16 sectors and 34 sub-sectors, the Fiserv Small Business Index is positioned to become a standard reference point for the state of small business, providing a timely, reliable and consistent measure of small business performance even in industries where large businesses dominate.

Fiserv Small Business Index: December 2023

According to the December 2023 Fiserv Small Business Index, spending at small businesses ended the year with a modest upswing. Spending advanced one point in December 2023 with an index of 138, a +0.6% month-over-month increase from November and a +2.6% year-over-year increase compared to December 2022.

“Small business sales gains in December reflected consumers’ priorities as the end of the year approached – food and drink, retail and healthcare,” said Prasanna Dhore, Chief Data Officer at Fiserv. “The biggest increases in small business spending came from restaurants, clothing and related accessories, and ambulatory healthcare services.”

Food Services and Drinking Places had a very strong December with a six-point gain over November, up to 128, with sales growing +4.9% compared to November and +3.1% compared to December 2022. Customer visits were also on the rise, with transaction growth up roughly +2.0% month over month and year over year.

Nationally, the Fiserv Small Business Index for Retail in December 2023 was 142, unchanged from November. Sales across the Retail sector declined marginally month over month, down -0.3%, but grew +1.6% year over year. The Clothing/Accessories/ Shoes/Jewelry subsector performed especially well, with sales up +6.1% month over month and +5% year over year.

Accessing the Fiserv Small Business Index

To access the Fiserv Small Business Index visit fiserv.com and click on “Fiserv Small Business Index” or visit fiserv.com/FiservSmallBusinessIndex.

About Fiserv

Fiserv, Inc. (NYSE: FI), a Fortune 500 company, aspires to move money and information in a way that moves the world. As a global leader in payments and financial technology, the company helps clients achieve best-in-class results through a commitment to innovation and excellence in areas including account processing and digital banking solutions; card issuer processing and network services; payments; e-commerce; merchant acquiring and processing; and the Clover® cloud-based point-of-sale and business management platform. Fiserv is a member of the S&P 500® Index and one of Fortune® World’s Most Admired Companies™. Visit fiserv.com and follow on social media for more information and the latest company news.

FISV-G

View source version on businesswire.com: https://www.businesswire.com/news/home/20240109986972/en/

Contacts

Media Relations:

Chase Wallace

Director, Communications

Fiserv, Inc.

+1 470-481-2555

chase.wallace@fiserv.com

Additional Contact:

Ann S. Cave

Vice President, External Communications

Fiserv, Inc.

+1 678-325-9435

ann.cave@fiserv.com