Capital One Ranks Highest in Small Business Banking Satisfaction for Second Consecutive Year

Small business owners are more optimistic about the future and more confident about their bank’s ability to help them meet their future needs. According to the J.D. Power 2024 U.S. Small Business Banking Satisfaction Study,SM released today, overall customer satisfaction among small business owners has surged 20 points (on a 1,000-point scale) this year as economic outlooks continue to improve and banks have stepped up their game on problem resolution, people and financial health support.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241029603406/en/

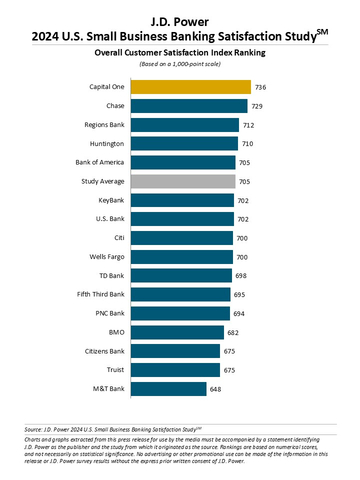

J.D. Power 2024 U.S. Small Business Banking Satisfaction Study (Graphic: Business Wire)

“Small businesses are not out of the woods yet,” said Paul McAdam, senior director of banking and payments intelligence at J.D. Power. “Increased costs for material and labor are still very much a factor, and future business outlooks have still not risen to pre-pandemic levels, but we are seeing a strong trend toward optimism for the future. Many small businesses have come to see their banks as valuable partners in that journey. In many cases, banks have really doubled down on support for small businesses through tailored financial advice; improved customer support and problem resolution; and investments in training and staff to manage key relationships. These efforts are paying off in the form of significantly higher customer satisfaction scores.”

Following are some key findings of the 2024 study:

- Overall satisfaction rises in key areas: Overall satisfaction among small business banking customers has risen 20 points this year to 705, driven by dramatic improvements in problem resolution; branch and phone-based customer service and relationship managers; and guidance to improve the financial health of small businesses.

- Business outlook improves but challenges remain: Small business owners are feeling more optimistic about their outlook than they were at this time a year ago, with an overall business outlook score of 7.5 (on a 10-point scale). While this is a significant improvement from 2023, it is below pre-pandemic levels. Current business headwinds include increased costs for material and labor—which continues to negatively affect 53% of businesses—as well as a decline to 73% of small businesses that said their creditworthiness is excellent or very good, down from 75% in 2023.

- Small businesses highly receptive to financial advice: Overall satisfaction with financial health support increases 34 points this year as small business owners increasingly turn to their banks for information on how to reduce fees, maintain a manageable level of debt and improve their overall creditworthiness.

- Small business confidence with banks on the rise: The significant improvement in overall satisfaction scores in this year’s study is driven by a combination of variables working in concert. Small businesses say they have improved experiences with the personal service; technology; products and communication; and advice provided by their bank. Improvements in the timeliness and ease of using bank services are accompanied by a growing sense that the bank is proactive, personalized and supporting the business in challenging times.

Study Ranking

Capital One ranks highest nationally in small business banking customer satisfaction for a second consecutive year, with a score of 736. Chase (729) ranks second and Regions Bank (712) ranks third.

The 2024 U.S. Small Business Banking Satisfaction Study measures satisfaction across seven factors (in order of importance): level of trust; people; allowing me to bank how and when I want; account offerings; helping me save time or money for my business; digital channels; and resolving problems or complaints. The study includes responses from 6,976 owners of—or financial decision-makers at—small businesses that use business banking services. The study was fielded from May through August 2024.

For more information about the U.S. Small Business Banking Satisfaction Study, visit https://www.jdpower.com/resource/us-small-business-banking-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2024134.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20241029603406/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com