Maxell, Ltd. (TOKYO:6810) has announced in its new medium-term management plan “MEX26” (Maximum Excellence 2026) to accelerate the development of all-solid-state batteries as core of new business.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241004244685/en/

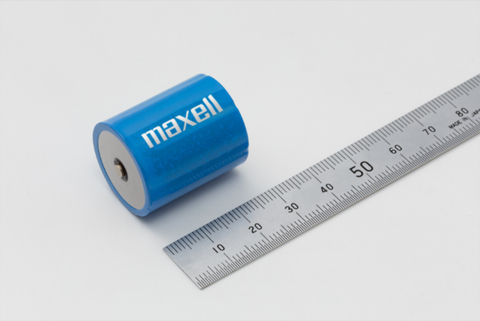

Maxell's medium-sized all-solid-state battery (Photo: Business Wire)

Maxell, whose name derives from the phrase “Maximum Capacity Dry Cell”, started business as a manufacturer of battery and magnetic tape in 1961 and is today renowned not only for its high-quality electronics products but company to contribute to society through the use of its groundbreaking, original technologies. These technologies include the Maxell’s unique Analog Core Technologies, including mixing and dispersion; fine coating; and high precision molding and forming, all of which are driving technological innovation in a range of fields.

The new medium-term management plan, MEX26, is an ambitious program which aims to improve profitability and capital efficiency while achieving sales and profit growth through proactive investments in growth areas.

Maxell, which achieved mass production of the world's first small-sized sulfide based all-solid-state battery in June 2023, is considering mass production of a medium-sized all-solid-state battery by the end of fiscal 2027. Maxell’s all-solid-state batteries are not only highly reliable - with a battery life of up to 20 years - but also capable of performing at a wide range of temperatures without risk of leakage. By commercializing all-solid-state batteries with these features and a large capacity of medium size, it aims to contribute to the realization of a sustainable society by commercializing permanent power sources that can meet a wide range of market needs, including sensing and monitoring in harsh environments, automotive devices. Maxell aims for sales of around 30 billion yen with the all-solid-state battery business in fiscal 2030. Maxell looks for sequential investment toward the development of next-generation technologies as well as to commercialize medium-sized all-solid-state batteries.

Maxell aims to be recognized as an indispensable company by stakeholders by accelerating technology development in key areas as a leading company.

[Outline of MEX26]

Maxell will strengthen products that have advantages in the 3 focus areas of “Mobility”, “ICT/AI” and “Human/Social Infrastructure”. Growth businesses within these areas include heat-resistant coin-type lithium batteries, coated separators and primary batteries for medical devices. Maxell will also strengthen technical sales team to enhance relationships with global customers in the Americas, Europe, and Asia.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241004244685/en/

Maxell, Ltd. has announced in its new medium-term management plan “MEX26” (Maximum Excellence 2026) to accelerate the development of all-solid-state batteries as core of new business toward 2027.

Contacts

Customer Inquiries

Sales & Marketing Div., Maxell, Ltd.

marketing_sales@maxell.co.jp

Media Inquiries

Hitoshi Yamagata

PR&IR Dept., Maxell, Ltd.

hitoshi-yamagata@maxell.co.jp