Kodiak analysis of three million claims finds patient collection rates drop significantly for bills that exceed $500 and then drop sharply again at $5,000 or more

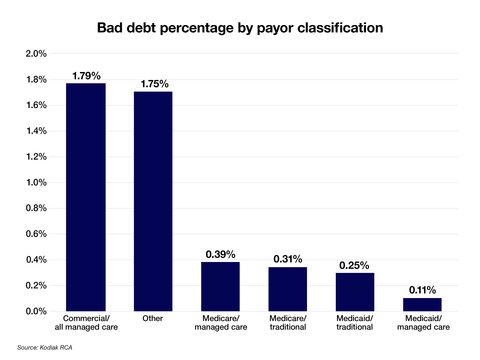

Patients with some form of insurance coverage accounted for 53% of the estimated $17.4 billion that hospitals, health systems and medical practices wrote off as bad debts in 2023, according to data collected by Kodiak Solutions (formerly Crowe healthcare consulting) and analyzed in its latest quarterly revenue cycle benchmarking report.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240222016295/en/

Among patients with some form of insurance coverage, hospitals, health systems and medical practices wrote off the highest percentage of total claim charges for commercially insured patients in 2023, according to a Kodiak Solutions analysis. (Graphic: Business Wire)

The data analyzed in the report also show that the collection rate from patients in 2022 and 2023 was 47.6%, down sharply from 54.8% in 2021.

Kodiak Revenue Cycle Analytics (RCA) software monitors every patient financial transaction from more than 1,850 hospitals and 250,000 physicians nationwide. This quarterly key performance indicator (KPI) revenue cycle benchmarking report is based on exclusive analysis of nearly 3 million fully resolved claims from commercially insured patients who received services from providers in 2022 and 2023.

Bills go up, collection rates go down

The analysis of Kodiak RCA data shows that patient collection rates leave provider organizations shortchanged. For bills of $100 or less, hospitals, health systems and medical practices collect only 69 cents on the dollar. As the bills rise in dollar amount, the collection rate only falls further.

The significant drop off in the collection rate when bills exceed $500 may reflect a widely cited KFF survey of consumers released in June 2022: About half of respondents said they would not be able to pay an unexpected $500 medical bill in full or at all. The decisions last year by three consumer credit rating agencies to remove unpaid medical debt of $500 or less from consumer credit reports may make patients even less likely to pay smaller bills, with no risk to their credit scores.

“With the amounts that health plans require patients to pay continuing to grow, provider organizations need a strategy to avoid intensifying pressure on their already thin margins,” said Colleen Hall, senior vice president and Revenue Cycle leader at Kodiak Solutions. “For scheduled encounters, we recommend solidifying point-of-service collection practices and requiring deposits from patients when they face higher-dollar financial responsibility. We also recommend providing patients with financing options for higher-dollar balances.”

To view the full report, please visit “Drawing the Line on Patient Responsibility Collection Rates.”

About Kodiak Solutions

Kodiak Solutions is a leading technology and tech-enabled services company that simplifies complex business problems for healthcare provider organizations. For nearly two decades as a part of Crowe LLP, Kodiak created and developed our proprietary net revenue reporting solution, Revenue Cycle Analytics. Kodiak also provides a broad suite of software and services in support of CFOs looking for solutions in financial reporting, revenue cycle, risk and compliance, and unclaimed property. Kodiak’s 400 employees engage with more than 1,850 hospitals and 250,000 practice-based physicians, across all 50 states, and serve as the unclaimed property outsourcing provider of choice for more than 2,000 companies. To learn more, visit our website.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240222016295/en/

“With the amounts that health plans require patients to pay continuing to grow, provider organizations need a strategy to avoid intensifying pressure on their already thin margins.” -- Colleen Hall, SVP and Revenue Cycle leader at Kodiak Solutions

Contacts

Vince Galloro

(312) 625-2137

vince.galloro@sunrisehlth.com